Rocket Pool’s RPL token has shifted from prolonged weakness to decisive recovery on the four-hour chart, as buyers forced a strong breakout from the $1.35–$1.40 base and drove price sharply higher.

The impulsive rally cleared several resistance zones in one expansion move, signaling renewed confidence after months of compression. Consequently, traders now watch whether RPL can defend newly established support levels while momentum cools.

RPL now trades around $2.65 after testing higher Fibonacci retracement levels. The 0.618 retracement at $2.545 stands as immediate support. A sustained hold above this zone keeps the bullish structure intact.

However, a break below $2.545 would expose $2.318 at the 0.5 level. Deeper support rests near $2.091 at the 0.382 retracement.

Significantly, the Ichimoku cloud clusters between $2.48 and $2.40. This range aligns closely with the 0.618 and 0.5 Fibonacci levels. Hence, traders may treat this region as a key decision zone.

On the upside, $2.868 marks the 0.786 retracement resistance. A decisive push above that barrier could open the path toward the $3.27 Fibonacci extension target.

The Directional Movement Index signals strong trend expansion. However, the recent pullback shows short-term cooling. Momentum remains constructive above $2.54. Loss of $2.31 would likely shift price into consolidation.

Source:

Source:

Derivatives data shows heavy positioning shifts over recent months. Open interest surged aggressively in June and July, surpassing $20 million. That spike reflected rising leverage and speculative activity. However, each peak triggered sharp pullbacks, highlighting unstable positioning.

Through late summer, open interest compressed as traders reduced risk exposure. Into year-end, participation declined further. Recently, open interest rebounded toward $21.37 million. This rise suggests renewed engagement and potential volatility buildup.

Source:

Source:

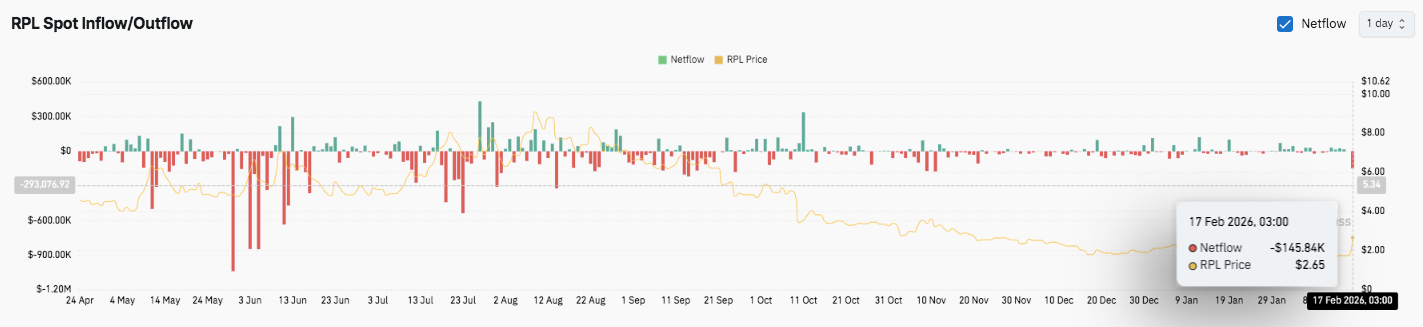

Spot market flows tell a more cautious story. Heavy outflows dominated May and early June, including a capitulation event near $1 million. Although late July and mid-August showed inflow spikes, buyers failed to sustain momentum.

Moreover, netflows turned negative again from October onward. The latest reading shows roughly $145,000 in outflows, signaling continued mild selling pressure.

Additionally, Rocket Pool will host a live stream for the Saturn One launch on YouTube on February 18 at 00:00 UTC. Market participants may watch the event closely for ecosystem updates. Hence, technical strength, derivatives positioning, and upcoming developments could shape RPL’s next move.

Rocket Pool price structure has shifted into a recovery phase after a sharp impulsive breakout from the $1.35 base. Key levels remain clearly defined as RPL consolidates above $2.60.

Upside levels: $2.868 stands as the immediate resistance at the 0.786 Fibonacci retracement. A decisive breakout above this barrier could open the path toward $3.27, the Fib extension target. If momentum accelerates, price may attempt a broader expansion toward the $3.50 psychological zone.

Downside levels: $2.545 marks the first critical support at the 0.618 retracement. Below that, $2.318 at the 0.5 Fib serves as secondary structure support. A deeper pullback could test $2.091 at the 0.382 level. Loss of $2.31 would likely shift momentum toward consolidation rather than continuation.

Support confluence: The Ichimoku cloud between $2.48 and $2.40 aligns closely with the 0.618–0.5 region. This overlap reinforces the area as a high-importance decision zone for trend validation. Holding above this band keeps short-term bullish momentum intact.

The broader technical picture shows RPL transitioning from accumulation into expansion. DMI signals strong trend development, though recent cooling suggests temporary consolidation.

RPL’s near-term outlook depends on whether buyers can defend $2.54 while building pressure toward $2.87. Sustained strength above resistance could trigger volatility expansion toward $3.27. However, failure to hold $2.31 risks weakening structure and exposing the $2.09 support zone.

For now, Rocket Pool trades in a pivotal range where confirmation above resistance or breakdown below support will define the next directional leg.

Related: