Genius Sports Limited (GENI) Announces a Partnership with WPP Media

Genius Sports Limited (NYSE:GENI) is among the 15 Best Small Cap Stocks to Buy According to Wall Street.

On February 10, 2026, Genius Sports Limited (NYSE:GENI) announced a partnership with WPP Media to support brand investment in sports using Genius Sports’ Fan Graph and FANHub, resulting in the creation of the WPP Brand Sports Momentum Score.

On February 9, 2026, Wells Fargo lowered its price target on Genius Sports to $10 from $16 and maintained an Overweight rating, citing uncertainty surrounding the acquisition of Legend. The firm said the transaction surprised it and believes the stock’s valuation could remain under pressure without additional clarity on the payment terms and the durability of Legend.

Earlier, on February 6, 2026, Genius Sports entered into a definitive agreement to acquire Legend, a global digital sports and gaming media network, in a transaction valued at up to $1.2 billion, including $900 million at closing and up to $300 million in earnouts. The company said the acquisition is expected to be immediately accretive to Group adjusted EBITDA margins and free cash flow conversion while maintaining at least 20% Group revenue CAGR through 2028.

Separately, on February 6, 2026, Genius Sports reported preliminary unaudited results for the fiscal year ended December 31, 2025, including Group revenue of $669 million, up 31% year over year, and Group adjusted EBITDA of $136 million, up 59% year over year, with a 20% margin. Cash and cash equivalents totaled $281 million. For 2026 on a standalone basis, the company expects Group revenue of approximately $810 million to $820 million and Group adjusted EBITDA of approximately $180 million to $190 million.

Genius Sports Limited (NYSE:GENI) develops and sells technology-driven products and services for sports leagues, sports betting operators, and media companies, including live data infrastructure, streaming solutions, and integrity monitoring services.

While we acknowledge the potential of GENI as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the

READ NEXT: 10 Most Profitable Undervalued Stocks to Buy and 11 Best Mining Stocks to Buy According to Wall Street

Disclosure: None.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

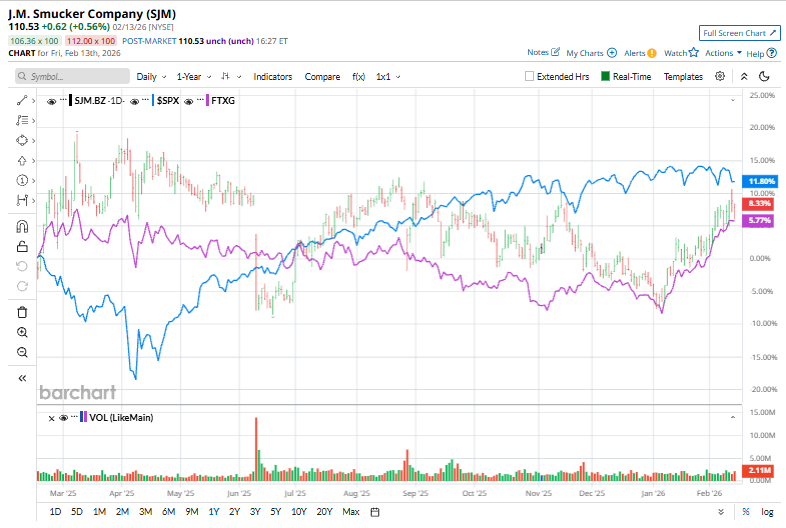

J. M. Smucker Shares: Expert Predictions and Evaluations

Solana’s Structure Outperforms Ethereum as Shorts Stack

BofA survey flags dollar bearish bets at over a decade high. Here's what it means for bitcoin

Herc Holdings: Fourth Quarter Earnings Overview