Triumph Financial’s ‘white label’ FaaS solution aims to expand its presence in the factoring market

Triumph Financial Expands Factoring Reach with White Label FaaS

During a recent analyst call, Triumph Financial CEO Aaron Graft estimated that the company faces daily competition from roughly 400 other factoring providers. With so many players in the market and little room for significant differences in rates or financial terms, Triumph has sought new ways to grow its business.

In the past couple of years, Triumph Financial (NASDAQ: TFIN) has introduced a “white label” Factoring as a Service (FaaS) solution. This offering allows brokers and other organizations to provide factoring services to their clients, leveraging Triumph’s expertise and infrastructure.

While Graft has mentioned FaaS in earnings discussions, details have been limited, and analysts have only lightly touched on the topic. However, Kimberly Fisk, Triumph’s president of factoring, explained in an interview with FreightWaves that FaaS is designed to help transportation-focused businesses expand their service offerings. She described it as a turnkey solution, supported by Triumph’s established systems and knowledge.

Major industry names such as C.H. Robinson (NASDAQ: CHRW) and RXO (NYSE: RXO) have already adopted Triumph’s FaaS platform. Fisk noted that transportation companies, like brokers, can use FaaS to offer factoring to the carriers they work with, even if they lack the resources to manage factoring operations themselves.

“Many brokers are interested in launching a factoring division because of their sales teams and carrier relationships,” Fisk said. “But they often don’t have the necessary systems or expertise to run such a business.”

This is where Triumph steps in, handling the back-office processes and, if needed, providing financing for transactions. The FaaS model is considered “white label” because the broker or transportation company presents the service under its own brand, while Triumph operates behind the scenes.

According to Indeed.com, a white label product is a generic solution sold by various retailers, each applying their own branding and packaging, though the underlying product remains unchanged.

How FaaS Empowers Brokers

For brokers who previously did not offer factoring, Triumph’s FaaS enables them to approach carriers with a new value proposition: not only can they provide loads, but they can also serve as a financial partner. Fisk emphasized that Triumph does not handle customer acquisition for FaaS; that responsibility remains with the broker or company using the service.

Graft reinforced this point during a recent quarterly call, stating that Triumph does not control the marketing or growth strategies for FaaS, as those are managed by the clients themselves. He added that companies utilizing FaaS are seeking to strengthen relationships with their carriers and encourage repeat business.

Growth and Financial Impact

Triumph does not separately report FaaS revenue in its financial statements. In the fourth quarter ending December 31, total factoring revenue reached $41.9 million, with operating income at $13.7 million. FaaS currently represents a small portion of that total.

“We’re seeing steady growth and increasing interest in FaaS each quarter,” Fisk said. Graft echoed this in his letter to investors, noting that FaaS purchase volume grew by 136% in the fourth quarter, though he cautioned that this growth is from a relatively small base. Multiple organizations have approached Triumph to explore FaaS for their own operations, and Graft expects to provide further updates in future investor communications.

Challenges and Flexibility

Fisk acknowledged that launching a factoring service is complex for companies without prior experience. Triumph supports its partners by providing training and guidance on selling factoring solutions. The proportion of financing Triumph provides can vary—sometimes covering the full amount, sometimes sharing the risk, or even not participating financially, depending on the agreement.

Triumph’s ability to offer FaaS stems from years of investment in technology and operational efficiency, giving the company the capacity to extend its platform to others interested in the program.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto ETFs Record $202.8M Weekly Inflows as AUM Tops $108.6B

Kenvue beats quarterly estimates, announces job cuts amid Kimberly-Clark acquisition

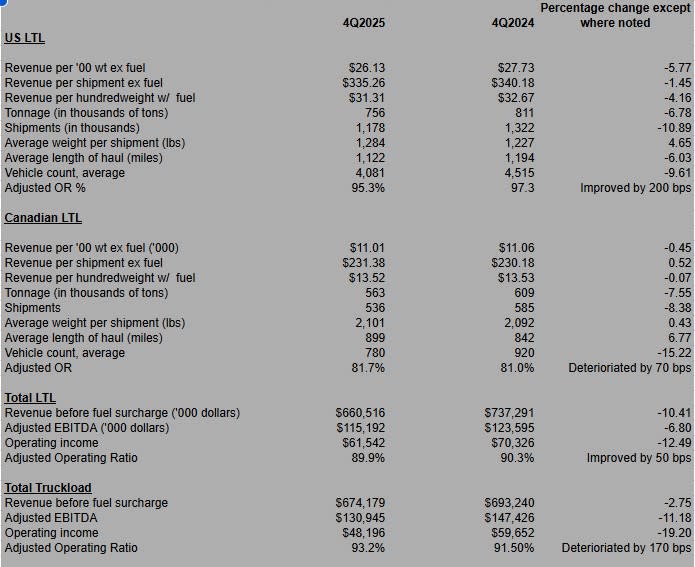

First glance: Certain US LTL metrics at TFI International begin to rise

David Tepper's Appaloosa Ups Micron Stake By 250%, Trims Nvidia And Amazon