BofA Survey Reveals Investor Concerns About Unprecedented Capex Competition

Investors Voice Concerns Over Corporate Spending Surge

According to the latest Bank of America survey, an unprecedented number of investors believe that companies are currently overspending.

Despite investor optimism reaching its highest point since mid-2021, around 35% of those surveyed expressed worries about excessive corporate investment—a figure not seen in the past twenty years, as noted by strategist Michael Hartnett. Additionally, participants are reducing their holdings in technology stocks.

Top Stories from Bloomberg

This year, capital expenditures are expected to hit new highs, with the four largest US tech giants projecting a combined $650 billion in spending for 2026. Reactions in the market have varied: Microsoft shares experienced their steepest drop in nearly six years due to doubts about the timeline for returns on investment, while Meta Platforms saw its stock soar over 11% after announcing bold plans for AI-related spending.

In the survey, 25% of respondents identified a potential "AI bubble" as the biggest risk to markets, and 30% pointed to major tech firms’ AI investments as the most likely trigger for a credit crisis.

Hartnett observed that investors now view capital expenditure as "overheated," even as their outlook for global corporate earnings is the most positive since August 2021.

At the same time, survey participants are shifting away from technology stocks and the US dollar, favoring sectors like energy, materials, and consumer staples. The reduction in tech exposure is the largest since March 2025, with only a net 5% overweight in the sector, down sharply from 19% the previous month.

There is also a notable move away from US equities toward emerging and European markets, reaching the highest level since early 2021.

Market Rotation Highlights

Recent outperformance by small-cap stocks further illustrates the shift away from dominant tech companies. Investors are now more heavily weighted in small caps compared to large caps than at any time since April 2021.

The Bank of America Global survey, conducted from February 6 to February 12, included 162 participants managing a total of $440 billion in assets.

Reporting assistance by Michael Msika.

Most Popular from Bloomberg Businessweek

©2026 Bloomberg L.P.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JUST IN: BlackRock Announces Controversial Ethereum Spot ETF Decision

Pre-Markets Begins Shorter Week Slowly

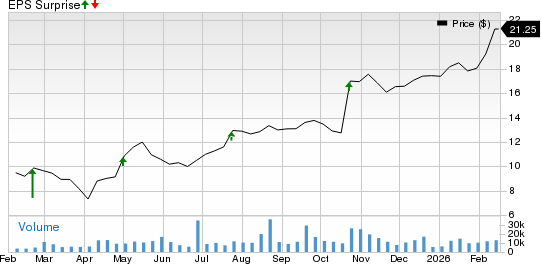

Garrett Gears Up to Report Q4 Earnings: What's in the Cards?

Dogecoin Rallies 20% as 4-Hour Contracting Triangle Breakout Lifts Price Toward $0.1168 Resistance