MSTR Stock Dips: Mizuho Trims Target by 20% on ‘BTC Weakness’

Mizuho Securities analyst Dan Dolev lowered his price target on Strategy (MSTR) stock due to falling Bitcoin (BTC-USD) prices, which drive much of the company’s valuation via its massive BTC holdings. MSTR stock fell 2.5% in pre-market trading on the news. Nonetheless, Dolev remains constructive on the shares and maintained his Buy rating because of Strategy’s $2.25 billion to $2.3 billion in reserves intended to cover 2–3 years of dividends.

Dolev compared the ongoing “crypto winter” to NYC’s unprecedented brutal cold snaps. This freeze, he says, has driven Strategy’s Bitcoin holding value (672,500 BTC) below its roughly $76,000 average cost basis.

Dolev Updates MSTR Model Post-Q4 Results

Following Strategy’s Q4FY25 results, Dolev revised his end-2027 BTC price forecast to $128,000, down from $159,000. He highlighted Strategy’s massive Q4 loss that was fueled almost entirely from unrealized markdowns on its Bitcoin holdings under the new fair-value accounting standards.

Strategy reported a staggering $12.4 billion net loss ($42.93 per share) in Q4, up from $670.8 million the prior year, alongside a $17.4 billion operating loss. The loss stemmed directly from Bitcoin’s sharp drop into early 2026. Management stressed these are purely accounting losses under fair-value rules, not cash flow issues.

Why Dolev Stays Bullish on MSTR

Dolev cited three prime reasons for remaining bullish on Strategy stock:

- MSTR remains the world’s largest corporate holder of Bitcoin, with 22.8% BTC yield, within its target range.

- MSTR has sufficient cash reserves of $2.25bn–$2.3bn to survive the crypto winter.

- Historical BTC winters prove temporary, supporting long-term upside.

What Is the Prediction for MSTR Shares?

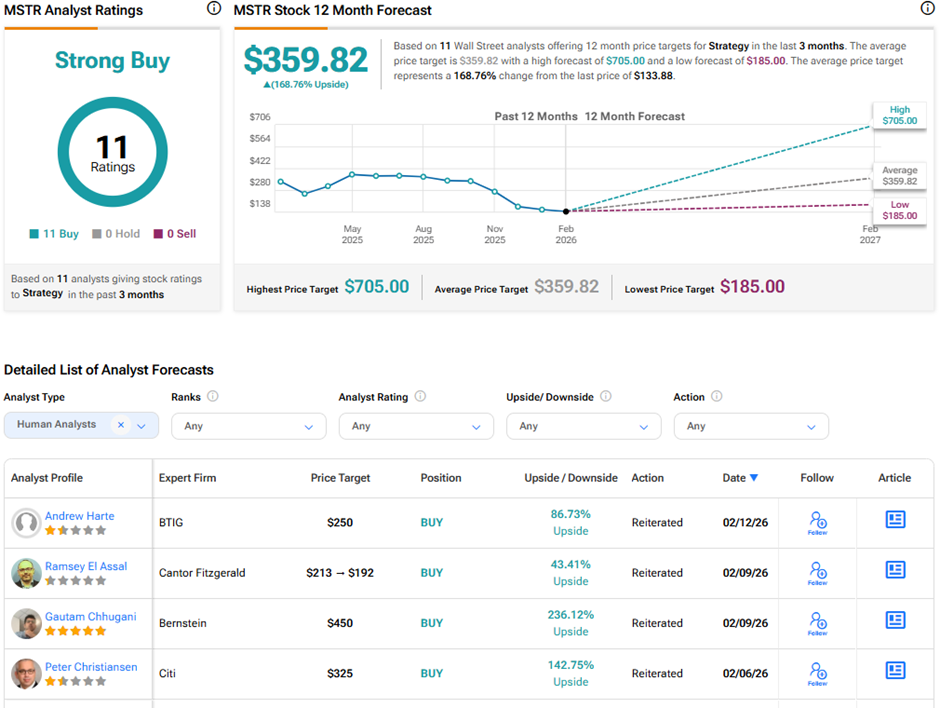

Despite the ongoing Bitcoin weakness, analysts remain optimistic about Strategy’s long-term prospects. On TipRanks, MSTR has a Strong Buy consensus rating based on 11 unanimous Buys. The average Strategy price target of $359.82 implies 168.8% upside potential from current levels. Over the past year, MSTR shares have dropped 59.9%.

Copyright © 2026, TipRanks. All rights reserved.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What Adyen gets by embracing Uber at the airport

Vistra Stock Looks Ready to Topple Technical Resistance

Next Berkshire Hathaway Letter Comes Soon, And It Won't Be From Buffett