MCD and TXRH: 2 Low-Risk Restaurant Stocks With Upside

The restaurant sector has often been at the forefront of the debate on the K-shaped economy. While consumer sentiment continues to diverge from actual consumer behavior (especially in the retail sector), the food service industry is a setting in which divergent trends become apparent quickly. While the upper end of the ‘K’ continues to indulge, more cost-conscious consumers at the bottom are searching for value to maximize their dollars.

In such an economy, two restaurants are starting to stand out, albeit for very different reasons. But the numbers speak for themselves, and McDonald’s Corp. (NYSE: MCD) and Texas Roadhouse Inc. (NASDAQ: TXRH) continue to grow comparable sales and gain market share from their competitors. Today, we’ll look at why these two have thrived in a challenging dining environment, and explain why their stocks could be set up to outperform the restaurant industry this year.

McDonald's Continues to Dominate the Fast Food Market

The earnings reports from McDonald's and Wendy’s Co. (NASDAQ: WEN) over the past week highlighted how players in the fast-food industry are separating themselves.

McDonald’s reported Q4 2025 results last week and beat on both earnings per share (EPS) and revenue projections, with 9.7% year-over-year (YOY) sales growth.

Global same-store sales smashed expectations with 5.7% YOY growth, including 6.8% growth in the United States. Now, compare these figures to the Q4 2025 report released by Wendy’s last Friday, which saw revenue decline 5.5% YOY with a same-store sales drop of 11.3% in the U.S. How has McDonald’s been able to grow sales at nearly a 7% clip in the U.S. when other Quick Service Restaurants (QSRs) struggle?

Value, value, and more value. The company projects operating margins above 40% in 2026, which enables it to pursue its Value Leadership strategy.

Unlike the limited-time value promotions run by Wendy’s and Burger King, McDonald’s Value Menu 2.0 is a permanent fixture. Extra Value Meals were reintroduced last September, and earlier this year, the company launched the McValue platform, which includes $5 Meal Deals and Buy One, Get One for $1 offers. The Grinch Meal holiday promotion drove the biggest single-day sales figure in the company’s lengthy history.

Additionally, the McDonald’s app has approximately 200 million active users, which helps drive repeat business, and the marketing focus on chicken meals, such as the McCrispy, mitigates the impact of beef price inflation. The company also plans to open an additional 2,600 stores this year, while competitors like Wendy’s are closing underperforming restaurants.

.

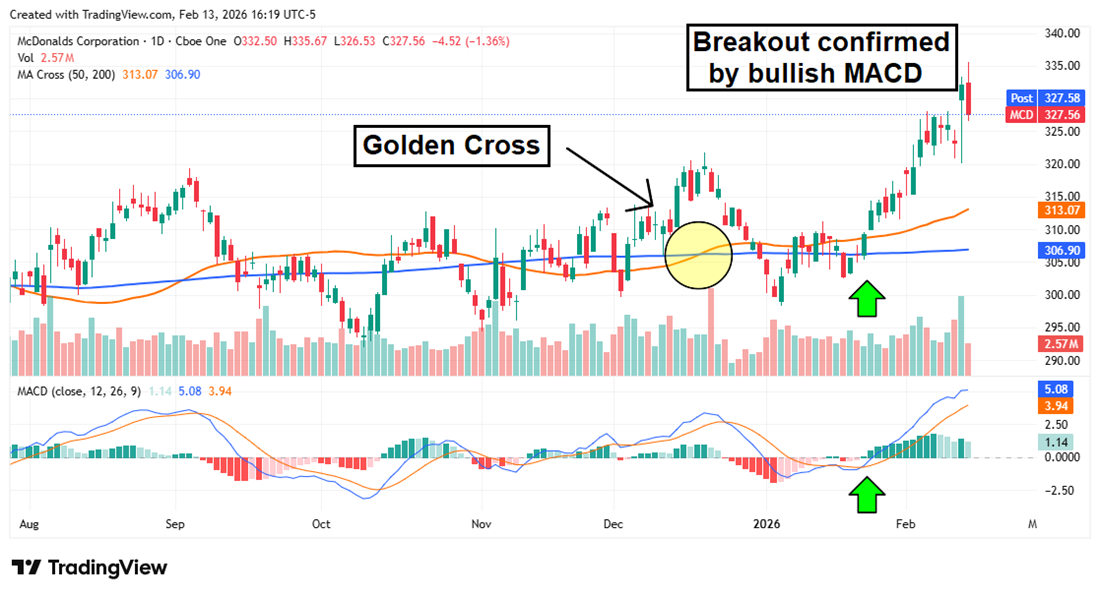

The breakout in MCD shares got started well before last week’s earnings release. A bullish crossover in the Moving Average Convergence Divergence (MACD) indicator coincided with the stock price rising above the 50-day and 200-day simple moving averages (SMAs), indicating strong upward momentum. If low-income consumers continue to trade down for value, McDonald’s is well-positioned to continue growing sales, with fundamental and technical catalysts in 2026.

Texas Roadhouse Grows Market Share Despite Commodity Headwinds

Soaring beef prices have been hanging over shares of Texas Roadhouse like a black cloud for most of the last year. Beef prices have been rising faster than inflation since the COVID-19 pandemic began, but the surge over the last two years has frightened restaurant owners and investors alike.

The price rise has been driven in part by cattle shortages, which have pushed live cow and steer prices to record levels, and this problem is likely to persist into 2027.

Despite this headwind, Texas Roadhouse continues to see same-store sales grow faster than those of its casual-dining rivals.

Texas Roadhouse’s barbell business strategy continues to offer value to cost-conscious customers while providing premium steaks and upcharge options for diners who don’t mind splurging.

In its Q3 2025 report back in November, the company reported comps of 6.1% and nearly 13% YOY revenue growth despite a 224 basis point increase in food and beverage costs. Texas Roadhouse raised prices by only 1.7% to offset these costs, a planned margin sacrifice to retain value-oriented diners.

The customer experience is a key factor in Texas Roadhouse’s success. Traffic durability is an important metric for fast-casual restaurants that depend on repeat sales. Large portion sizes, fast servers, streamlined digital kitchens, and a host of add-ons and upgrades give Texas Roadhouse the feel of a special night out without breaking the bank. Customers repeatedly report that the restaurant is “worth it” for date nights and family dinners because they know the value and experience will meet their standards.

The performance of TXRH shares so far this year suggests that the doldrums of 2025 could be a thing of the past. The stock was up 11 days in a row to open 2026, bursting through the 200-day SMA barrier that had resisted previous breakout attempts. The win streak was followed by a consolidation period during which the Relative Strength Index (RSI) retreated to more neutral levels while the 50-day and 200-day SMAs converged.

Now that a Golden Cross seems imminent, the 50-day SMA could become a support level for a new rally. This area has already been tested once and held, and the share price is now approaching the 50-day moving average. This could be an opportune entry point for new investors, especially with a catalyst coming this week when the company reports its Q4 2025 results after the market closes on Feb. 19.

Where Should You Invest $1,000 Right Now?

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

The article "MCD and TXRH: 2 Low-Risk Restaurant Stocks With Upside" first appeared on MarketBeat.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wall Street Turns Bullish on ASML Holding N.V. (ASML), Here's Why

What's Going On With Airbnb Stock?

Top crypto treasury companies Strategy and Bitmine add to BTC, ETH stacks

Barr: How Will Artificial Intelligence Impact Jobs and the Economy?