Price declines for gold and silver; bulls require new catalysts

Gold and Silver Prices Drop Sharply

Gold and silver experienced significant declines in early U.S. trading on Monday, largely due to short-term futures traders liquidating their positions. In trading circles, it's often said that a bull market requires a steady stream of new, positive developments to maintain momentum. Currently, gold and silver bulls have not encountered any fresh, supportive news to fuel further gains. As of the latest update, April gold had fallen by $85.60 to $4,960.00, while March silver was down $3.13 at $74.83.

U.S. and Iran Resume Nuclear Negotiations

Officials from the United States and Iran convened in Geneva for a second round of nuclear discussions, aiming to prevent renewed tensions in the Middle East after last year’s U.S. strikes on Iran. Oman is facilitating these talks. Iranian representatives have shown openness to addressing their nuclear enrichment program, but any concessions are linked to the possibility of easing U.S. sanctions. Both nations have increased their military presence in the region, with the U.S. sending a second aircraft carrier amid threats of potential action should negotiations stall. Meanwhile, Iran’s Islamic Revolutionary Guard Corps conducted military exercises near the Strait of Hormuz, focusing on responding decisively to security challenges. The American delegation is led by Middle East envoy Steve Witkoff and Jared Kushner, President Trump’s son-in-law. President Trump stated that Iran is interested in reaching an agreement and that he will be indirectly involved in the process.

U.S. and China Hold Talks Ahead of Leaders’ Summit

In Munich last week, Chinese Foreign Minister Wang Yi met with U.S. Secretary of State Marco Rubio as both countries prepare for President Trump’s planned visit to Beijing in April. Wang emphasized the importance of 2026 as a year for advancing mutual respect between the two nations. Both sides agreed to enhance dialogue and cooperation across various sectors, with the meeting serving to maintain positive momentum ahead of the upcoming U.S.-China summit.

Market Overview

Today’s broader market landscape shows the U.S. dollar index trading higher, while crude oil prices have also risen, hovering around $64 per barrel. The yield on the 10-year U.S. Treasury note is approximately 4.03%, marking its lowest point in two and a half months.

Gold is priced through two main channels: the spot market, which reflects immediate purchase and delivery, and the futures market, which sets prices for future delivery. Due to year-end trading activity, the December gold futures contract is currently the most heavily traded on the CME.

Technical Analysis: Gold

For April gold futures, bulls are aiming to close above strong resistance at $5,250.00. On the other hand, bears are targeting a drop below key support at last week’s low of $4,670.00. Initial resistance is found at $5,000.00, followed by last week’s high of $5,144.50. Support levels are at the overnight low of $4,875.20 and then at $4,800.00. Wyckoff's Market Rating stands at 6.5.

Technical Analysis: Silver

For March silver futures, bulls are looking to push prices above strong resistance at $90.00. Bears, meanwhile, are aiming for a close below solid support at the February low of $63.90. The first resistance is at the overnight high of $78.42, followed by $80.00. Support is seen at the overnight low of $72.505 and then at $71.20. Wyckoff's Market Rating is 5.0.

Stay Informed with Market Insights

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Chart is Turning Positive for XRP! “On-Chain Data Also Shows Signals!”

Stock Market News for Feb 18, 2026

BTC, ETH eyed as Kiyosaki calls giant stock crash near

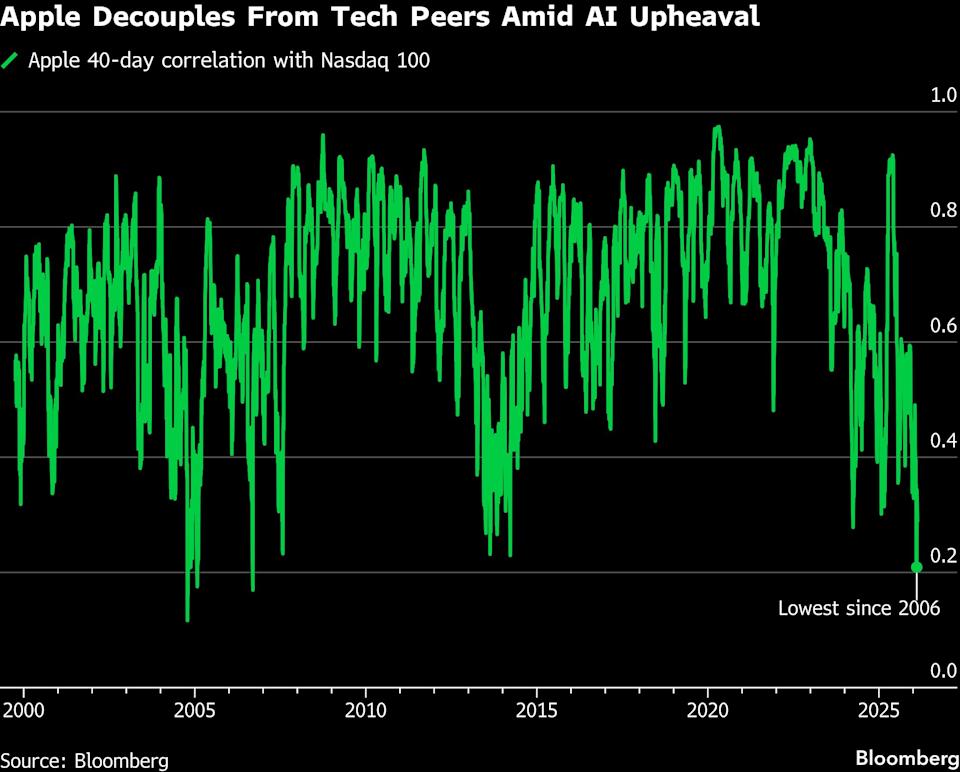

Apple Breaks Away From Nasdaq Amid AI ‘Whack-a-Mole’ Craze in the Market