Software stock optimists continue to hold onto a risky belief

The Uncertain Outlook for Software Companies Amid AI Disruption

No individual or business can count on a prosperous future, and this uncertainty is becoming especially apparent for software giants that once seemed invincible. Rapid advancements in artificial intelligence from companies like OpenAI, Google, and Anthropic are putting significant pressure on these firms.

Major players such as Workday and Salesforce are experiencing serious challenges reflected in their share prices. Yet, many on Wall Street seem slow to recognize the full extent of the threat.

One clear sign is the reluctance to lower future earnings forecasts. Surprisingly, projections for software company profits have actually increased, even as mounting evidence suggests AI could severely impact their bottom lines.

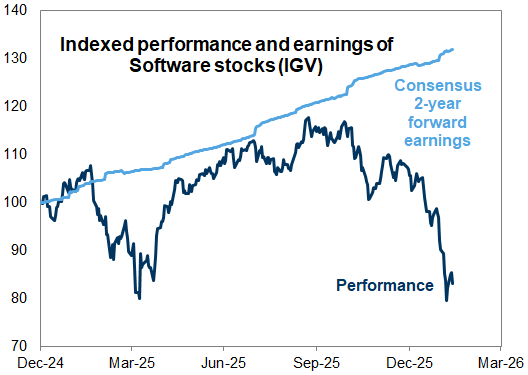

Goldman Sachs strategist Ben Snider recently highlighted this disconnect. Over the past quarter, the iShares Expanded Tech Software Sector ETF (IGV) has dropped by 24%, but two-year forward earnings estimates for these stocks have climbed by 5%. Similarly, industries considered most vulnerable to AI—such as insurance brokers and advertising firms—have seen their 2026 earnings per share estimates revised upward.

Many investors in software stocks have yet to face reality. · Goldman Sachs

Typically, Wall Street analysts are known for their optimism when forecasting company earnings. However, their current approach to software stocks seems increasingly disconnected from market realities.

Stock prices often reveal the underlying truth, and the steep decline in software shares points to tough times ahead as AI continues to reshape the industry.

The market will only stabilize once analysts adjust their expectations to better reflect these new risks. The sooner this happens, the sooner these stocks can find a bottom.

"Not long ago, software stocks traded at price-to-earnings multiples around 35. Now, they've fallen below 20—a dramatic selloff. This is the downside of AI, and it's a warning sign for other sectors as well. Even if the impact isn't immediate, investors should be alert and prepared," said Tim Urbanowicz, chief investment strategist at Innovator Capital Management, in an interview with Yahoo Finance's Opening Bid.

He added, "This will unsettle investors. The trajectory won't always be upward, despite some people's hopes."

It's encouraging to see some voices on Wall Street acknowledging these challenges.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Insiders Piled Into These 3 Stocks in Q4-One Stands Out

Palantir Technologies Stock Options Stay Hot in 2026

Apple's AI moment is finally arriving in 2026, Wedbush says