AMC Stock Hovers Around All-Time Low Ahead Of Earnings: What Investors Need To Know

AMC Entertainment Holdings (NYSE:AMC) shares are trading flat on Tuesday as the company faces ongoing scrutiny following its recent financial filings. The stock is reacting to news about potential equity offerings, which may dilute existing shares, adding pressure as broader markets edged lower. Here’s what investors need to know.

- AMC Entertainment stock is showing downward pressure. Where is AMC stock headed?

AMC Expands Equity Flexibility

In filings with the SEC last week, AMC registered an automatic shelf on Form S-3 that allows the company to issue a variety of securities, including Class A common stock and warrants.

Additionally, AMC filed a prospectus supplement covering up to $150 million in Class A common stock to be sold through an at-the-market program, highlighting its need for continued balance-sheet flexibility.

The filings also revealed preliminary financial results for 2025, showing fourth-quarter revenue of about $1.29 billion and a quarterly net loss of roughly $127 million. AMC ended the year with $428.5 million in cash and equivalents, down sharply from the previous year, which has made investors sensitive to any signals of further equity issuance.

AMC Pursues $2.5B Refinancing

In a separate move, AMC has begun marketing a $2.5 billion refinancing package to credit investors, including a new $750 million term loan and other secured borrowings.

According to Bloomberg, the deal is intended to replace a $2 billion loan due in 2029 and $400 million of high-interest notes maturing next year, and represents the company's latest attempt to tackle its post-pandemic debt load following a flexibility-enhancing agreement with noteholders in January.

Technical Signals Remain Mixed

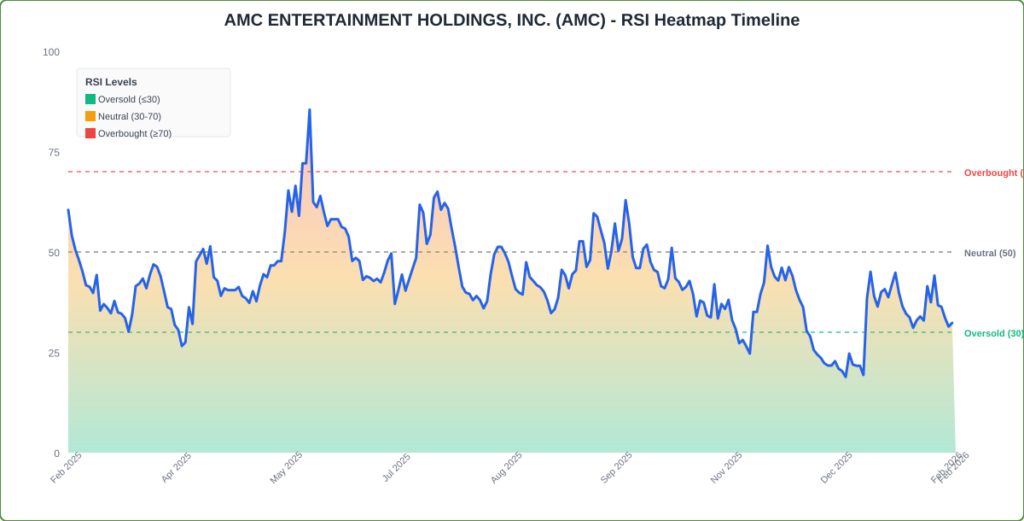

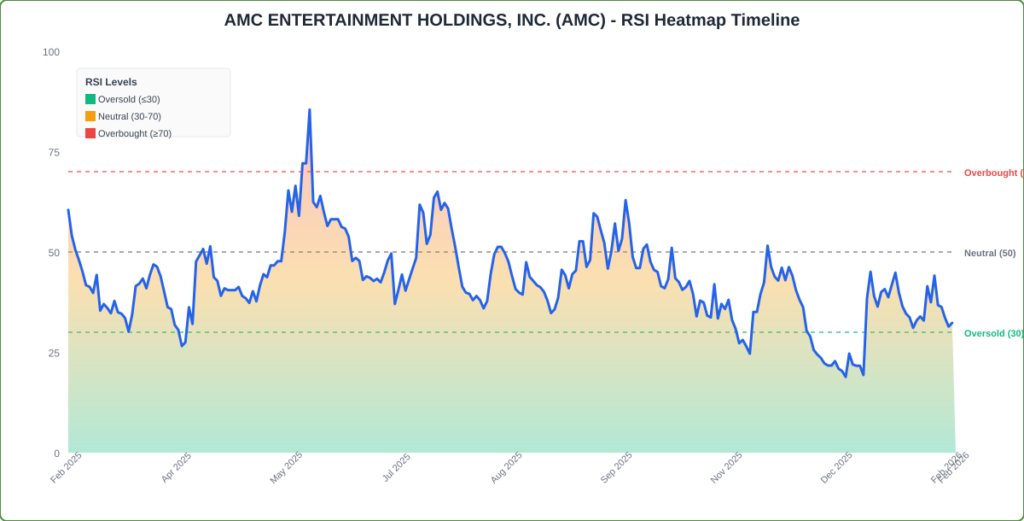

Currently, AMC is trading 1.64% above its 20-day simple moving average (SMA) and 2.44% below its 100-day SMA, reflecting a mixed technical picture.

Over the past 12 months, shares have decreased by 66.62%, and they are currently positioned closer to their 52-week lows than highs, indicating ongoing challenges for the stock.

The RSI is not available, but the MACD status remains neutral, suggesting that momentum is currently indecisive. This combination of technical indicators implies that while there may be short-term optimism, the longer-term outlook remains uncertain.

- Key Resistance: $1.50

- Key Support: $1.00

AMC's stock has also seen sharp, sentiment-driven downdrafts during regular trading hours in recent weeks, with prior sessions marked by multi-percentage-point declines that reflected how quickly the market reprices the equity when dilution risk, leverage concerns, or liquidity headlines dominate the narrative. That pattern has kept AMC highly reactive to broader market pressure.

AMC Entertainment Earnings Preview

The countdown is on: AMC Entertainment is set to report earnings on Feb. 24.

- EPS Estimate: Loss of 19 cents (Down from Loss of 18 cents)

- Revenue Estimate: $1.27 billion (Down from $1.31 billion)

Analyst Consensus & Recent Actions: The stock carries a Hold Rating with an average price target of $5.04. Recent analyst moves include:

- Macquarie: Neutral (Lowers Target to $2.00) (Jan. 15)

- Citigroup: Sell (Lowers Target to $1.30) (Jan. 12)

AMC Shares Trade Near All-Time Low

AMC Price Action: AMC Entertainment shares were trading up 0.81% at $1.24 at the time of publication on Tuesday, according to Benzinga Pro data. The stock is trading near its all-time low of $1.21.

Image: Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Natural Health Trends Announces Repurchase of All Outstanding Broady Shares

Retail investors will have the opportunity to invest in SpaceX and Anthropic through a new fund

Why LKQ (LKQ) Shares Are Falling Today