As Microsoft Pursues ‘Complete Independence,’ Is Investing in MSFT Shares a Wise Move?

Microsoft's Shift Toward AI Independence

Microsoft is embarking on a new phase in its artificial intelligence journey, one that emphasizes autonomy over collaboration. After pouring nearly $14 billion into OpenAI and weaving its technology throughout Azure, Microsoft 365 Copilot, GitHub, and other major offerings, the company is now openly striving for what it calls “true self-sufficiency” in AI. This move represents more than just diversification—it marks a fundamental transition toward building proprietary AI models, expanding its own AI chip lineup such as the Maia accelerator, and lessening its dependence on outside providers for critical technology.

As Microsoft intensifies its focus on AI independence, investors are left to consider: Is this a strategic leap that will strengthen Microsoft’s competitive edge and drive long-term growth, or does it introduce new risks to the company’s trajectory? Should you consider increasing your MSFT holdings now, or wait for more concrete signs of success? Let’s explore these questions in depth.

Latest Updates from Barchart

Overview of Microsoft Stock

Microsoft stands as a powerhouse in the tech industry, with a broad range of businesses including software, cloud services, artificial intelligence, gaming, and hardware. The company has been at the forefront of AI innovation, notably through its significant partnership and investment in OpenAI. With a market capitalization of $2.98 trillion, Microsoft ranks as the world’s fourth most valuable publicly traded company.

Despite its dominance, Microsoft’s shares have dropped 18% so far this year. This decline is largely attributed to its fiscal Q2 earnings report and a broader downturn in sentiment toward software companies. The stock suffered in late January after Microsoft reported higher-than-expected expenses and a slowdown in cloud revenue growth, raising concerns that its AI investments may take longer to yield returns. Additionally, the sector-wide sell-off was fueled by worries that AI could disrupt the software industry.

Microsoft's Pursuit of AI Self-Sufficiency

Mustafa Suleyman, Microsoft’s head of AI, recently shared with the Financial Times that the company is determined to achieve “true self-sufficiency” in artificial intelligence. This involves building its own advanced models and gradually reducing its reliance on OpenAI, even as the partnership continues. The goal is to move away from depending on external technology providers.

Suleyman explained that this strategic pivot followed a restructuring of Microsoft’s relationship with OpenAI in October 2025. The revised agreement transformed Microsoft’s $13.75 billion investment into a 27% ownership stake in OpenAI Group PBC, which is valued at around $135 billion. The deal also extended Microsoft’s intellectual property rights for both AI models and products through 2032, covering even post-AGI (Artificial General Intelligence) models. According to Bloomberg, Microsoft will continue to receive 20% of OpenAI’s revenue. Meanwhile, OpenAI gained the ability to seek computing resources outside of Azure and attract new investors, while Microsoft secured the right to independently develop AGI, either solo or with other partners.

Microsoft 365 Copilot is the company’s flagship AI product, acting as an “AI-first” assistant embedded throughout the Microsoft 365 suite. It leverages large language models and organizational data from Microsoft Graph—including emails, chats, and documents—to deliver context-aware support. This tool has become a significant driver of Microsoft’s financial performance. In the latest quarter, revenue from the Productivity and Business Processes segment climbed 16% year-over-year to $34.1 billion, propelled by growth in Microsoft 365 Commercial Cloud, especially Microsoft 365 E5 and Copilot. CEO Satya Nadella revealed that 15 million Copilot subscriptions are now active. However, Copilot’s heavy reliance on OpenAI’s language models, hosted via Azure OpenAI Service, highlighted the risks of depending on a single supplier—prompting Microsoft to accelerate its in-house AI development.

Suleyman emphasized, “We must create our own foundational models at the cutting edge, utilizing gigawatt-scale computing and some of the world’s top AI research teams.” Microsoft is investing substantially in gathering and structuring the massive datasets required for training these advanced systems. He added that the company’s proprietary models are expected to debut “sometime this year.” The aim is to capture a larger share of the enterprise market by delivering “professional-grade AGI”—AI tools designed to handle routine tasks for knowledge workers.

Interestingly, Microsoft’s journey toward AI independence began even before the OpenAI partnership was restructured. In August 2025, Microsoft AI introduced MAI-1-preview, an internal “mixture-of-experts” model trained on approximately 15,000 NVIDIA H100 GPUs, with plans to integrate it into select Copilot text features. The company is also advancing its hardware self-sufficiency, having recently launched the Maia 200 accelerator, its second-generation in-house processor. Early units are being deployed to Microsoft’s superintelligence team to generate data for future AI models. These chips will also support Copilot for businesses and power AI models—including OpenAI’s latest offerings—available to Microsoft’s cloud customers.

Beyond its core push for AI independence, Microsoft is diversifying its AI partnerships. The company now hosts models from xAI, Meta, Mistral, and Black Forest Labs in its data centers, and has begun using Anthropic’s models for coding and within the Microsoft 365 suite.

Is Now the Time to Invest in MSFT?

Microsoft’s drive for “true self-sufficiency” marks a significant evolution—from being OpenAI’s main distributor to directly competing in the development of advanced AI models. This approach is designed to give Microsoft end-to-end control over its AI stack, from hardware and infrastructure to the intelligence layer, reducing the risk of relying on third parties. Many view this as a strategic, long-term advantage for MSFT shareholders.

- Microsoft gains greater control over its AI future, minimizing dependence on a single partner.

- Deploying its own models can lower licensing costs to OpenAI, potentially boosting profit margins.

- Custom-built models allow Microsoft to tailor AI solutions for enterprise clients, potentially expanding its market share in business AI.

However, this strategy is not without challenges. Developing proprietary, cutting-edge models demands significant investment in infrastructure, leading to higher capital expenditures—a factor that has recently weighed on Microsoft’s stock. The company also faces constraints in AI computing capacity, forcing it to balance resources between internal AI projects and the needs of external cloud customers. CFO Amy Hood noted that if all of Microsoft’s latest GPUs had been allocated to Azure, cloud growth in FQ2 would have surpassed 40%.

Overall, the long-term rewards of Microsoft’s pursuit of AI independence appear to outweigh the risks. With MSFT shares trading lower after recent earnings, the stock may present an attractive opportunity for long-term investors.

Analysts on Wall Street remain overwhelmingly positive on Microsoft, with a consensus “Strong Buy” rating. Out of 50 analysts, 41 recommend a “Strong Buy,” four suggest a “Moderate Buy,” and five advise holding. The average price target stands at $595.60, indicating a potential upside of 48.4% from the latest closing price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

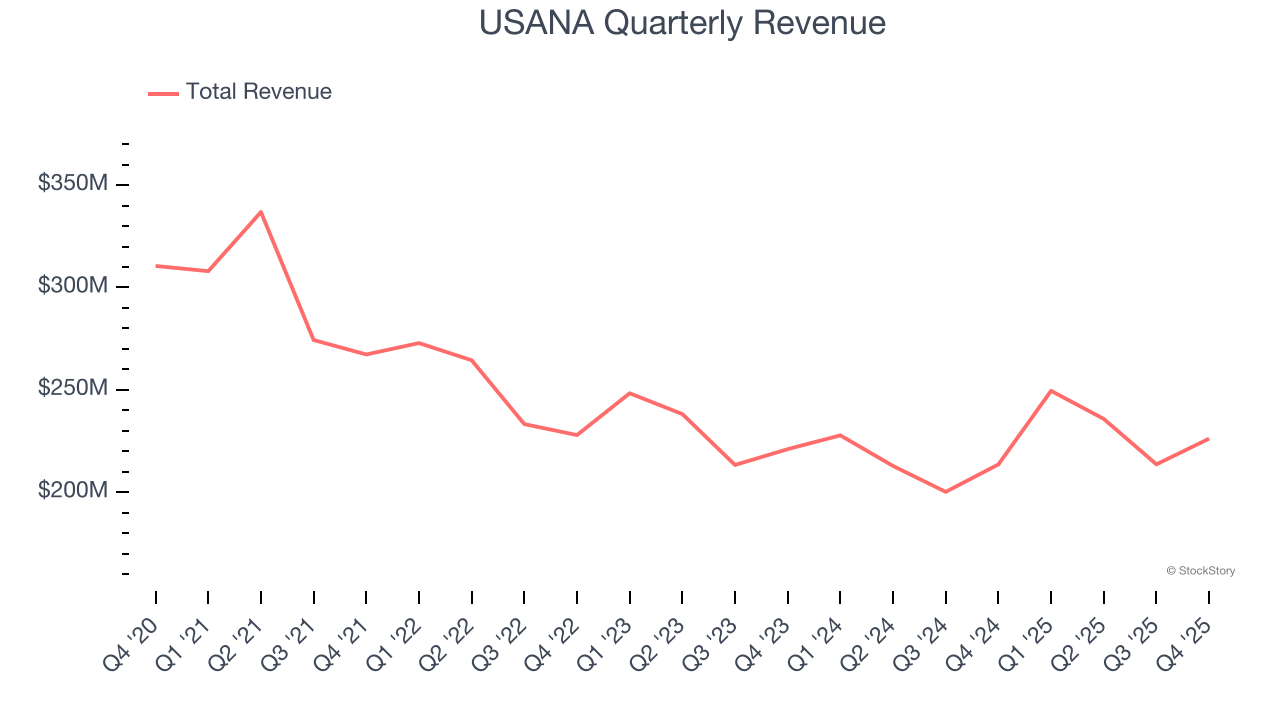

USANA's (NYSE:USNA) Q4 CY2025 Earnings Results: Revenue In Line With Expectations

Prediction Market ETFs? Roundhill Files For 6 Political Funds For 2026, 2028 Elections

AtriCure: Fourth Quarter Earnings Overview

Palo Alto Networks (NASDAQ:PANW) Reports Q4 CY2025 In Line With Expectations But Stock Drops