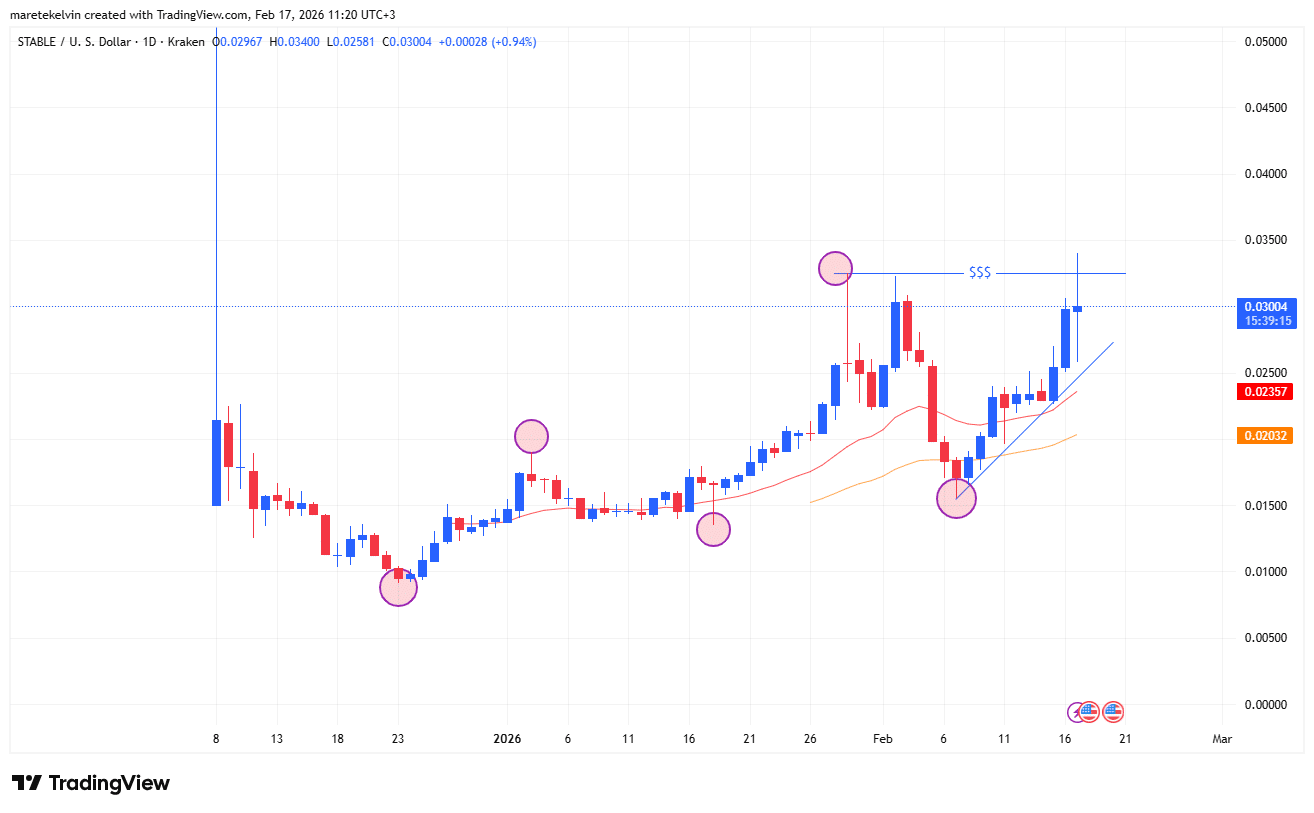

Stable [STABLE] has posted an 18% daily surge. This sharp and aggressive move signals a quick momentum return. Yet, derivatives data tells a deeper story.

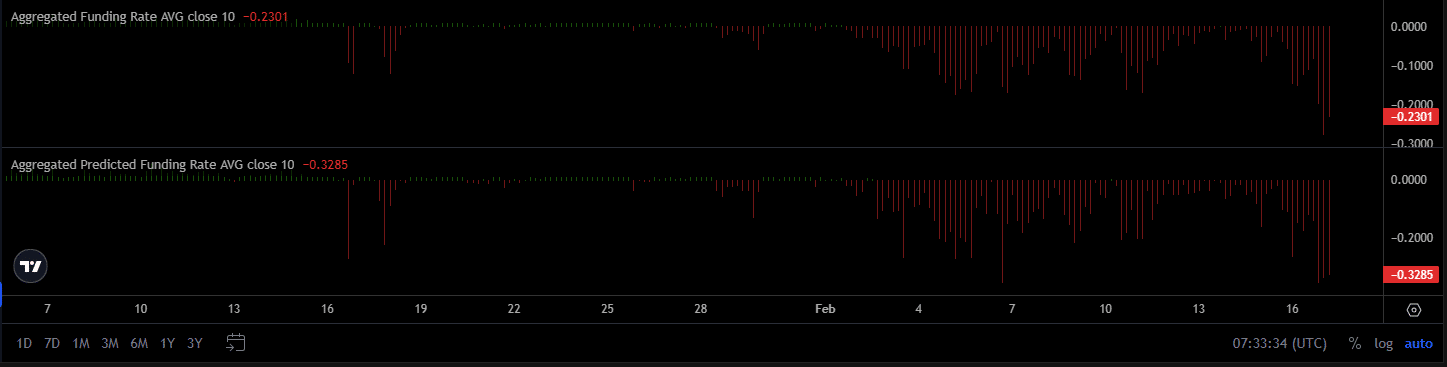

Despite the rally, STABLE’s aggregated Funding Rate remained negative at -0.2300.

At press time, the aggregated Funding Rate was above the predicted aggregated Funding Rate, which stood at -0.3285. However, the value is still below neutral.

In most cases, negative funding during a rally often suggests that short position takers are active.

However, the recent Funding Rate drop suggests that the price is still undervalued compared to how investors are positioned. That gap creates tension in the market.

Funding structure hints at re-entry

When funding remains negative after a strong price move, it shows hesitation. Many traders are still leaning bearish as they are not fully convinced by the rally. This creates a fragile balance.

If the price keeps climbing while funding stays compressed, shorts begin to feel pressure. Their positions become expensive to hold. Eventually, some are forced to close.

When that happens, the unwinding can be sharp. And that short squeeze can fuel the next leg higher. That scenario forces repositioning.

In many cases, such conditions support further bullish moves as sidelined traders re-enter and shorts close positions.

Liquidity cluster sets near-term target

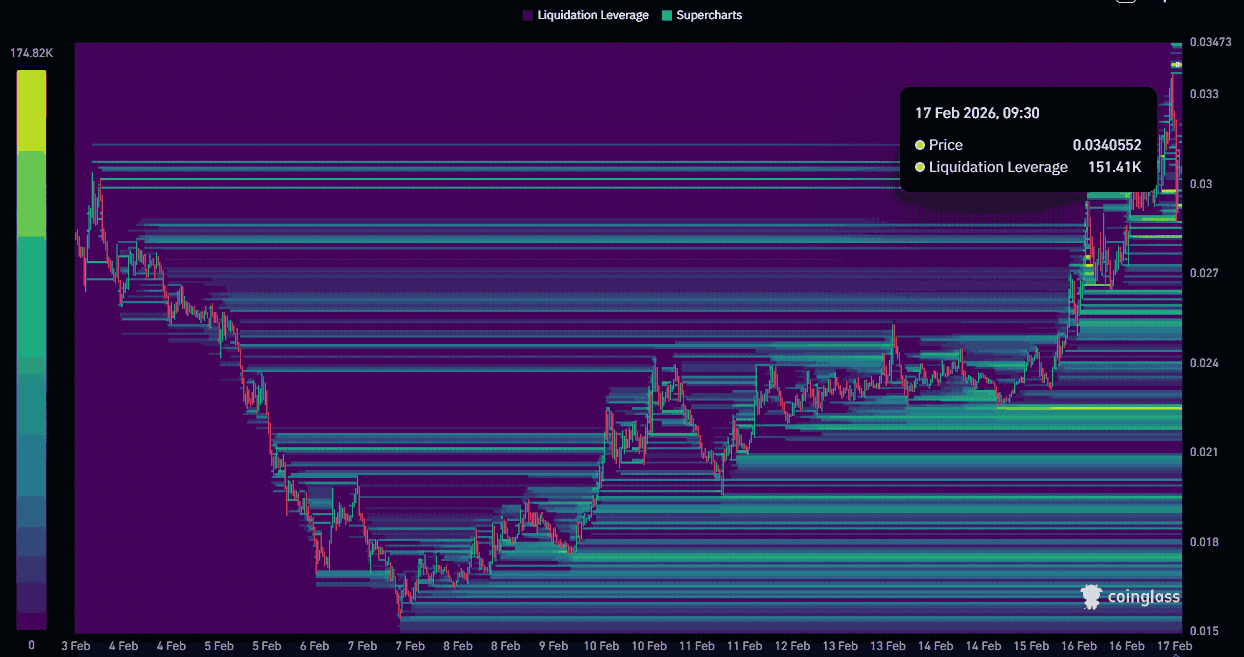

Above STABLE’s current price is a liquidity cluster worth $151K around the $0.034 level.

Usually, liquidity clusters act like a magnet on which price action oscillates. Prices often gravitate toward zones where orders are concentrated.

If accumulation builds on this surge, the $0.034 level becomes a logical near-term target.

A move into that cluster would confirm sustained momentum rather than a one-day spike.

What’s next for STABLE?

STABLE has momentum; funding suggests undervaluation, and liquidity clusters above the current trading price point to the market’s bullish bias.

Moreover, the token was trading above the 20-day and 50-day EMA support levels at the time of writing. This offers a line of defense for the token bulls in long-term positions.

The current technical structure favors a continuation of STABLE’s bullish run if buyers maintain control. However, follow-through remains critical. If demand fades, funding may normalize without price extension.

For now, bulls hold the edge. The $0.034 zone stands as the next test if accumulation strengthens in the long run.

Final Summary

- STABLE rallied 18% despite funding staying negative at -0.2300.

- A $151K liquidity cluster near $0.034 sets this price level as the next target.