Mizuho sees BitGo upsides, calling custodian ‘military-grade’ despite 44% post-IPO slump

Shares of crypto custodian BitGo (BTGO) slipped Tuesday as Mizuho initiated coverage of the newly public company with an "outperform" rating and a $17 price target, arguing the firm’s institutional custody platform is positioned to benefit from growing demand for regulated digital asset infrastructure.

BitGo shares are trading at around $10.15, leaving the stock down roughly 44% from its $18 January IPO price, as enthusiasm surrounding the company’s New York Stock Exchange debut quickly faded amid broader weakness across crypto-linked equities.

In a note, Mizuho analysts described BitGo as a "military-grade custodian," citing the company’s long-standing security track record and its focus on institutional clients as key advantages in an increasingly competitive custody market.

Analysts Dan Dolev and Alexander Jenkins argued BitGo stands out among crypto infrastructure companies due to its recurring revenue mix, with more than 80% of revenue tied to custody and staking services rather than volatile transaction activity.

"Institutions are likely to overwhelmingly favor large, established providers with long security track records," they wrote, adding that BitGo’s platform already safeguards more than $100 billion in client assets.

Upside despite post-IPO pressure

Mizuho’s $17 price target implies nearly 70% upside from current levels, with analysts expecting revenue growth to accelerate as institutional adoption of digital assets expands alongside stablecoins and tokenized real-world assets.

Still, BitGo’s shares have struggled since listing, echoing the broader pullback seen across crypto equities following last year’s rally. After briefly surging as much as 36% during its first day of trading, the stock quickly retraced toward its IPO price and has since drifted lower.

Investors remain cautious toward newly public crypto infrastructure firms, particularly those reliant on digital asset prices and institutional activity, both of which have softened in recent months.

Mizuho acknowledged risks remain, including crypto market volatility and intensifying competition from both crypto-native firms and traditional financial institutions entering custody.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

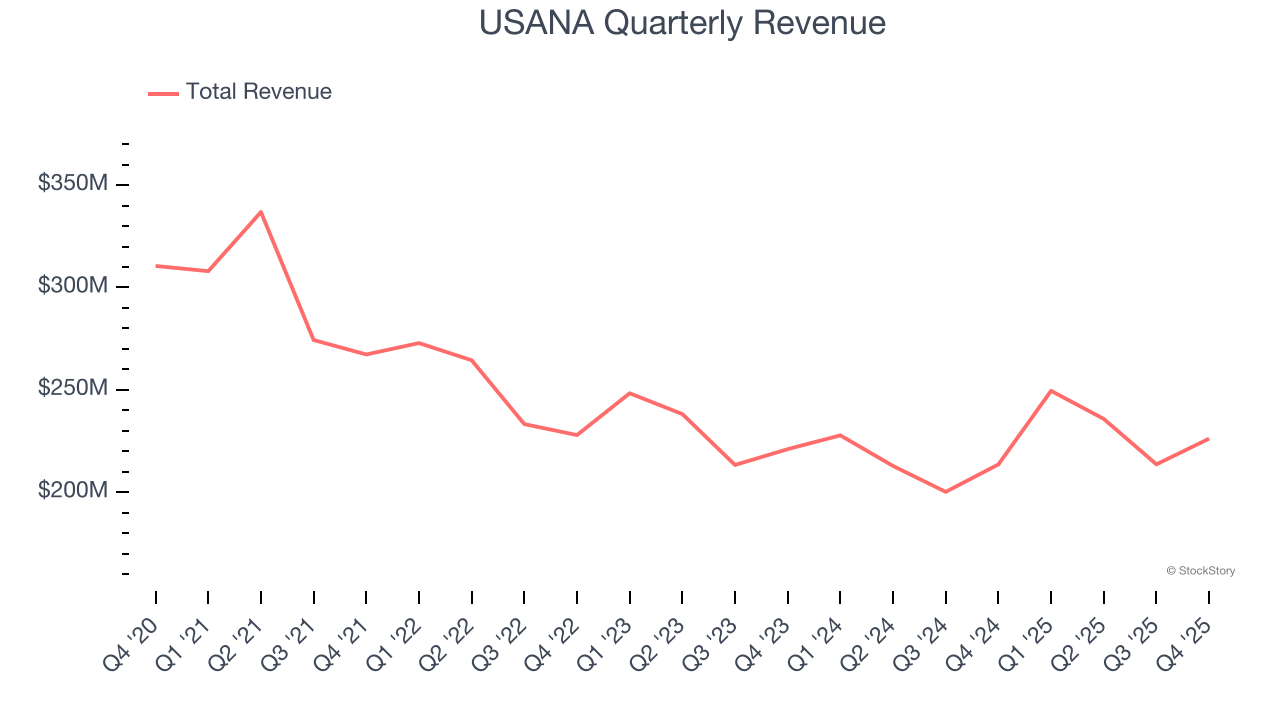

USANA's (NYSE:USNA) Q4 CY2025 Earnings Results: Revenue In Line With Expectations

Prediction Market ETFs? Roundhill Files For 6 Political Funds For 2026, 2028 Elections

AtriCure: Fourth Quarter Earnings Overview

Palo Alto Networks (NASDAQ:PANW) Reports Q4 CY2025 In Line With Expectations But Stock Drops