Rare Earth Stock Tests Historically Bullish Trendline

MP Materials Corp (NYSE:MP) stock slid to a one-month low today, with no clear catalyst behind the move. The equity was last seen down 2% to trade at $56.87, but remains technically resilient, with multiple layers of support in place. What's more, the equity is testing its ascending 200-day moving average, which could result in tailwinds.

According to Schaeffer's Senior Quantitative Analyst Rocky White, MP is within 0.75 of its 126-day moving average's 200-day average true range (ATR), after remaining above this level 80% of the time in the past two weeks and 80% of the last 42 trading sessions. This signal has occurred five other times in the past decade, after which MP was higher one month later 80% of the time with an average pop of 17.3%. A similar move from the stock's current perch would put it back above $66.

Analysts lean firmly bullish, with 15 of the 16 covering firms maintaining a "buy" or better rating. Plus, the 12-month consensus target price of $222.71 is now a 28.3% premium to current levels.

Shorts are firmly in control, with short interest up 5.4% in the last two reporting periods. The 24.52 million shares sold short account for 17.3% of the equity's available float, or nearly three days' worth of pent-up buying power.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

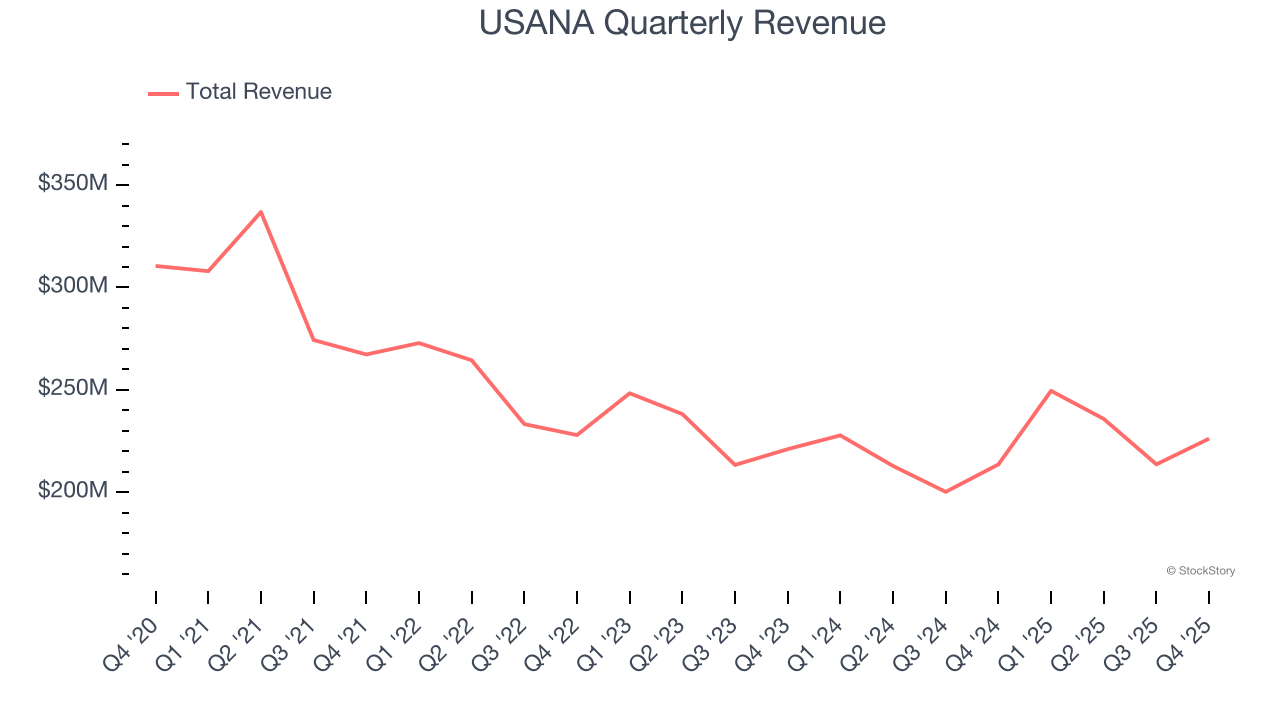

USANA's (NYSE:USNA) Q4 CY2025 Earnings Results: Revenue In Line With Expectations

Prediction Market ETFs? Roundhill Files For 6 Political Funds For 2026, 2028 Elections

AtriCure: Fourth Quarter Earnings Overview

Palo Alto Networks (NASDAQ:PANW) Reports Q4 CY2025 In Line With Expectations But Stock Drops