AlphaTON Capital Executes Binding Call Option to Sell Legacy Biotech Asset iOx Therapeutics to Immunova

Structure Preserves Shareholder Upside Through Equity, Milestones, Royalties, and Sublicensing Participation

Dover, DE, Feb. 17, 2026 (GLOBE NEWSWIRE) -- AlphaTON Capital Corp. ("AlphaTON" or the "Company"), the world's leading public technology company scaling the Telegram super app for an addressable market of over 1 billion monthly active users, today announced the execution of a binding call option agreement with Immunova, LLC ("Immunova"), granting Immunova, or an affiliate, the option to acquire iOx Therapeutics Limited ("iOx"), a wholly owned subsidiary of AlphaTON focused on developing liposomal iNKT agonists.

Upon exercise of the option and completion of the acquisition, AlphaTON would be entitled to an upfront cash payment at closing, equity consideration representing 10% of the fully diluted equity of the acquiring entity at the time of exercise, milestone payments potentially exceeding $100 million (payable upon achievement of specified milestones), and single-digit royalties on future net sales, subject to the terms of the definitive documentation.

iOx’s lead candidate, PORT-2 (IMM60), a liposomal iNKT cell agonist, has been evaluated in advanced melanoma and metastatic NSCLC patients in the Phase 1/2 IMP-MEL study, conducted in the U.S. and U.K. (reported as the IMPORT-201 study).The program originated at the University of Oxford, and Merck provided pembrolizumab (KEYTRUDA) under a clinical trial collaboration. Data presented at ASCO and SITC indicated PORT-2 was well tolerated as a monotherapy at all doses tested, with biomarker evidence of immune activation and preliminary signs of anti-tumor activity, including shrinkage in several lesions in heavily pre-treated PD-1 refractory patients.

The transaction enables AlphaTON to unlock value from iOx while maintaining significant participation in the future success of the pipeline through its equity stake, milestone payments, and royalty structure.

“Executing this agreement is an important step to unlock value from iOx while preserving meaningful long-term economic participation for AlphaTON,” said Brittany Kaiser, Chief Executive Officer of AlphaTON Capital. “iOx is a differentiated, clinically supported lipid-based immune program, and placing it with Immunova enables dedicated execution under a focused development platform. We will continue to advance our mesothelioma program, where we remain on track to dose the first patient with TT-4, and we are progressing our new Telegram-oriented, AI-driven biotech initiative aimed at rare cancers. This is about maximizing value across the portfolio with clear priorities and disciplined execution.”

Brian Horsburgh, PhD, CEO of Immunova, said: "We are pleased to partner with AlphaTON on this transaction. The iOx portfolio represents a differentiated lipid-based immune platform supported by human clinical data and compelling biomarker evidence, well aligned with our deep expertise in lipid science and development. With formalized rights to the assets, we intend to pursue a disciplined, capital-efficient, biomarker-driven development strategy to advance meaningful clinical milestones and build a focused clinical-stage biotechnology company to deliver new medicines for patients.”

The call option is exercisable subject to certain conditions, including Immunova securing financing commitments. There can be no assurance that the call option will be exercised, that the contemplated transaction will be completed or that, if the transaction is completed, it will prove to be beneficial to AlphaTON. The transaction remains subject to customary closing conditions.

About AlphaTON Capital Corp. (Nasdaq: ATON)

AlphaTON Capital Corp (NASDAQ: ATON) is the world's leading technology public company scaling the Telegram super-app, with an addressable market of 1 billion monthly active users. The Company is delivering a comprehensive hyperscaler strategy on the Telegram ecosystem through a combination of software products, middleware data, AI training assets, and AI infrastructure hardware clusters deploying Confidential AI for the Telegram ecosystem.

Through its operations, AlphaTON Capital provides public market investors with institutional-grade exposure to the Telegram ecosystem and its one billion-user platform while maintaining the governance standards and reporting transparency of a Nasdaq-listed company. Led by Chief Executive Officer Brittany Kaiser, Executive Chairman and Chief Investment Officer Enzo Villani, and Chief Business Development Officer Yury Mitin, the Company's activities span network validation and staking operations, development of Telegram-based applications, and strategic investments in TON-based decentralized finance protocols, gaming platforms, and business applications.

AlphaTON Capital, through its legacy business, is also advancing first-in-class therapies targeting known checkpoint resistance pathways to achieve durable treatment responses and improve patients' quality of life. AlphaTON Capital actively engages in the drug development process and provides strategic counsel to guide the development of novel immunotherapy assets and asset combinations.

AlphaTON Capital Corp is incorporated in the British Virgin Islands and trades on Nasdaq under the ticker symbol "ATON".

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

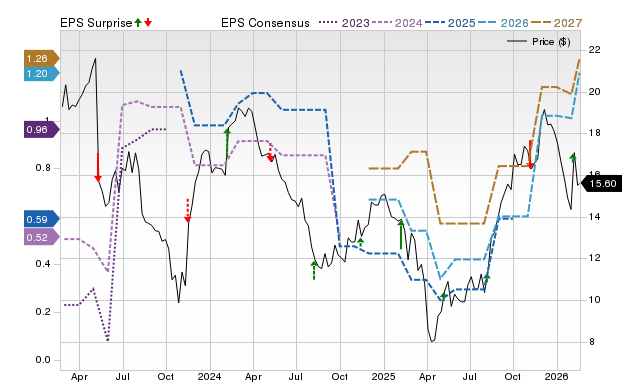

Wall Street Analysts Think Sonos (SONO) Could Surge 28.21%: Read This Before Placing a Bet

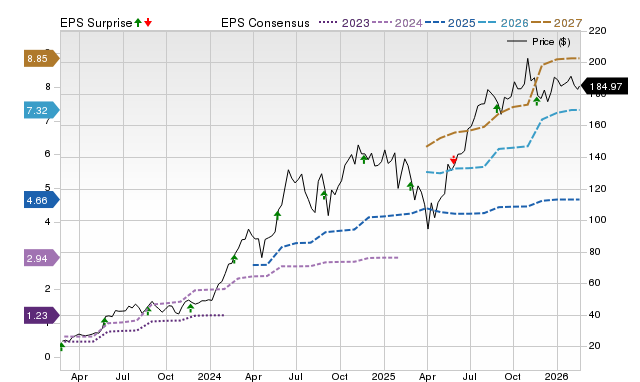

Wall Street Analysts Believe Nvidia (NVDA) Could Rally 38.16%: Here's is How to Trade