Silver prices remain stuck below the triple-digit mark, and Bitcoin is still finding fresh reasons to slide. With the U.S. Federal Reserve set to release its minutes at 10 PM and two major economic data points due on Friday, the uncertainty looks set to continue. Bitcoin, while indecisive, now seems more inclined toward a downside, having failed to defend the $69,000 support. What do historical trends reveal about the current market mood?

Long-Term Crypto Holders Shift Tactics

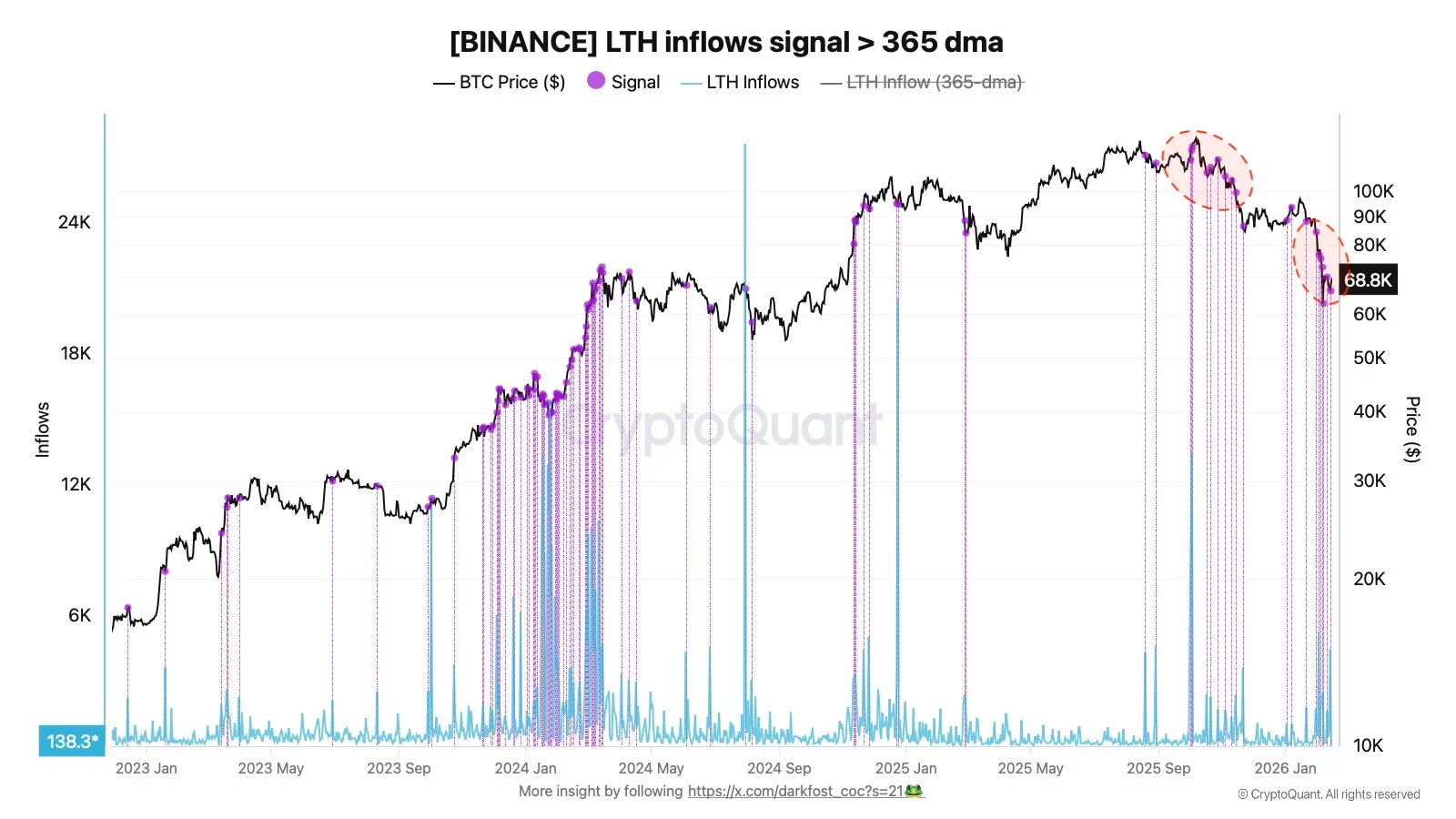

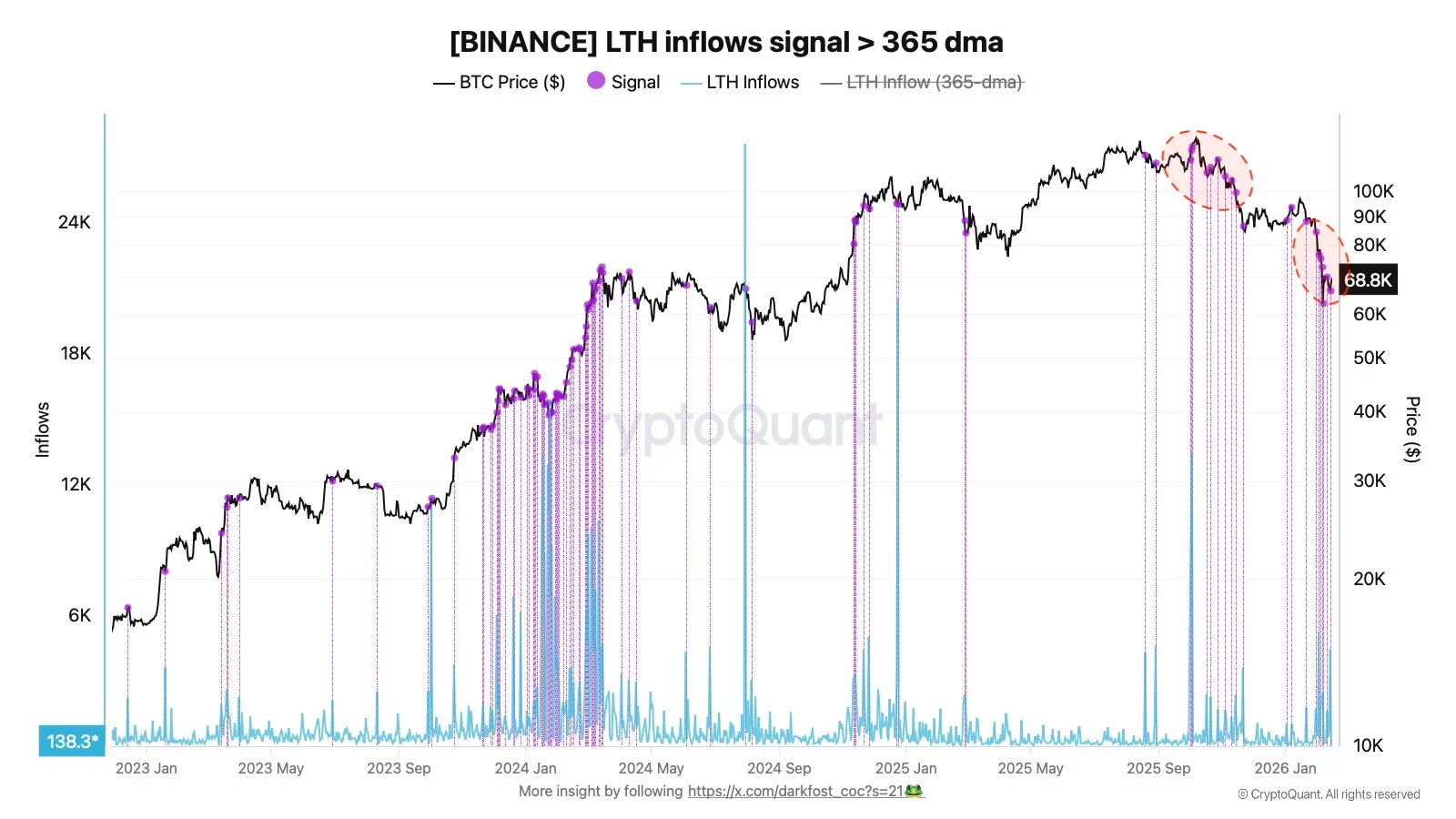

Long-Term Holders (LTH) are known as the patient “smart money” of the crypto world, sitting on their Bitcoin for at least 155 days without moving it. According to analyst Darkfost, there’s now a notable increase in the volume of Bitcoin these seasoned investors are transferring to the exchange.

This prolonged correction phase is weighing on a broad base of investors, but even long-term holders—typically regarded as the market’s most resilient participants—are showing signs of stress. For the first time in a while, these holders are booking losses on their sales, indicating their financial strains are mounting.

“The chart highlights periods when daily inflows reached nearly twice the yearly average, signaling exceptionally high activity and a clear behavioral shift. This indicates that some LTHs are actively repositioning in response to current market conditions—a trend that’s accelerated since the recent peak. For several consecutive days, inflows into the exchange have been well above normal, suggesting a sustained uptick in LTH activity. Given their capacity for large BTC movements, it’s no surprise these participants prefer Binance for its depth and liquidity,” Darkfost explained.

What does this mean for the average observer? Rising inflows from long-term holders, even during a widespread correction, are a signal that the pressure to sell is intensifying. This suggests that Bitcoin’s downturn might not be over yet.

In short, it wouldn’t be surprising to see deeper lows for Bitcoin in the weeks and even months ahead. This wave of selling from veteran holders draws fuel from several sources: the upcoming leadership change at the Federal Reserve in May, trade tariffs, mounting geopolitical risks, and historical data hinting at a bear market for 2026.

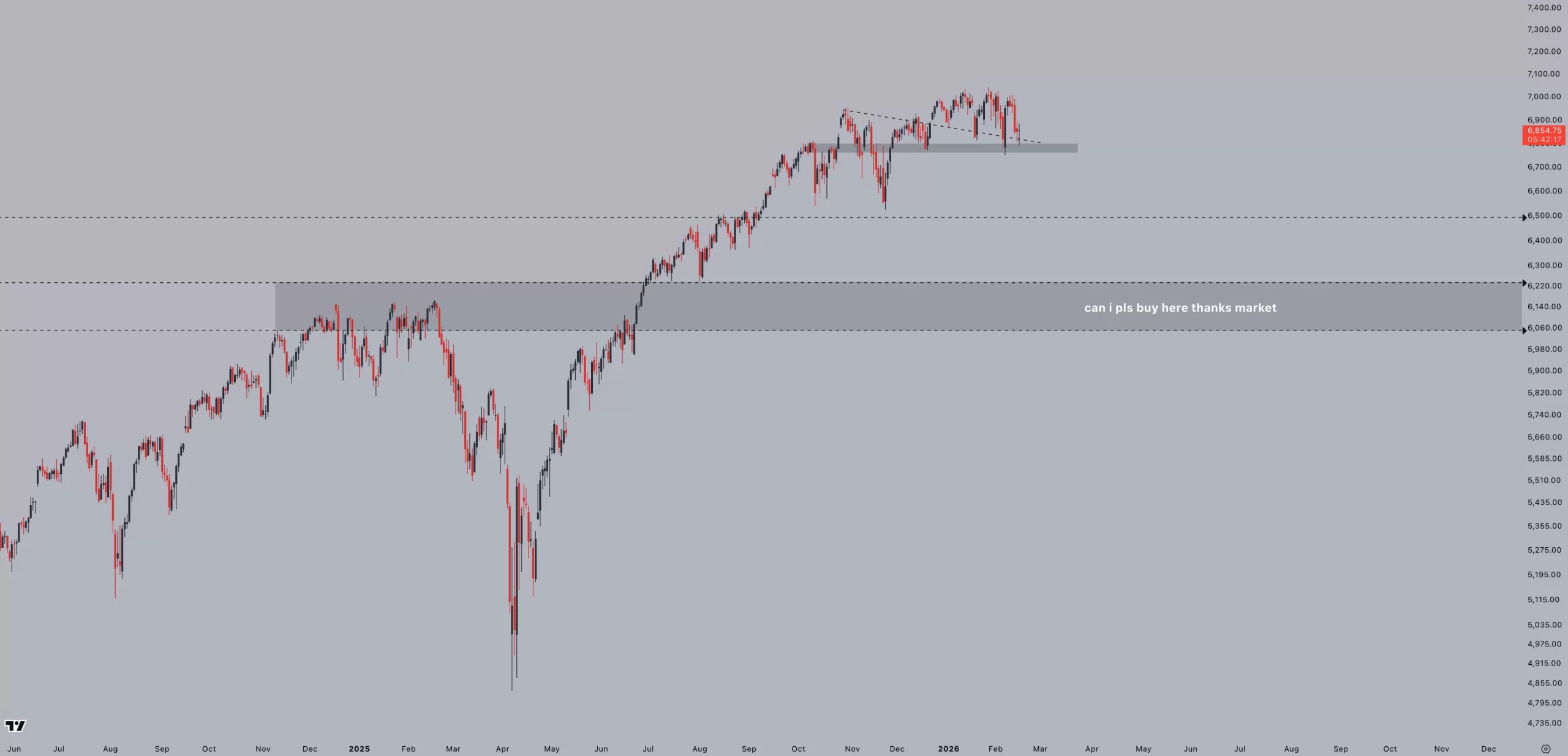

US Stocks Slide Could Drag Bitcoin Lower

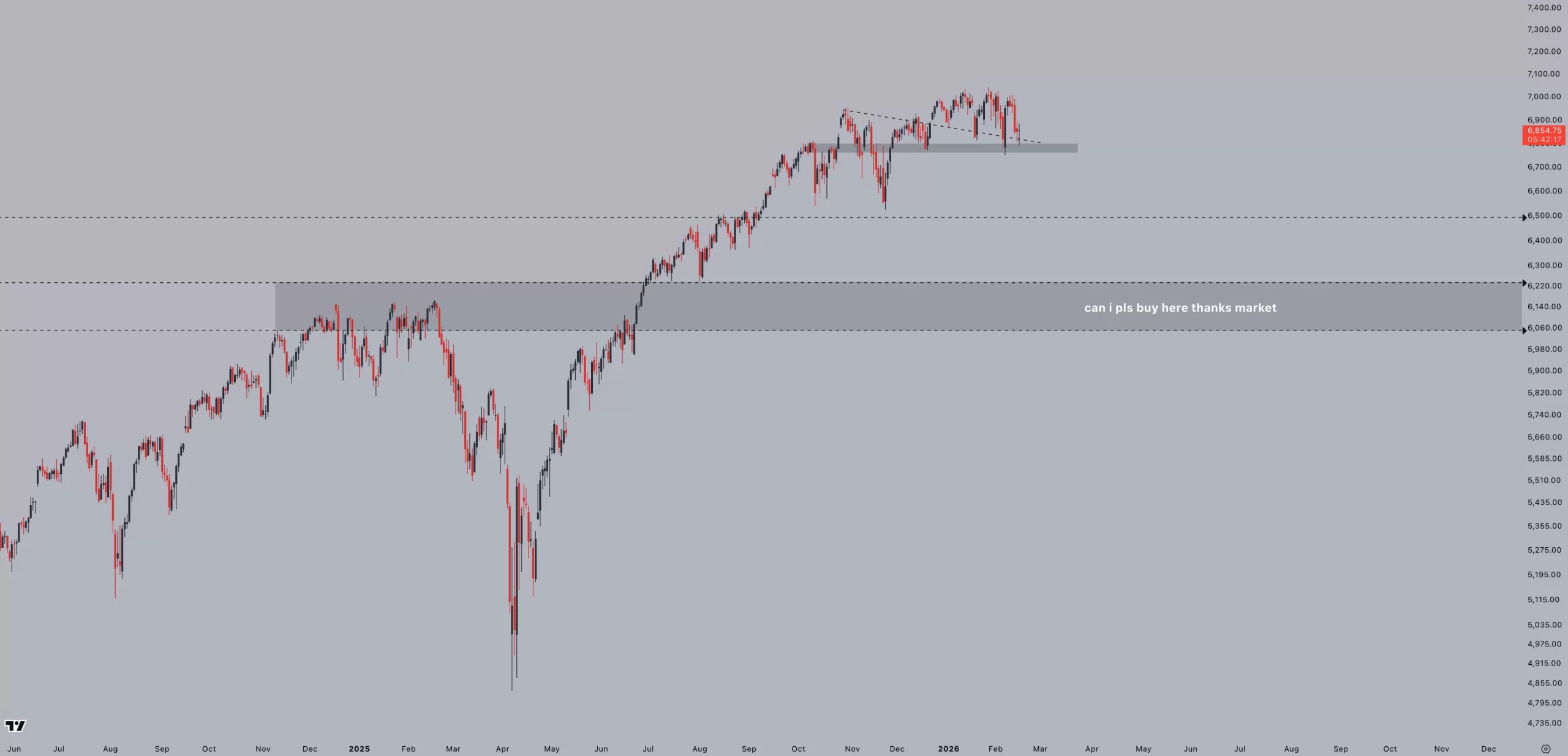

Analyst Jelle warns that U.S. equity markets may soon see selloffs gather pace—a scenario reminiscent of the February 17 dip, which had ripple effects on crypto prices as well. Should American stocks take a hit, Bitcoin will likely follow in their footsteps.

“The probability of the S&P turning downward in the coming weeks is rising rapidly, which means attractive entry points are approaching. Stocks are becoming undervalued, and that could mean an even steeper discount for $BTC.” Jelle commented.

Could Silver’s Drop Fuel a Crypto Rally?

Ever the optimist, Michael Poppe points out weakness in silver prices and sees this as a cue for capital to flow back into crypto. Yet, despite Poppe’s positive outlook, the prevailing sentiment among long-term crypto investors leans heavily bearish; their selling adds supply and applies further downward pressure on prices—potentially undermining Poppe’s call for a rebound.

“The downward trend for silver is clear. We’ve hit a peak, and a prolonged consolidation period is ahead. This is perfectly normal—by buying silver at lower levels, we’re preparing for the next upward run. At the same time, this is when we begin to rotate into other assets like crypto,” Poppe said.