Solana (SOL) Thrives as Token Holders Question Its Applied Value

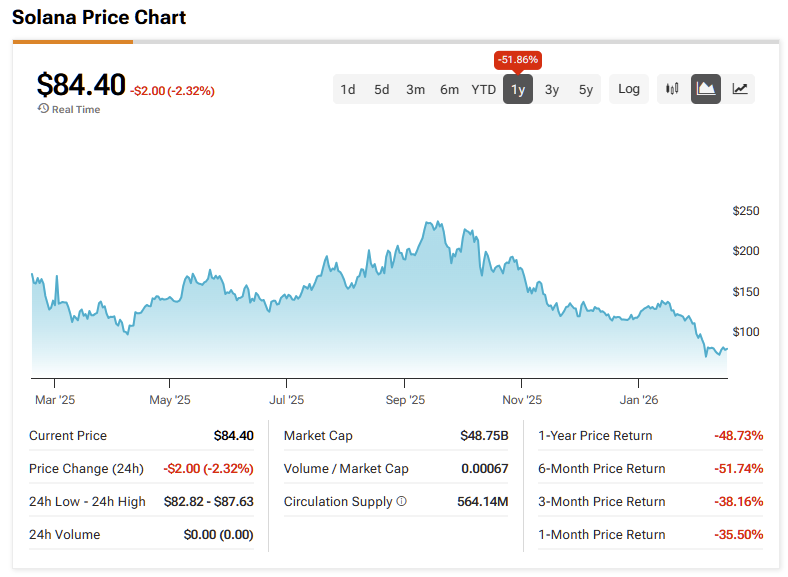

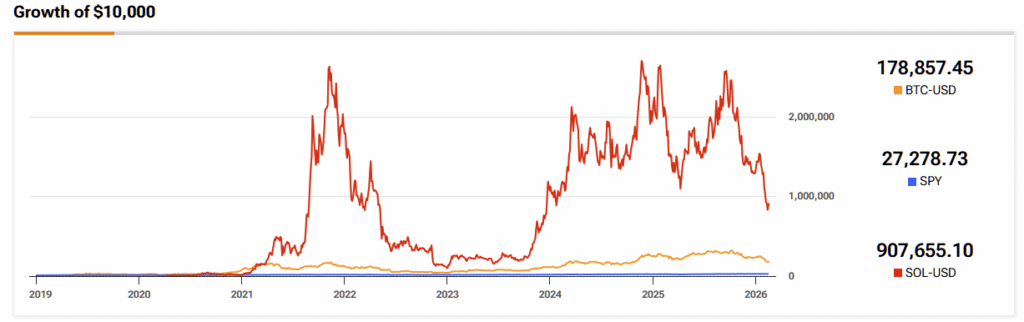

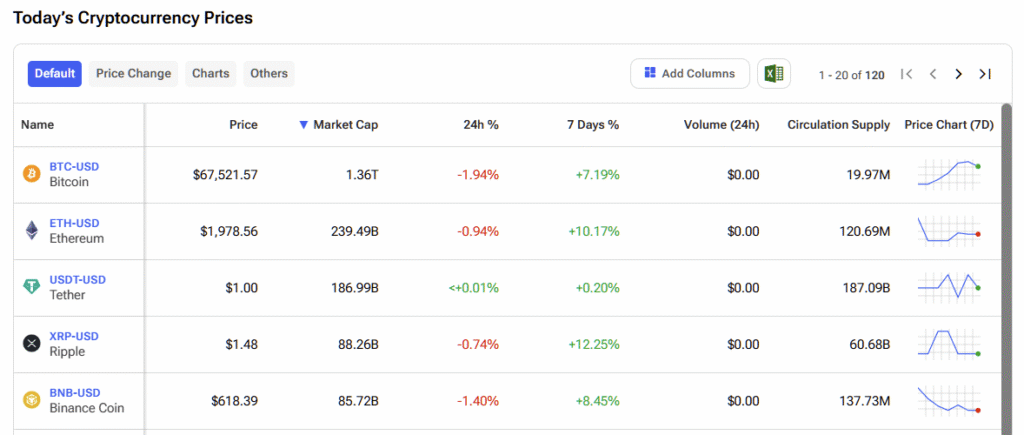

Cryptocoin Solana (SOL-USD) has delivered a striking comeback over the past year, with network activity surging and the token’s price climbing in tandem. The blockchain now ranks among the most heavily used in crypto, processing millions of transactions daily at speeds and costs few competitors can rival. Investors such as the Franklin Solana ETF are “doubling down,” according to recent reports.

President's Day Sale - 70% Off

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Yet beneath the headline growth sits a question central to long-term investors: is this burst of on-chain activity translating into real economic value for SOL holders, or is the market once again running ahead of what the network truly generates?

What’s clear is that Solana stands on far firmer ground than it did two years ago. The network has proven its resilience, cultivated a broad ecosystem, and positioned itself as a credible alternative to more established chains — achievements that form the backbone of the bullish case.

Network Performance Shows Clear Improvement

Solana is built as a high-throughput blockchain capable of processing thousands of transactions per second with minimal latency. That architecture has kept fees consistently below a cent in most cases, positioning the network as an appealing platform for applications that require speed, scale, and low friction.

Usage metrics reflect that advantage. Daily active addresses continue to trend higher, on-chain volume has grown across multiple sectors, and the network has now operated reliably for more than two years without major disruptions. This track record represents a meaningful shift from earlier periods when outages cast doubt on Solana’s readiness for sustained, real-world use.

The ecosystem now stretches across decentralized finance, NFT marketplaces, memecoin trading, and payment applications, signaling that activity is no longer driven by a single narrative. Developers remain highly active, while institutional interest has expanded alongside retail participation.

Still, robust network usage does not automatically translate into strong economic returns for token holders — a distinction that sits at the heart of Solana’s long-term investment case.

The Value Capture Challenge

At its core, the debate centers on how Solana captures value from the activity flowing through its network. Blockchain economics hinge on mechanisms such as transaction fees, fee burns, and staking rewards to link usage to token value.

Solana has deliberately kept base fees extremely low to drive adoption and enable high-frequency applications. That strategy lowers friction for users and helps explain the sharp rise in transaction counts. The tradeoff, however, is that even elevated activity levels translate into relatively modest total fee revenue.

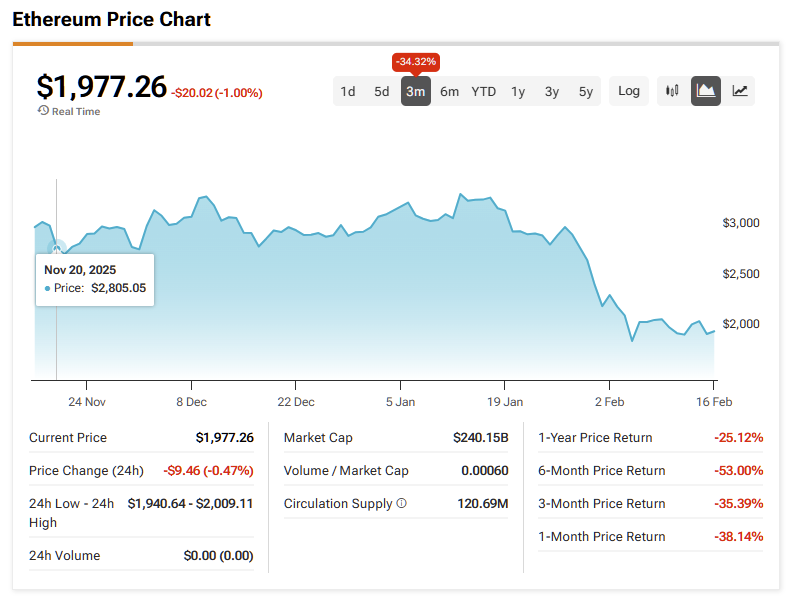

Compare this to networks like Ethereum (ETH-USD), where higher fees generate substantial revenue per transaction despite lower throughput. Solana made a conscious trade-off, prioritizing accessibility and scale over fee capture. That decision has enabled the network to process far more transactions than most competitors, but it creates a structural ceiling on how much value can flow back to token holders through fees alone.

Fee Burns Battle Ongoing Inflation

Each Solana transaction includes a small fee burn, introducing a deflationary force that can, over time, counterbalance new token issuance. The problem is scale. Inflation — which funds validator incentives and secures the network — still exceeds fee burns by a wide margin at current usage levels. Independent blockchain analytics consistently show that net issuance remains positive, meaning more SOL is created through inflation than removed through burns.

That balance could eventually shift if transaction volumes rise far beyond today’s levels. For now, however, fee burns are not a primary driver of Solana’s token economics. They act more as a modest tailwind, slightly improving the supply outlook rather than fundamentally changing it. The gap between fees generated and inflation distributed suggests network growth is supportive — but not yet transformative — for SOL’s near-term supply dynamics.

Staking Yields Settle Into Sustainable Range

Staking is the second primary channel through which network growth can accrue to SOL holders. A substantial share of the circulating supply is delegated to validators, with annual yields typically in the mid- to high single digits. The expansion of liquid staking has been especially significant, enabling investors to earn yield while retaining flexibility and limiting counterparty exposure.

As participation increases, however, the fixed reward pool is spread across a broader base of tokens, gradually compressing returns. On-chain data reflects this trend: effective yields have moderated as staking adoption has widened. That pattern signals a maturing and more secure network, but it also suggests staking is unlikely to produce outsized income gains purely from rising activity. Its core benefit is strengthening validator security rather than materially boosting short-term returns for existing stakers.

Price Driven by Sentiment Over Fundamentals

SOL’s price behavior continues to track broader crypto sentiment more closely than on-chain fundamentals. The token tends to move with shifts in risk appetite, reacting to macro headlines, regulatory signals, and capital flows into digital asset products. When sentiment turns favorable, SOL can reprice rapidly as investors lean into its status as a leading smart-contract platform. When risk fades, prices pull back even if network usage remains strong. For now, improving fundamentals appear to function more as narrative reinforcement than as a firm anchor for valuation.

Promise vs. Performance

Solana stands on a far firmer footing than it did two years ago. The network has proven its resilience, cultivated a broad ecosystem, and positioned itself as a credible alternative to more established blockchains — all of which strengthen the bullish narrative. Yet the direct economic payoff from rising activity remains relatively modest compared with SOL’s market capitalization, largely due to the network’s low-fee structure and ongoing inflation.

Growth has advanced enough to support the case that Solana is no longer just a speculative experiment. Still, recent price appreciation leans heavily on expectations that today’s usage will mature into higher-value economic activity. Investors embracing that thesis are effectively wagering that Solana’s next phase will focus on turning raw transaction throughput into deeper value creation — and, ultimately, tighter alignment between the network’s utility and the value captured by SOL. For now, that transition remains very much in progress.

Copyright © 2026, TipRanks. All rights reserved.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wheat Ends Tuesday Trading in the Red

Soybeans Maintain Their Advances on Tuesday

Hogs Make a Comeback This Tuesday