Live Nation (LYV) Q4 Earnings Report Preview: What To Look For

Live events and entertainment company Live Nation (NYSE:LYV) will be reporting results this Thursday afternoon. Here’s what investors should know.

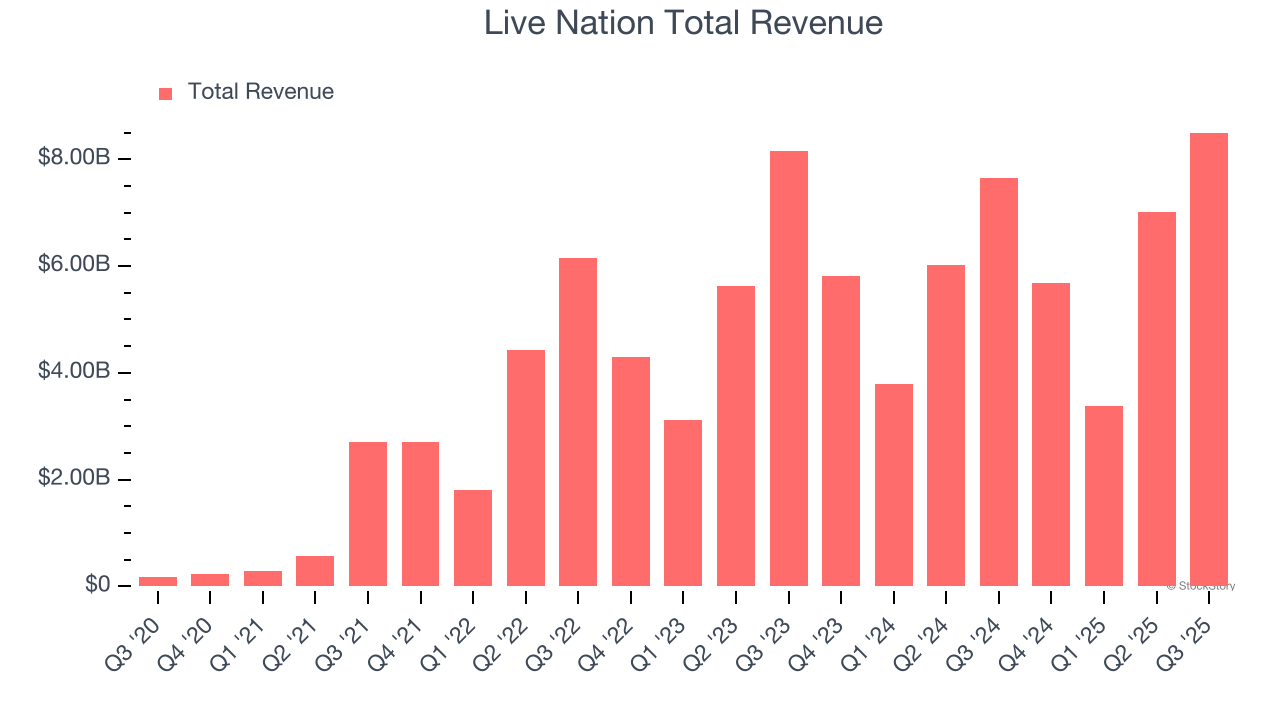

Live Nation missed analysts’ revenue expectations by 0.9% last quarter, reporting revenues of $8.50 billion, up 11.1% year on year. It was a mixed quarter for the company, with a solid beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EPS estimates.

This quarter, analysts are expecting Live Nation’s revenue to grow 7.4% year on year to $6.10 billion, a reversal from the 2.4% decrease it recorded in the same quarter last year. Adjusted loss is expected to come in at -$1.05 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Live Nation has missed Wall Street’s revenue estimates four times over the last two years.

Looking at Live Nation’s peers in the consumer discretionary - leisure facilities segment, some have already reported their Q4 results, giving us a hint as to what we can expect. Sphere Entertainment delivered year-on-year revenue growth of 27.9%, beating analysts’ expectations by 4.4%, and Callaway Golf Company reported a revenue decline of 60.2%, falling short of estimates by 53.5%. Sphere Entertainment traded up 22% following the results while Callaway Golf Company was down 15%.

Investors in the consumer discretionary - leisure facilities segment have had steady hands going into earnings, with share prices flat over the last month. Live Nation is up 12.5% during the same time and is heading into earnings with an average analyst price target of $170.10 (compared to the current share price of $158.10).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What Makes Snowflake (SNOW) a Lucrative Investment?

Dangerous Scenario for Altcoins: The Worst of the Last Five Years is Happening! “Except for Ethereum (ETH)!”

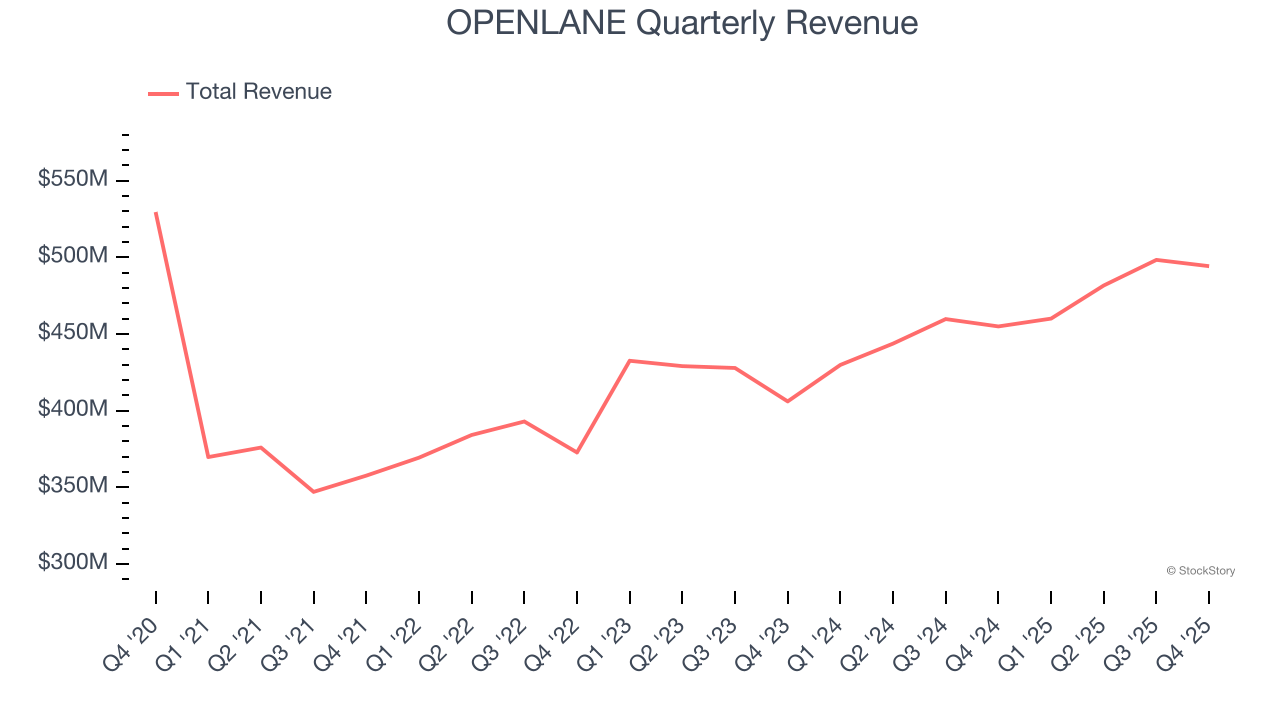

OPENLANE (NYSE:OPLN) Surprises With Q4 CY2025 Sales

SolarEdge's (NASDAQ:SEDG) Q4 CY2025 Sales Beat Estimates