Bitcoin, Ethereum, XRP, Dogecoin Slide Ahead Of Fed Meeting Minutes: Analyst Says BTC In An Area Where They'd 'Fancy' Buying Some

Leading cryptocurrencies tumbled, while stocks closed higher on Tuesday, as investors awaited the Federal Reserve’s minutes from January’s policy meeting.

| Bitcoin (CRYPTO: BTC) | -2.66% | $67,011.90 |

| Ethereum (CRYPTO: ETH) |

-1.34% | $1.973.18 |

| XRP (CRYPTO: XRP) | -1.18% | $1.46 |

| Solana (CRYPTO: SOL) | -3.00% | $84.33 |

| Dogecoin (CRYPTO: DOGE) | -0.14% | $0.1006 |

No Respite For Crypto

Bitcoin slid to an intraday low of $66,600, accompanied by a slight increase in 24-hour trading volumes.

Ethereum continued to battle bears at $2,000, while XRP and Solana recorded noticeable declines.

Shares of cryptocurrency-related companies, including Strategy Inc. (NASDAQ:MSTR) and BitMine Immersion Technologies, Inc. (NYSE:BMNR), closed down 3.89% and 3,86%, respectively.

Roughly $200 million was liquidated from the market in the last 24 hours, with $138 million in long liquidations alone wiped out.

Bitcoin’s open interest rose 0.68% over the past 24 hours. An increase in open interest coupled with a drop in price typically indicates entry of new short positions.

However, both retail and whale investors on Binance continued to be bullish on Bitcoin, placing a higher number of longs compared to shorts.

Top Gainers (24 Hours)

| Cryptocurrency (Market Cap>$100 M) | Gains +/- | Price (Recorded at 8:30 p.m. ET) |

| Ribbita by Virtuals (TIBBIR) | +15.42% | $0.1506 |

| Jito (JTO) | +15.50% | $0.3118 |

| Morpho (MORPHO) | +10.36% | $1.50 |

The global cryptocurrency market capitalization stood at $2.36 trillion, following a modest increase of 0.74% over the past 24 hours.

Stocks Gain Ahead Of Fed Minutes Release

Stocks closed in the green on Tuesday. The Dow Jones Industrial Average rose 32.26 points, or 0.07%, to finish at 49,533.19. The S&P 500 gained 0.10% to settle at 6,843.22, while the tech-focused Nasdaq Composite added 0.14% to close at 22,578.38.

Spot gold traded below $5,000, while spot silver wobbled in the range between $72-$73 an ounce.

Investors awaited minutes from the Fed's January policy meeting, scheduled for Wednesday, for clues on the trajectory of interest rates.

More inflation data is also on the way, with the personal consumption expenditures price index report slated for Friday

Is A 26% Upside On The Way?

Widely followed cryptocurrency analyst and trader Michaël van de Poppe noted there's "nothing special" about Bitcoin's trajectory and the asset is just consolidating in the $66,000–$70,000 range.

"It’s stuck in a range and simply consolidating, through which it’s a waiting game until volatility slows down and the expansion is about to game," the analyst added. "Nonetheless; this means that we’re still in an area where I’d fancy buying the asset."

Nothing special on $BTC.

— Michaël van de Poppe

It's stuck in a range and simply consolidating, through which it's a waiting game until volatility slows down and the expansion is about to game.

Nonetheless; this means that we're still in an area where I'd fancy buying the asset.

Satoshi Flipper, another popular cryptocurrency market commentator, highlighted a symmetrical triangle pattern on Bitcoin's 4-hour chart, projecting a breakout to $85,000, roughly 26% higher from current levels.

$BTC/usdt 4 hour

— Satoshi Flipper

When 95% of CT is bearish AF w/ all chart targets pointing to $40k-$50k while I spot a beautiful, textbook & bullish symmetrical triangle w a breakout pointing to $85k

$85k WAITING ROOM 😍

Photo Courtesy: vinnstock on Shutterstock.com

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pi Network Price Prediction: PI Surges 40% As Mainnet Migration Halts And Supply Pressure Drops

Wall Street Expands Its Presence in Prediction Markets Through Recent ETF Applications

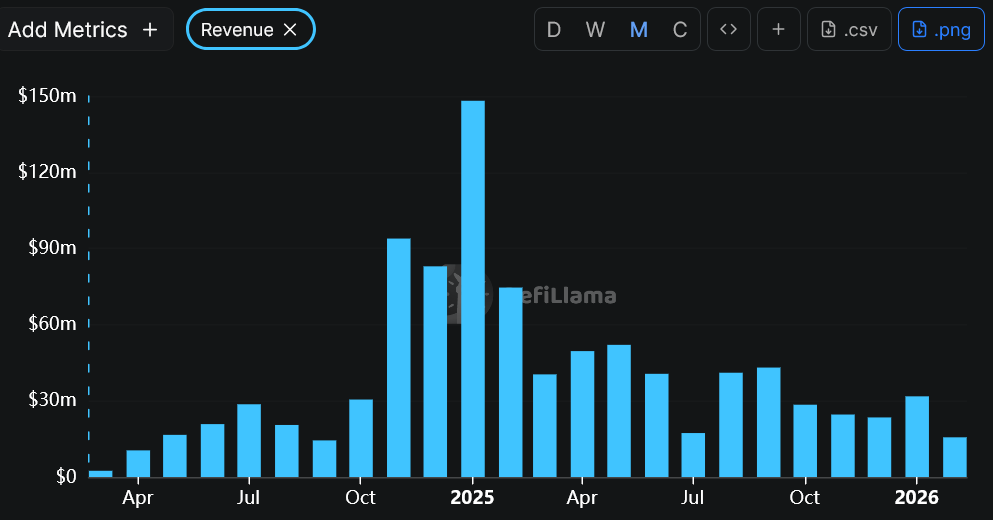

Pump.fun rolls out trader cashbacks amid memecoin 'capitulation'