Morgan Stanley Maintains Equal Weight on Phibro Animal Health Corporation (PAHC), Cites Margin Expansion

Phibro Animal Health Corporation (NASDAQ:PAHC) is among the 7 Cheap Pharmaceutical Stocks to Buy According to Hedge Funds.

The seventh stock on our list of cheap pharmaceutical stocks is Phibro Animal Health Corporation (NASDAQ:PAHC).

TheFly reported on February 6 that Morgan Stanley increased its price target on PAHC to $49 from $45 and maintained an Equal Weight rating. The firm cited strong operational performance in the company’s latest quarterly results and highlighted effective execution within the Animal Health segment and progress related to the Zoetis MFA transaction. The upgrade came after significant margin expansion, a better fiscal 2026 forecast, and a second-quarter profit beat. Disciplined cost control was also cited by Morgan Stanley as a significant element, pointing out that recent outcomes show strong momentum in several important business areas.

Adding to that, earlier on February 4, Phibro Animal Health Corporation (NASDAQ:PAHC) revealed fiscal second-quarter results for the fiscal year that ended on December 31, 2025. The report shows a significant improvement from year to year, with the net sales rising 21% to $373.9 million, while net income increased to $27.5 million. Adjusted EBITDA rose 41% to $68.1 million, while adjusted diluted EPS rose 58% to $0.87.

A good quarter led to an increase in the company's fiscal 2026 estimate. PAHC has updated its full-year net sales estimates to $1.45 billion to $1.50 billion and adjusted EBITDA to $245 million to $255 million in light of improved operating momentum and increased profitability forecasts for the rest of the year.

Phibro Animal Health Corporation (NASDAQ:PAHC) is a global animal health and nutrition company that develops and markets vaccines, medicated feed additives, trace minerals, and specialty products to improve livestock and companion animal health.

While we acknowledge the potential of PAHC as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the

Disclosure: None.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Chart is Turning Positive for XRP! “On-Chain Data Also Shows Signals!”

Stock Market News for Feb 18, 2026

BTC, ETH eyed as Kiyosaki calls giant stock crash near

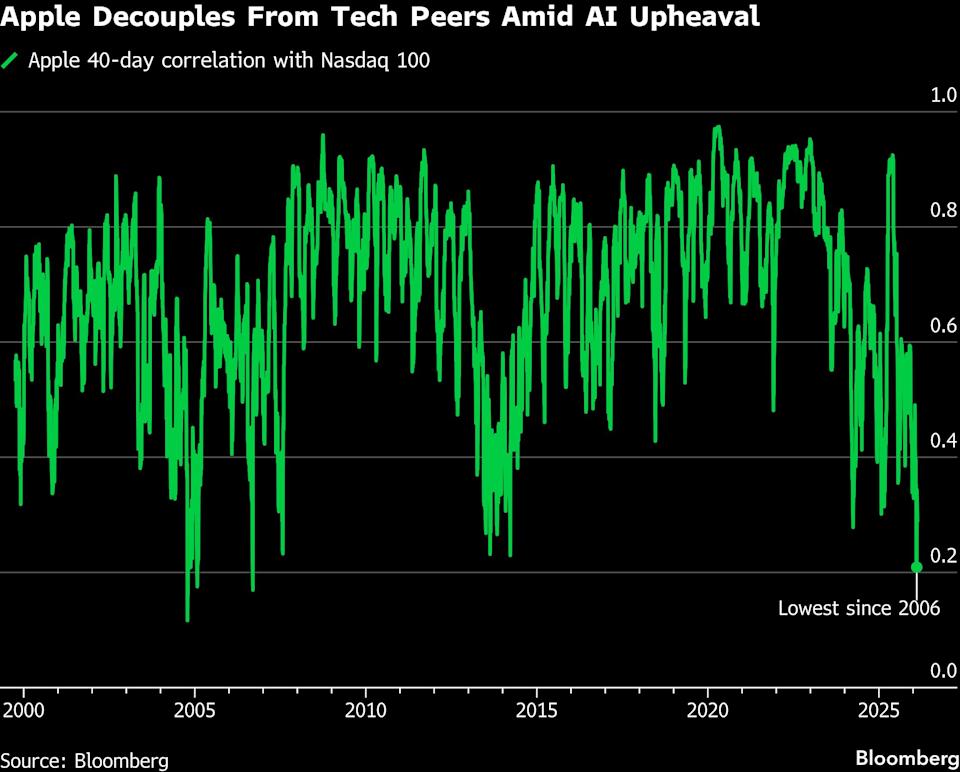

Apple Breaks Away From Nasdaq Amid AI ‘Whack-a-Mole’ Craze in the Market