Anduril's new funding round shows that the military technology sector remains extremely hot

Author: Katie Roof

In case you missed last Friday’s news, here’s the highlight: Anduril is in talks for a new round of financing, with its valuation expected to double to around $60 billion.

The significance of this round goes beyond just the valuation. Although Anduril's name happens to contain both an A and an I, it is not the typical AI-centric startup fueling this investment boom. This funding move demonstrates that the growth momentum in the defense tech sector remains extremely strong.

Drone company Shield AI is also in fundraising talks, targeting a $12 billion valuation — the company has caught the AI investment wave thanks to its autonomous flight software. We’ve learned that several younger startups are expected to complete financing in the coming months.

Paul Kwan, Managing Director at General Catalyst, said the firm’s bullish outlook on defense tech is partly because:

“There are very few trillion-dollar global defense markets, which are critical to global security, still dominated by traditional players, and now undergoing technological transformation and geopolitical realignment at the same time.”

General Catalyst has invested in Anduril as well as other defense-related companies, including military autonomous equipment manufacturer Saronic and Anduril’s European competitor Helsing.

As the world (unfortunately) prepares for more conflicts, governments are ramping up defense spending, bringing lucrative contracts to defense tech companies. Mr. Kwan noted that the U.S. Department of Defense now recognizes that: “Defense technology is key to strategic deterrence”.

He also pointed out a shift in the entrepreneurial landscape: many of the brightest “brilliant founders are choosing to start businesses within the defense industrial system.”

They don’t even have to live in San Francisco. Many major startups in this sector are based in Southern California, with a particular concentration around El Segundo, an area known as “Gundo.”

These types of entrepreneurs are attracting more and more investor interest. One of Anduril’s investors, Andreessen Horowitz (a16z), has recently raised $2.5 billion for its “American Dynamism Fund”; Lux Capital, another Anduril backer, has also just completed a new fundraise of $1.5 billion.

Although the industry has received massive investment, it’s still in its early stages, and exit cases are gradually increasing. Groq was recently acquired by Nvidia, with defense factors at play — the AI chip upstart previously stated its systems could be used to detect emerging threats. Anduril may not be in a hurry to go public, but a SpaceX IPO would highlight Starlink’s value in supporting the military during wartime.

If SpaceX’s IPO goes smoothly, it’s expected that investors in the defense tech sector will use it to further drive up high valuations in the industry.

Editor: Guo Mingyu

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hormel Sells Whole-Bird Turkey Unit To Chase Steadier Growth

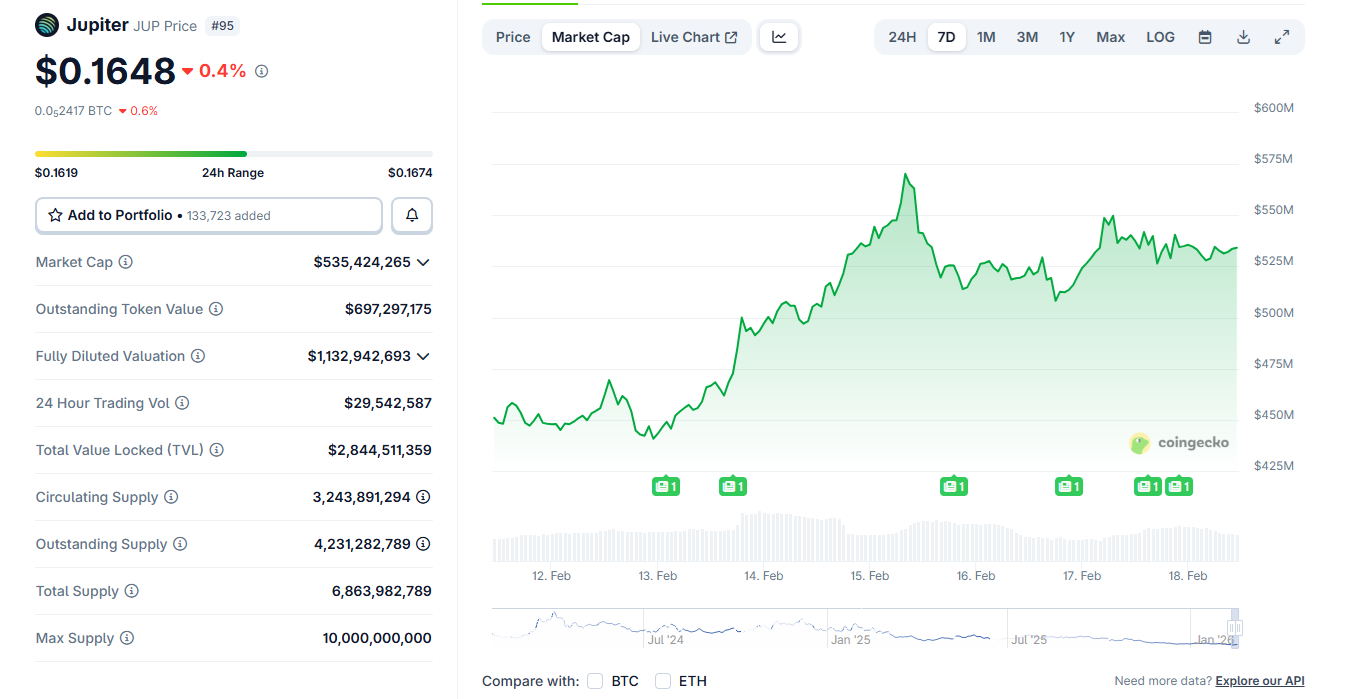

Jupiter DAO opens vote on potentially canceling Jupuary airdrops