Fusion Fuel Inks Transformational Agreement to Acquire a Portfolio of Nineteen High-Quality Uranium & Gas Royalties Based in the Americas

-

Acquisition is expected to provide key exposure to uranium and natural gas markets, both experiencing some of the highest growth in global demand due to their roles in energy security, decarbonization, and the rising power needs of AI-driven data centers

-

Portfolio includes sixteen (16) uranium and three (3) natural gas royalties being developed and explored by industry leaders such as Cameco, IsoEnergy, Uranium Energy Corp., among others

Dublin, Feb. 18, 2026 (GLOBE NEWSWIRE) -- Fusion Fuel Green PLC (NASDAQ:HTOO) (“Fusion Fuel” or the “Company”), an integrated green energy engineering, distribution, and solutions provider, is pleased to announce that it has entered into a definitive agreement to acquire a controlling interest in Royal Uranium Inc. (“Royal Uranium”), a diversified portfolio of uranium royalties spanning the exploration and development sectors of the mining cycle (the “Portfolio”), in a strategic share exchange transaction.

This acquisition is expected to provide Fusion Fuel with direct exposure to one of the most compelling and increasingly fundamental asset classes supporting global energy security and the rapid expansion of AI-driven infrastructure and the nuclear power required to support it.

By gaining meaningful exposure to sixteen (16) uranium and three (3) natural gas royalties in the Americas, Fusion Fuel believes that it is poised to secure long-term economic participation in the energy sources increasingly required to power AI infrastructure, electrification and global decarbonization. The acquisition is expected to position Fusion Fuel at the intersection of three powerful structural trends:

- The accelerating global demand for electricity driven by the need for enhanced power security and the increasing demand from AI and data center infrastructure;

- A growing structural supply deficit in uranium, alongside a renewed global commitment to nuclear energy as a critical source for reliable, low-carbon baseload power; and

- An increasing strategic focus on secure, regional access to critical energy materials, particularly within the Americas, as governments and industries prioritize supply chain resilience, energy independence and regional security.

Global data center power demand is expected to grow more than 160% by 2030, with AI-related power demand projected to increase materially over the balance of the decade.

The Portfolio includes royalties from some of the globe’s most significant uranium miners operating projects located in world-class uranium districts, including:

- The

Athabasca Basin, one of the world’s highest-grade uranium regions;

- The advanced-stage

Berlin Projectin Colombia, with historical resources and meaningful expansion potential; and

- Additional projects across Argentina and Newfoundland and Labrador.

The diversified royalty base is expected to provide exposure across multiple uranium operations, development stages and jurisdictions — while avoiding direct operating risk and capital intensity typically associated with mining companies.

In addition to uranium royalties, the Portfolio includes producing Alberta natural gas royalties that are operating and already generate cash flow. Natural gas provides reliable, dispatchable baseload power and complements nuclear energy in supporting expanding data center infrastructure.

These producing royalties are expected to provide near-term revenue while maintaining leverage to long-term structural energy demand growth.

The royalty structure is expected to provide Fusion Fuel with:

- Long-term revenue participation without operating cost exposure;

- No capital expenditure obligations;

- High-margin, scalable cash flow potential; and

- Embedded leverage to uranium and natural gas price appreciation.

As uranium markets move deeper into structural supply deficits and nuclear energy regains global policy support, the embedded optionality within this royalty Portfolio has the potential to significantly enhance shareholder value.

This acquisition is expected to materially strengthen Fusion Fuel’s strategic positioning and significantly enhance its exposure to a rapidly appreciating and increasingly essential asset class.

By securing a diversified Portfolio of clean energy royalties, Fusion Fuel is expected to:

- Enter a supply-constrained commodity cycle with strong structural fundamentals;

- Align with long-term global electrification and AI infrastructure growth;

- Establish a scalable platform for additional royalty acquisitions; and

- Enhance long-term asset value and enterprise optionality.

Management believes this transaction represents a foundational step in building a differentiated clean energy royalty platform focused on powering the next generation of global energy demand.

“By agreeing to acquire exposure to uranium and clean energy royalties, we are entering an asset class that is experiencing strong structural growth and is increasingly central to global energy development,” said JP Backwell, Chief Executive Officer of Fusion Fuel. “As electrification accelerates and AI-driven infrastructure continues to expand, reliable and scalable clean energy sources, in particular nuclear energy, are expected to play a critical role. We believe this acquisition meaningfully enhances our long-term strategic positioning and supports our ambition to meaningfully participate in the energy systems that will underpin future global growth. As we move forward, our aim is to expand on this strong starting Portfolio in the uranium and nuclear related industries.”

Frederico Figueira de Chaves, Fusion Fuel’s Interim Chief Financial Officer and Chief Strategy Officer, noted, “We believe this acquisition is highly compelling from both a financial and strategic standpoint. The Portfolio comprises high-quality royalty assets that offer attractive long-term optionality. Importantly, these assets are expected to provide exposure to potential upside without requiring additional capital investment by the Company. In addition, we believe this positions Fusion Fuel to be a valuable and strong option for those interested in exposure to the expected growth for the nuclear industry and energy transition in general. This transaction reflects our disciplined, capital-efficient approach to value creation, and we intend to continue to evaluate and cultivate similar strategic opportunities as we build and expand our clean energy royalty platform.”

Fusion Fuel has entered into a definitive Share Exchange Agreement dated February 18, 2026 (the “Agreement”) with certain shareholders of Royal Uranium, pursuant to which Fusion Fuel is expected to acquire between 75-100% of the shares of Royal Uranium, in consideration for the allotment of up to 3,750,025 shares in Fusion Fuel to the current shareholders of Royal Uranium.

Closing of the transaction is subject to certain conditions, including but not limited to:

- approval by the Irish Takeover Panel (the “Panel”) in accordance with the Irish Takeover Panel Act, 1997, Takeover Rules, 2022, of a circular prepared by Fusion Fuel to be issued to Fusion Fuel shareholders, convening an extraordinary general meeting of the Company (the “EGM”);

- Fusion Fuel shareholder approval of the share exchange transaction at the EGM; and

- Satisfaction of such conditions and compliance with such requirements as the Panel may impose or specify in relation to the transaction.

The transaction is expected to close in the first half of 2026. A further description of the terms and conditions of the transaction has been separately disclosed in a Form 6-K furnished today with the U.S. Securities and Exchange Commission (the “SEC”).

Fusion Fuel Green PLC (NASDAQ: HTOO) provides integrated energy engineering, distribution, and green hydrogen solutions through its Al Shola Gas, BrightHy Solutions, and BioSteam Energy platforms. With operations spanning LPG supply to hydrogen and bio-steam solutions, the Company supports decarbonization across industrial, residential, and commercial sectors. For more information, please visit .

Royal Uranium is a private energy royalty entity holding a Portfolio of tier one high-quality uranium and natural gas royalties across premier mining jurisdictions in the Americas, operated by experienced industry partners. The Portfolio is designed to provide long-duration exposure to commodity price upside while minimizing operating risk through the royalty model. For more information, please visit .

The directors of Fusion Fuel (the “Directors”) accept responsibility for the information contained in this announcement other than that relating to Royal Uranium and, to the best of the knowledge and belief of the Directors (who have taken all reasonable care to ensure that such is the case), the information contained in this announcement for which they accept responsibility is in accordance with the facts and does not omit anything likely to affect the import of such information.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

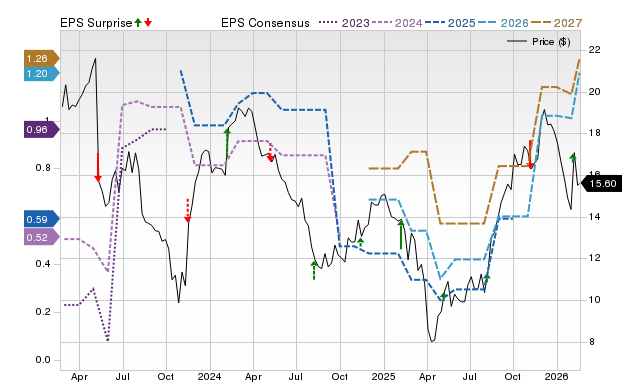

Wall Street Analysts Think Sonos (SONO) Could Surge 28.21%: Read This Before Placing a Bet

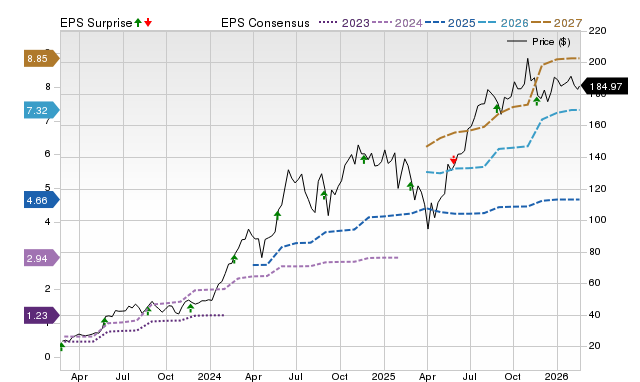

Wall Street Analysts Believe Nvidia (NVDA) Could Rally 38.16%: Here's is How to Trade