U.S.-listed Bitcoin mining companies continue to hold a near-record share of the global Bitcoin network hashrate, even as the industry faces lower revenues, winter weather disruptions, and a growing pivot toward artificial intelligence infrastructure.

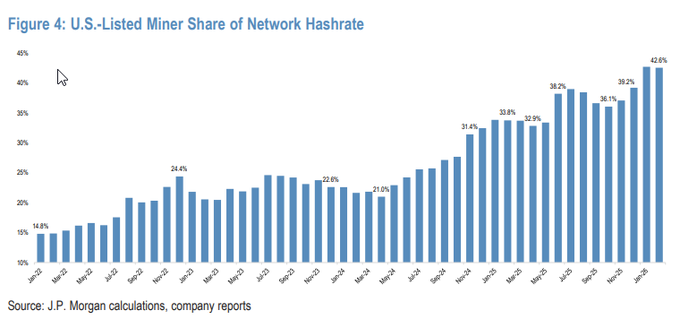

Data compiled by J.P. Morgan show that publicly traded U.S. miners accounted for 42.6% of total network hashrate in early 2026, the highest level in the dataset and an increase from 14.8% in January 2022.

The data shows a sustained expansion in U.S.-listed miners’ footprint over the past four years. Their share rose from 14.8% in early 2022 to more than 24% in early 2023, before stabilizing in the low-20% range for much of that year. Growth accelerated in 2024, when the figure surpassed 31% by year-end.

Source:

Source:

By mid-2025, U.S.-listed firms controlled roughly 38% of global hashrate. Despite intermittent monthly pullbacks, the broader trend remained upward, culminating in the early 2026 peak of 42.6%. The figures are based on J.P. Morgan calculations and company disclosures.

The expansion in hashrate share has occurred alongside a contraction in mining economics. Hashprice, a measure of mining revenue per unit of computing power, has fallen from nearly $70 per petahash when Bitcoin traded near record highs to just over $35 per petahash. That represents an effective 50% decline in revenue per petahash.

The revenue squeeze has prompted a shift. Some operators have redirected infrastructure toward artificial intelligence workloads, seeking longer-term contracts. One example is Bitfarms (BITF), which recently stated it is no longer operating solely as a Bitcoin mining company and is repositioning itself as a data center developer focused on high-performance computing and AI.

(adsbygoogle = window.adsbygoogle || []).push({});Operational challenges have compounded financial pressures. Severe winter storms, particularly in Texas, led grid operators to request curtailments as electricity demand surged. Public mining firms reduced output, with some reporting daily Bitcoin production declines of more than 60% during peak disruption.

These shutdowns contributed to a network hashrate decline and fed into a difficulty adjustment recorded on Feb. 9, 2026, the largest drop since 2021, according to prior reports. Despite these disruptions and broader industry shifts, U.S.-listed miners have continued to expand their relative share of global computational power, securing the Bitcoin network.