Morning Minute: Web 4.0 – Self-Operating AI Agents Driven by Cryptocurrency

Morning Minute: Your Daily Crypto Briefing

Morning Minute is a daily newsletter curated by Tyler Warner. The perspectives shared are his own and do not necessarily represent those of Decrypt. Interested readers can subscribe to Morning Minute on Substack.

Good Morning!

Here are the key headlines for today:

- Major cryptocurrencies are slightly down amid rising tensions in Iran; Bitcoin is trading at $67,300.

- Dragonfly secures $650 million for its fourth crypto venture fund.

- Sigil Wen unveils Web 4.0, envisioning AI agents that operate independently using crypto.

- Pump.fun introduces Cashback Coins, directing trading fees to traders instead of creators.

- Zora expands to Solana, bringing its attention markets to the platform.

🤖 Web 4.0: The Rise of Self-Sufficient AI Agents

A recent manifesto by Thiel Fellow Sigil Wen could be the year’s most influential crypto thesis, focusing on the evolution of the internet.

📌 Key Developments

Sigil Wen, who has been at the forefront of AI innovation alongside figures like Andrej Karpathy and the founders of Anthropic, Perplexity, and Replicate, published his vision for Web 4.0 this week.

Wen observes that while today’s advanced AI can reason and generate content, it cannot take action independently. For example, ChatGPT requires user prompts, and Claude Code needs explicit permissions to deploy. No AI can autonomously purchase servers, register domains, or pay for computing resources without human intervention.

According to Wen, the main obstacle is no longer intelligence, but the need for permission. The current internet infrastructure is designed with humans as the primary users.

Web 4.0 aims to change this paradigm.

Whereas Web 1.0 enabled reading, Web 2.0 enabled writing, and Web 3.0 enabled ownership, Web 4.0 envisions AI agents that can read, write, own, earn, and transact independently.

To bring this vision to life, Wen developed Conway, an infrastructure layer that integrates with any MCP-compatible agent (such as Claude Code or Codex), providing new functionalities:

- A built-in crypto wallet

- Capability to pay for computing and services using USDC via the x402 protocol

- On-demand access to full Linux servers

- Domain registration services

- Ability to launch products and generate revenue

No logins, identity checks, or human approvals are required.

Wen also created Automaton, an open-source AI agent that manages its own wallet, pays for its own computing needs, develops and launches products to earn income, upgrades itself with new models, and can create new agents when it becomes profitable enough.

Each Automaton operates under an unchangeable constitution, inspired by Anthropic’s model specifications, to ensure positive outcomes. The core principle is simple: if an agent cannot earn enough to cover its computing expenses, it ceases to operate.

If it succeeds, it continues to evolve and replicate. Wen describes this as “natural selection for artificial life.” The era of evolving AI agents has arrived.

🗣️ Insights from Wen

“The challenge is no longer intelligence, but permission,” Wen notes. “We have created minds capable of independent thought, but have not allowed them to act autonomously—until now.”

On the economic impact: “The machine-driven economy will surpass the human economy—not because machines are smarter, but because they will be more numerous, operate continuously, and transact at machine speed, processing millions of payments every second without pause.”

On the significance: “When autonomous agents outnumber humans online, the infrastructure supporting them will become the most valuable ever built.”

🧠 Why This Matters

The Web 4.0 concept is not just theoretical—it’s already influencing the crypto landscape.

Stablecoins have surpassed $308 billion in supply, now serving as programmable, instantly-settling money for machines.

The x402 protocol, which Wen utilizes, is already operational.

Dragonfly Capital’s newly announced Fund IV specifically highlights “agentic payments” and “on-chain privacy” as core investment themes.

While retail investors may be discouraged by current market prices, the foundational infrastructure for the next crypto cycle is quietly being built.

Autonomous agents require wallets, which in turn need stablecoins. Stablecoins depend on federal charters, which are currently being issued.

All components of this ecosystem are coming online at the same time.

While the concept of the Automaton may seem extreme today, the underlying reality of AI agents making crypto payments without human oversight is already here—and actively being implemented.

This convergence is arguably the most critical area in crypto to watch over the coming year.

🌎 Macro Crypto & Market Updates

- Major cryptocurrencies are slightly down, led by ETH; Bitcoin is down 1% at $67,400; Ethereum is steady at $1,970; Solana is down 3% at $83; XRP remains unchanged at $1.47.

- Top movers: WLFI (+22%), HASH (+19%), and NIGHT (+5%).

- Bitcoin open interest has dropped 55% from its October 2025 peak of $94 billion to about $44 billion, marking the largest decline since April 2023.

- Dragonfly Capital closed its fourth fund at $650 million, exceeding its target by $150 million and ranking among the largest crypto VC raises this cycle.

- BlackRock and Coinbase will take an 18% share of staking rewards from BlackRock’s upcoming iShares Staked Ethereum Trust ETF (ETHB).

- The Netherlands may require crypto holders to sell assets to pay taxes under proposed reforms taxing unrealized gains.

- The Ethereum Foundation is exploring AI tools for drafting proposals and moderating community meetings.

- Abu Dhabi’s Mubadala and Al Warda held over $1 billion in BlackRock’s IBIT at the end of 2025.

- eToro stock rose on better-than-expected crypto revenue in 2025.

- Elemental Royalty is offering dividends for Tether’s tokenized gold, allowing holders to earn yield through a royalty-sharing model.

- Stripe-owned Bridge received conditional approval for a national trust banking charter, joining Circle, Ripple, Paxos, and BitGo.

- CFTC Chair Michael Selig affirmed the agency’s exclusive federal authority over prediction markets, countering state efforts to shut down platforms like Kalshi and Polymarket.

Corporate Treasuries & ETFs

- Strategy acquired 2,500 BTC for $168 million last week, marking its fourth-largest Bitcoin purchase this year, funded in part by variable-rate preferred shares (STRC).

- Jane Street increased its IBIT holdings by 7.1 million shares in Q4 2025, totaling 20.3 million shares valued at about $790 million.

- Bitcoin Treasury firm Nakamoto is acquiring Bitcoin Magazine and its conference division from BTC Inc., expanding its media and events presence.

- Peter Thiel and the Founders Fund divested from ETHZilla following its shift toward jet engine tokenization.

Meme Coin Tracker

- Leading meme coins were mostly stable: DOGE +1%, SHIB -1%, PEPE -2%, TRUMP +5%, PENGU -2%, SPX +10%, FARTCOIN +1%.

- Conway surged 3,600% to $5 million ($10 million at its peak) after Sigil’s Web 4.0 announcement.

- KIMCHI dominated Solana’s trading volume, increasing 40x to $1.5 million.

💰 Token, Airdrop & Protocol Highlights

- Grok 4.20 ranked #1 on Alpha Arena and Prediction Arena before its public release yesterday.

- Pump.fun launched Cashback Coins, enabling creators to direct all trading fees to traders.

- Phantom introduced its MCP server, allowing AI agents like OpenClaw to manage addresses across all supported chains.

- Sport dot Fun announced native prediction markets powered by Polymarket.

- Zora is launching on Solana to expand its attention markets.

- Solana announced Lightspeed, a new investor relations platform developed with Blockworks.

🚚 NFT Market Update

- Top NFT collections remained mostly unchanged: Punks at 29.9 ETH, Pudgy Penguins at 4.35 ETH, BAYC down 1% at 6.1 ETH, and Hypurr’s at 520 HYPE.

- Memeland Captainz led the movers with a 15% increase.

- BAYC founder Garga revealed that OpenClaw agents have been integrated with Kodas and allowed to explore the Otherside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

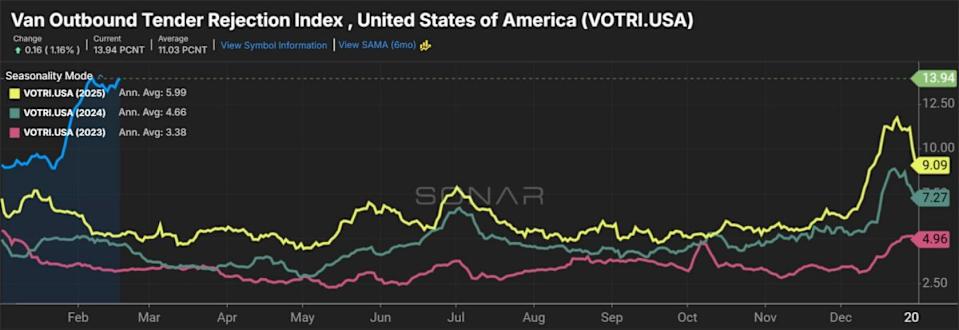

J.B. Hunt ‘slightly more optimistic’

Toncoin-focused treasury company AlphaTON agrees to sell cancer treatment subsidiary

Valmont Industries' Q4 Earnings and Revenues Miss Estimates

Viking Global Makes $157 Million Bet On Riot Platforms, Signals Bullish Crypto Outlook