Qualcomm vs. Sanmina: Which Tech Stock is the Better Buy Now?

Qualcomm Technologies Inc. QCOM and Sanmina Corporation SANM are key players in the semiconductor and electronics supply chain. Qualcomm offers high-performance, low-power chip designs for mobile devices, PCs, XR (Extended Reality), automotive, wearables, robotics, connectivity and AI use cases. The company boasts a comprehensive intellectual property portfolio comprising 4G, 5G and other technologies. Its brands include Snapdragon systems-on-chip, FastConnect Wi-Fi and Bluetooth systems and Qualcomm-branded 4G, 5G and IoT equipment. The company is currently pursuing the integration of on-device generative AI into all of its product lines.

Sanmina is a key player in the electronics manufacturing services (EMS) industry. It focuses on engineering and fabricating complex components and also on providing complete end-to-end supply chain solutions to Original Equipment Manufacturers across various end markets.

Let us delve a little deeper into the companies’ competitive dynamics to understand which of the two is relatively better placed in the industry.

The Case for Qualcomm

Qualcomm is benefiting from investments toward building a licensing program in mobile. Leveraging processors with multi-core CPUs with cutting-edge features, amazing graphics and worldwide network connectivity, Qualcomm Snapdragon mobile platforms are fast with superb power efficiency. Smartphones and mobile devices built with Snapdragon mobile platforms enable immersive augmented reality and virtual reality experiences, brilliant camera capabilities, superior 4G LTE and 5G connectivity with state-of-the-art security solutions. The buyout of U.K.-based chip firm Alphawave Semi offers Qualcomm an opportunity to expand its presence in high-growth applications, including data centers, AI, data networking and data storage.

The company is increasingly focusing on the seamless transition from a wireless communications firm for the mobile industry to a connected processor company for the intelligent edge. Qualcomm is witnessing healthy traction in EDGE networking, which helps transform connectivity in cars, business enterprises, homes, smart factories, next-generation PCs, wearables and tablets. The company is gaining traction in the vehicle-to-everything (V2X) communication systems market with the buyout of Autotalks. With seamless access to Autotalks’ comprehensive V2X expertise, Qualcomm has been able to offer an extensive suite of automotive-qualified global V2X solutions for installation in vehicles, as well as 2-wheelers and roadside infrastructure.

Despite efforts to ramp up its AI initiatives, Qualcomm has been facing tough competition from Intel in the AI PC market. Shift in the share among OEMs at the premium tier has reduced Qualcomm's near-term opportunity to sell integrated chipsets from the Snapdragon platform. The company’s handset revenues are likely to be adversely impacted owing to constrained supply. This is primarily because memory suppliers are increasingly redirecting their manufacturing capacity to meet the burgeoning AI data center demand, resulting in an acute shortage and inflated prices for the handset industry. This, in turn, has forced several handset OEMs to reduce their chip inventory, hurting Qualcomm’s handset revenues. Qualcomm’s extensive operations in China are further likely to be significantly affected by the U.S.-China trade hostilities.

The Case for Sanmina

Sanmina is increasingly focusing on 42Q connected manufacturing that effectively integrates data from customers’ global factories and suppliers’ fleets and creates an up-to-date information base. It offers a unified data ecosystem with real-time data analytics capabilities that significantly improve visibility across the enterprise’s distributed manufacturing and accelerate the decision-making process. Sanmina has deployed the 42Q connected manufacturing in more than 70 factories across 15 countries, connecting more than 35,000 pieces of manufacturing equipment in the cloud. Such a technology-driven, customer-focused approach enables Sanmina to work closely with its customers to anticipate future manufacturing requirements and modify its R&D initiatives accordingly. Attracting and developing strong customer relationships by delivering high-level customer service is one of the key strategies to drive commercial expansion.

Sanmina offers end-to-end solutions that include product designing, manufacturing, assembling, testing and aftermarket support. Such an end-to-end approach allows clients to rely on a single partner throughout the product lifecycle management. Its vertically integrated manufacturing process brings several other advantages. This approach streamlines processes and lowers costs, enabling Sanmina to achieve greater economies of scale.

However, Sanmina has been heavily affected by supply-chain disruptions over the past few years. Owing to current geopolitical events, the company is currently experiencing delays and shortages of critical components, including capacitors, resistors and more. Management expects supply chain issues to likely persist in the short to medium term. Intensifying competition in the EMS industry has hurt Sanmina’s net sales. The company faces stiff competition from larger players like Jabil, Inc. JBL. Moreover, it generates about 80% of its net sales from products manufactured outside the United States. This exposes it to political and economic disruptions in the operating countries. The company also has major production facilities in China. The recent imposition of tariffs on these countries by the U.S. government has increased the cost of sales and strained margins.

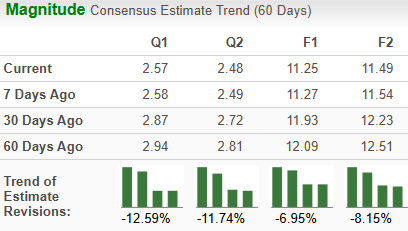

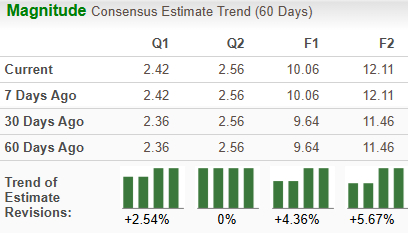

How Do Zacks Estimates Compare for QCOM & SANM?

The Zacks Consensus Estimate for Qualcomm’s fiscal 2026 sales indicates a year-over-year decline of 0.2%, while that for EPS suggests a decrease of 6.5%. The EPS estimates have been trending southward (down 6.9%) over the past 60 days.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Sanmina’s fiscal 2026 sales implies year-over-year growth of 67.9%, while that of EPS suggests an improvement of 66.6%. The EPS estimates have been trending northward (up 4.4%) over the past 60 days.

Image Source: Zacks Investment Research

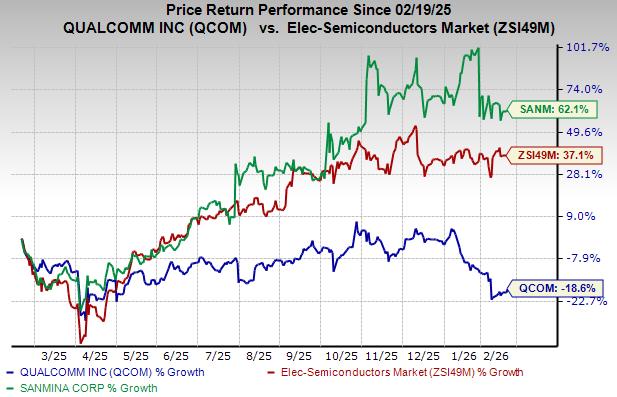

Price Performance & Valuation of QCOM & SANM

Over the past year, Qualcomm has plummeted 18.6% against the industry’s growth of 37.1%. Sanmina has surged 62.1% over the same period.

Image Source: Zacks Investment Research

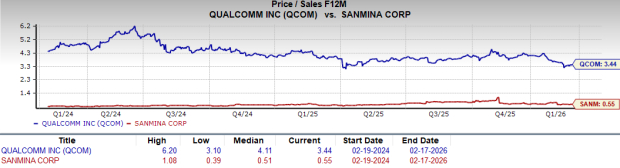

Qualcomm looks more expensive than Sanmina from a valuation standpoint. Going by the price/sales ratio, QCOM’s shares currently trade at 3.44 forward sales, higher than Sanmina’s 0.55.

Image Source: Zacks Investment Research

QCOM or SANM: Which is a Better Pick?

Qualcomm carries a Zacks Rank #5 (Strong Sell), while Sanmina sports a Zacks Rank #1 (Strong Buy).

Sanmina expects both sales and earnings to increase in fiscal 2026, while both metrics are likely to decline for Qualcomm. In terms of price performance, SANM has outperformed QCOM. It is also trading relatively cheaper than Qualcomm. With a superior Zacks Rank and favorable metrics, Sanmina seems to be a better investment option at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jim Cramer Believes Crowdstrike (CRWD) Shouldn't Be Afraid of Anthropic

Jim Cramer Discusses Gartner (IT) Stock

Jim Cramer Discusses Salesforce (CRM) Stock

Jim Cramer Believes Adobe's (ADBE) In Trouble