Gold and silver surge as investors seek bargains

Gold and Silver Surge on Wednesday

Gold and silver prices experienced significant gains by midday on Wednesday, rebounding from losses seen on Tuesday. This upward movement is attributed to technical corrections and increased interest from bargain hunters. As of the latest update, April gold climbed $116.10 to reach $5,022.50, while March silver advanced $4.30 to $77.81.

Market Focus: Federal Reserve Insights

Investors are turning their attention to the Federal Reserve’s Open Market Committee (FOMC) meeting minutes, which are set to be released this afternoon. During the January meeting, the Fed decided to keep U.S. interest rates unchanged. Any indication of a willingness to lower rates could benefit commodity markets by boosting demand. On Tuesday, Fed Governor Michael Barr suggested that rates should remain steady for an extended period until there is clearer evidence that inflation is moving toward the 2% target. Meanwhile, Austan Goolsbee, President of the Chicago Fed, noted that further rate cuts could be possible this year if inflation continues its downward trend.

Key Market Indicators

Elsewhere, the U.S. dollar index is trading higher today. Crude oil prices are also on the rise, currently hovering near $64.25 per barrel. The yield on the 10-year U.S. Treasury note stands at approximately 4.1%.

Understanding Gold Pricing

Gold prices are determined through two main channels: the spot market, which reflects immediate purchase and delivery, and the futures market, where contracts are set for future delivery. Due to end-of-year trading patterns, the December gold futures contract is currently the most actively traded on the CME.

Technical Analysis: Gold Outlook

From a technical perspective, bulls in the April gold futures market are aiming to push prices above the strong resistance level at $5,250.00. On the other hand, bears are targeting a move below the key support at last week’s low of $4,670.00. Immediate resistance is noted at $5,100.00, followed by $5,200.00, while support is found at $4,900.00 and then at this week’s low of $4,854.20. Wyckoff's Market Rating stands at 6.5.

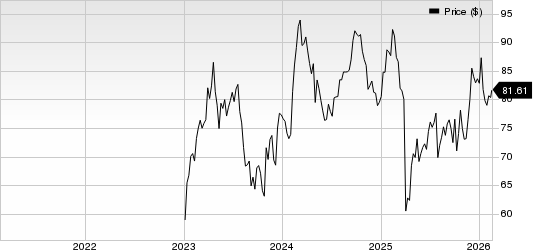

Technical Analysis: Silver Outlook

For March silver futures, bulls are looking to close above the significant resistance at $90.00. Bears, meanwhile, are focused on driving prices below the February low of $63.90. The first resistance levels are at $80.00 and $82.50, while support is identified at this week’s low of $71.815 and then at $70.00. Wyckoff's Market Rating is 5.0.

Stay Informed with Market Insights

For more in-depth analysis and market forecasts, consider subscribing to the weekly “Markets Front Burner” email report. This complimentary newsletter offers forward-looking commentary and educational content to help you advance your trading and investing skills.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

GEHC Expands BARDA Collaboration With $35M Boost for AI Ultrasound

Fed Maintains Rates as Meeting Minutes Reveal Uncertain Path Ahead

Recursion Pharmaceuticals Stock Drops: What's Behind It?

Fed minutes: Many officials require further declines in inflation before backing rate reductions