Historical data sends a clear warning: while the current climate of “extreme fear” in the crypto market might tempt some to take risks, now may not be the best time for bold moves. The United States’ military buildup targeting Iran raises the stakes, suggesting that a potential 2.4% gain could swiftly turn into double-digit losses. Let’s break down the factors behind this cautious sentiment.

Should You Buy Bitcoin Now?

The choice, of course, remains with traders and investors, but analyst Nic, drawing on historical trends, argues that this may not be the most opportune moment. Still, differing viewpoints abound, and some may justify new positions based on their own perspectives. To make informed decisions, it’s wise to consider multiple angles and broaden your outlook before taking action.

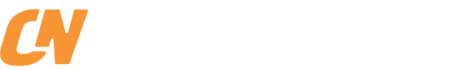

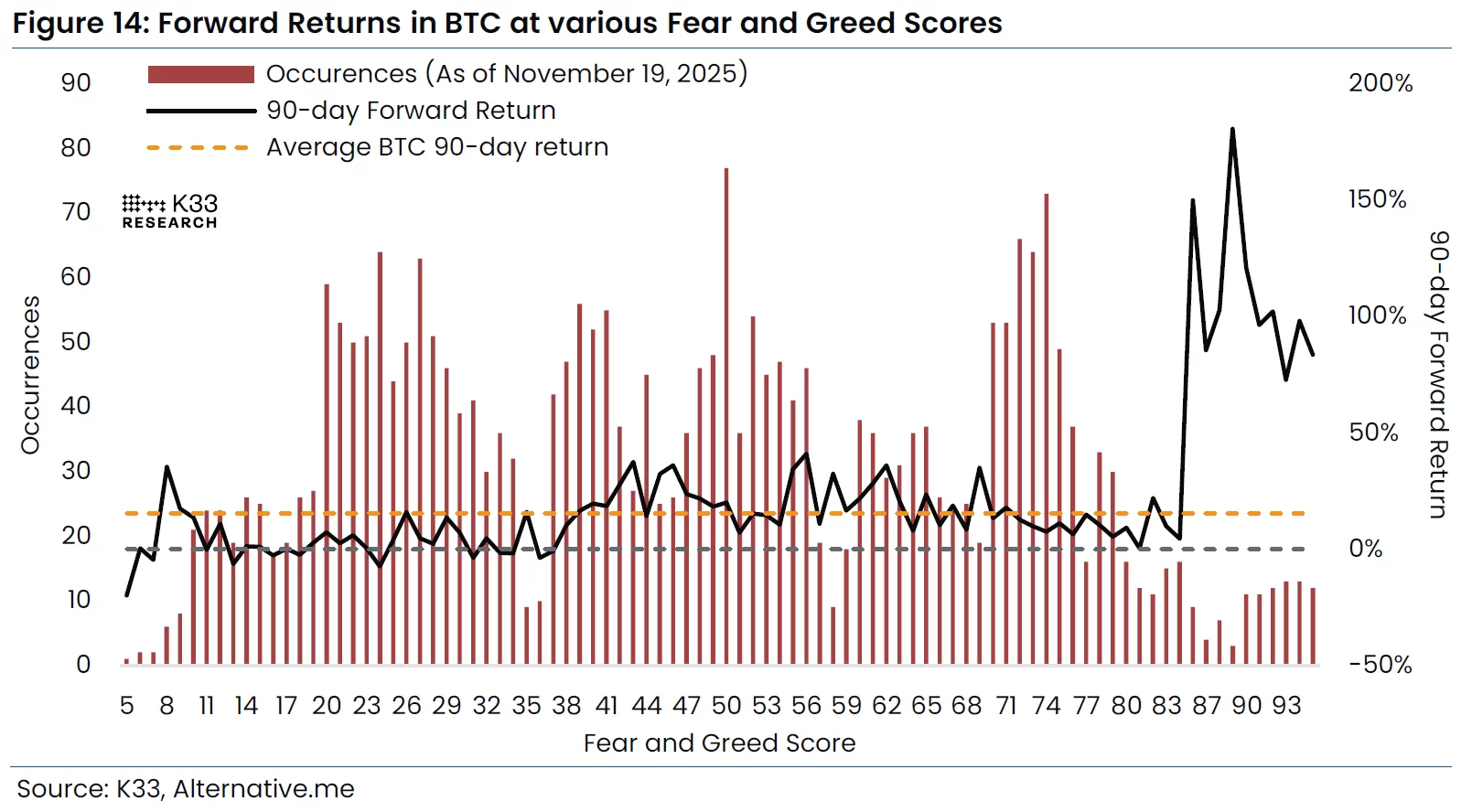

“Buying BTC during periods of ‘Extreme Fear’ is NOT the optimal choice. Historically, when the Fear & Greed Index falls below 25, the average 90-day return is only 2.4%. In contrast, entering during ‘Extreme Greed’ has produced average 90-day gains of 95%. The Fear & Greed index is little more than a backward-looking momentum gauge and isn’t particularly effective for predicting returns,” Nic remarked.

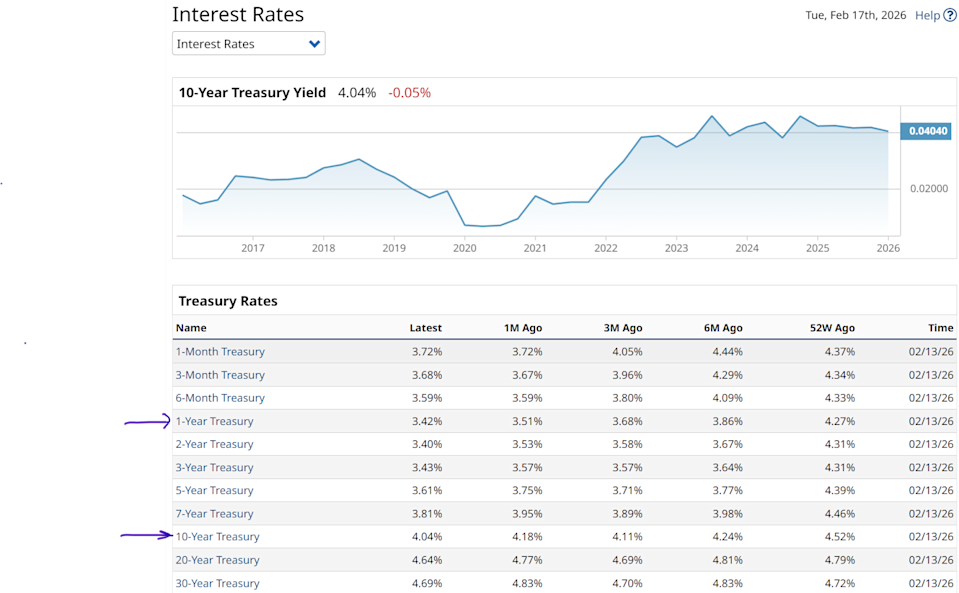

Other variables, such as impending tariffs, rising US-Iran tensions, and the likelihood of renewed political attacks on Trump ahead of midterm elections, further complicate the outlook for cryptocurrencies in the near term. Additionally, debates over a possible AI bubble remain in full swing, signaling ongoing volatility for related tech assets.

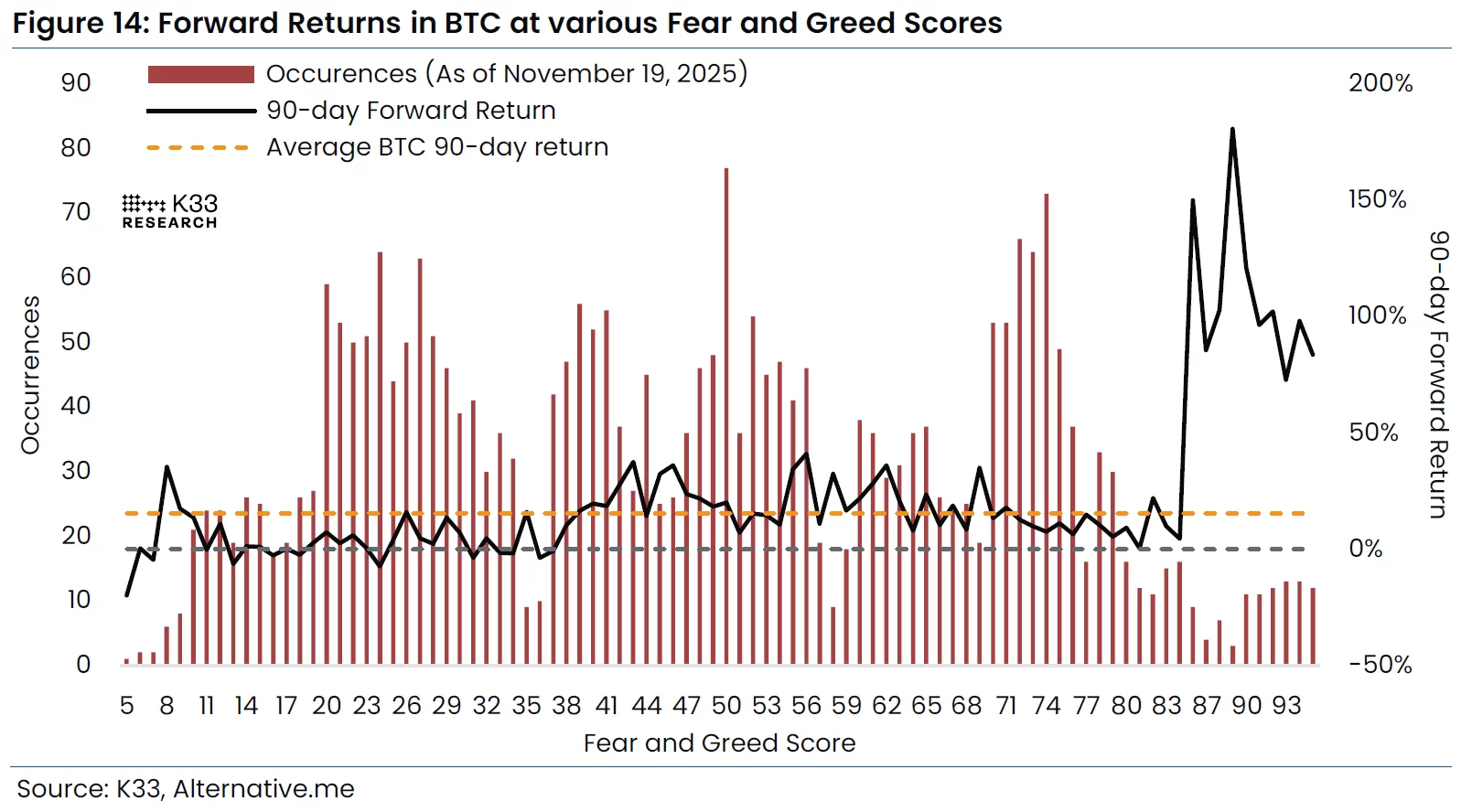

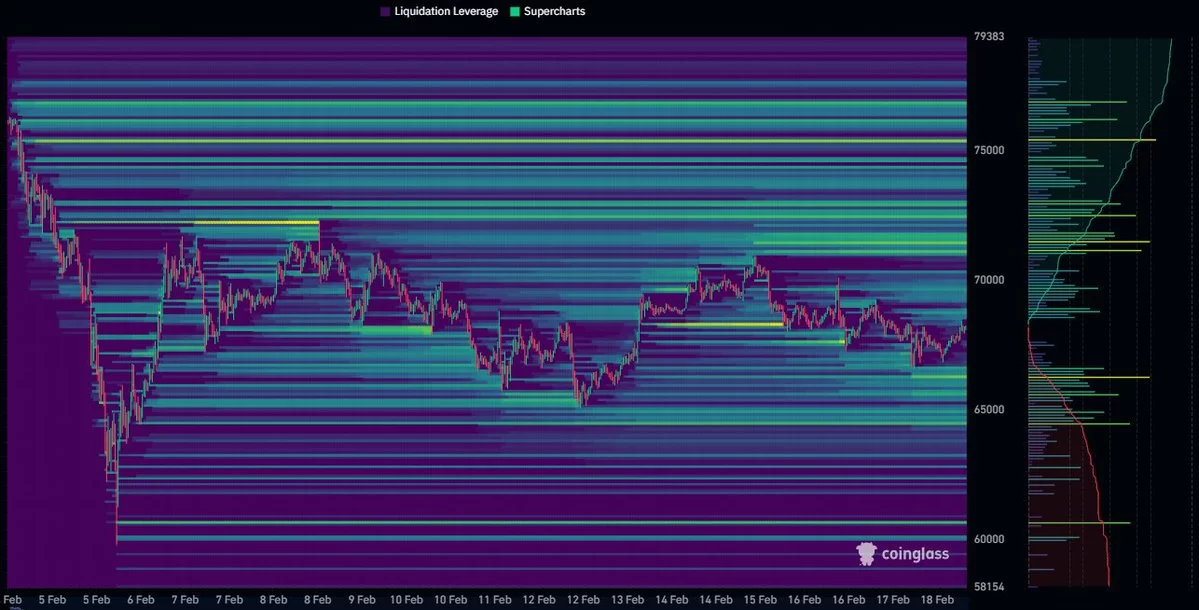

The liquidity heat map pinpoints two critical areas for Bitcoin: clusters build up below $66,000 and above $71,000. In the short term, a decisive move beyond either boundary could trigger strong price momentum—either prompting a deeper drop or igniting a bounce from the bottom. Given the US military escalation in the region, conditions currently look somewhat tilted toward the downside.

Ripple (XRP) Struggles Despite Good News

The long-running lawsuit has concluded, the XRP Ledger is advancing, and ETF approvals were seen as positive developments—yet the price of XRP Coin remains stubbornly below $2. For those who longed to revisit these levels during the bearish cycle, prices under $2 now feel more like losses than bargains.

Should the market stage a reversal from recent lows, XRP Coin could react with the kind of sharp movement seen in prior cycles. For bullish momentum to materialize, XRP must hold support at $1.42 and then reclaim the crucial $1.51 threshold.

In summary, current indicators point to caution as geopolitical risks and lackluster historical returns dampen the case for aggressive buying, both for Bitcoin and for key alternatives like XRP. With markets reacting swiftly to external shocks, even optimistic scenarios require careful timing and risk tolerance.