Monster Beverage Gears Up for Q4 Earnings: Here's What You Should Know

Monster Beverage Corporation MNST is expected to have delivered solid top- and bottom-line growth when it reports fourth-quarter 2025 results. The results are expected to have been supported by resilient demand for energy drinks, effective pricing actions and continued expansion across international markets.

The Zacks Consensus Estimate for revenues is pegged at $2.1 billion, indicating growth of 13% from the figure reported in the year-ago quarter. The consensus estimate for earnings of 49 cents per share implies a rise of 28.98% from the year-ago quarter’s actual. The consensus mark has been stable in the past 30 days.

Monster Beverage Corporation Price, Consensus and EPS Surprise

Monster Beverage Corporation price-consensus-eps-surprise-chart | Monster Beverage Corporation Quote

In the last reported quarter, the company registered a positive earnings surprise of 16.7%. It has delivered an average positive earnings surprise of 5.5% in the trailing four quarters.

Key Factors to Note Ahead of MNST’s Q4 Results

Monster Beverage’s fourth-quarter 2025 performance is expected to have reflected continued strength in global energy drink demand, supported by solid category growth across key regions, including North America, EMEA and Asia-Pacific. Management highlighted that the global energy drink category remains healthy, driven by rising household penetration, functionality and lifestyle appeal. Monster Beverage’s broad portfolio, led by Monster Energy, the Ultra family and strategic affordable brands, positions it well to benefit from evolving consumer preferences, particularly for zero-sugar and flavored offerings, which continue to be central growth drivers.

Innovation and product mix are other critical factors to watch. The Ultra and Juice Monster families have been consistent growth drivers, aided by strong demand for zero-sugar offerings and new flavor launches. Limited-time offerings and athlete-backed products have helped maintain brand relevance and repeat purchases. Investors will look for signs that these innovations are translating into sustained volume growth in the holiday quarter.

Pricing actions and cost management are anticipated to play a significant role in shaping profitability in the quarter to be reported. On its last reported quarter’s earnings call, Monster Beverage indicated selective price adjustments in the United States in the fourth quarter of 2025, along with reductions in promotional allowances. These moves are expected to have offset modest tariff-related pressures and maintain strong gross margins. The company’s ongoing supply chain optimization and strategic hedging against aluminum price volatility are expected to help stabilize input costs and protect margins despite a complex trade environment.

Finally, international performance and macro conditions are likely to have influenced fourth-quarter results. Monster Beverage continues to benefit from expanding household penetration and strong demand in international markets, though currency fluctuations and regulatory developments remain risks.

MNST has been grappling with high operating expenses due to higher costs associated with sponsorships, endorsements and payroll. These rising expenses have been further compounded by increased stock-based compensation tied to new equity awards and ongoing litigation provisions. While these investments support brand visibility and talent retention, they have also placed upward pressure on general and administrative costs, signaling the need for tighter expense management to preserve margins in the coming quarter.

What the Zacks Model Unveils for MNST

Our proven model conclusively predicts an earnings beat for Monster Beverage this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is exactly the case here.

Monster Beverage currently has an Earnings ESP of +8.31% and a Zacks Rank of 3. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Valuation Picture for MNST

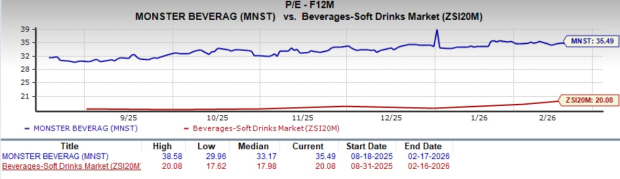

From a valuation perspective, Monster Beverage stock is trading at a premium relative to the industry benchmarks. With a forward 12-month price-to-earnings ratio of 35.49x, the stock is trading above the Beverages - Soft Drinks industry’s average of 20.08x.

MNST Stock's P/E Valuation

Image Source: Zacks Investment Research

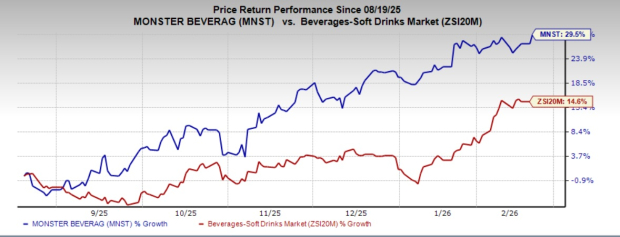

The recent market movements show that MNST’s shares have gained 29.5% in the past six months compared with the industry's 14.6% growth.

MNST Stcok's Price Performance

Image Source: Zacks Investment Research

Other Stocks With the Favorable Combination

Here are three other companies, which, per our model, also have the right combination of elements to post an earnings beat this reporting cycle:

Interparfums, Inc. IPAR currently has an Earnings ESP of +2.56% and a Zacks Rank of 2. IPAR is likely to register top-line growth when it reports fourth-quarter 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $385.9 million, indicating 6.8% growth from the figure reported in the year-ago quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for IPAR’s fourth-quarter earnings is pegged at 78 cents per share, implying a 4.9% decline from the year-earlier quarter. The consensus mark has increased 6.8% in the past 30 days. IPAR delivered a earnings surprise of 5.03% in the trailing four quarters, on average.

Celsius Holdings, Inc. CELH currently has an Earnings ESP of +6.46% and a Zacks Rank of 3. The Zacks Consensus Estimate for Celsius Holdings’ fourth-quarter 2025 EPS is pegged at 19 cents, which implies a 35.7% increase year over year.

The consensus estimate for Celsius Holdings’ quarterly revenues is pegged at $638.2 million, indicating an increase of 92.1% from the figure reported in the prior-year quarter. CELH delivered a trailing four-quarter earnings surprise of roughly 42.9%, on average.

Fomento Economico Mexicano S.A.B. de C.V. FMX, or FEMSA, currently has an Earnings ESP of +3.92% and a Zacks Rank of 3. The consensus mark for fourth-quarter 2025 revenues is pegged at $12.4 billion, suggesting growth of 24.6% from the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for FEMSA’s quarterly earnings per share of $1.53 implies growth of 232.6% from the figure reported in the year-ago quarter. FMX delivered a negative earnings surprise in the trailing three quarters.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coeur Mining: Fourth Quarter Earnings Overview

Oceaneering International: Fourth Quarter Earnings Overview

Ledn Issues $188 Million Bond Backed by Bitcoin-Collateralized Loans

Molson Coors Stock Tapped Out After Q4 Earnings: What To Know