What Price Target Have Wall Street Analysts Set for Alexandria Real Estate Equities Shares?

Alexandria Real Estate Equities, Inc.: Company Overview

With a market capitalization of $9.4 billion, Alexandria Real Estate Equities, Inc. (ARE) stands out as a prominent real estate investment trust (REIT) specializing in life sciences. The company is recognized for establishing and developing large-scale campus environments in leading U.S. innovation centers. By blending top-tier Class A/A+ properties with targeted venture capital investments, Alexandria supports advancements in life sciences and aims to generate sustainable, long-term returns.

Recent Stock Performance

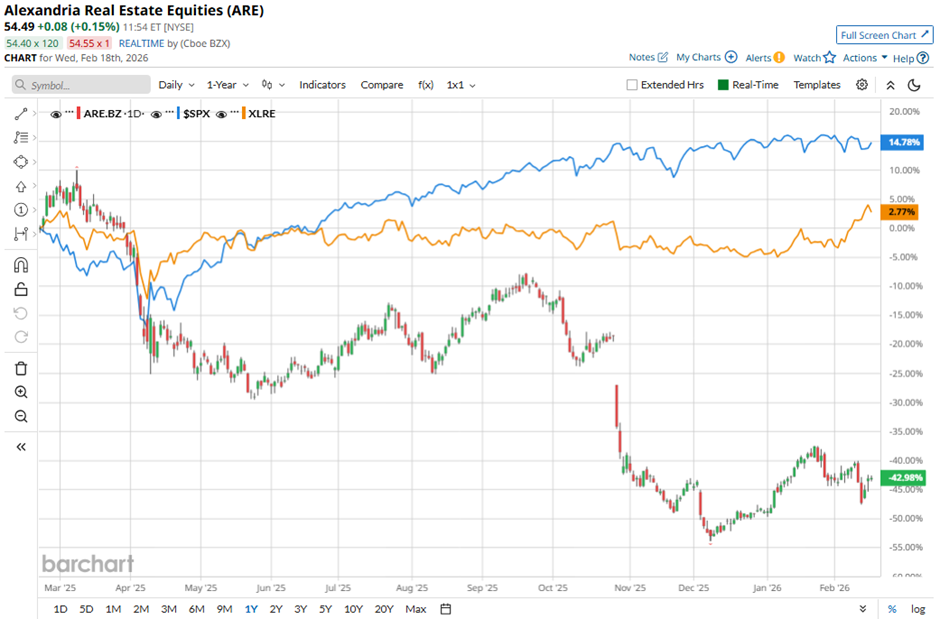

Over the past year, shares of this Pasadena, California-based REIT have trailed the overall market. ARE’s stock price has dropped 43.1% in the last 52 weeks, while the S&P 500 Index ($SPX) gained 12.6% during the same period. Despite this underperformance, ARE has rebounded 11.4% so far this year, surpassing the modest gains of the S&P 500.

Related Market News

When compared to the State Street Real Estate Select Sector SPDR ETF (XLRE), ARE’s performance has also lagged, as XLRE returned 2.9% over the last year.

Financial Highlights and Analyst Outlook

Following the release of its Q4 2025 results on January 26, Alexandria’s stock climbed 1.7%. The company reported adjusted funds from operations (AFFO) per share of $2.16 and revenue totaling $754.4 million, both surpassing expectations. Positive investor sentiment was further fueled by strong leasing activity of 1.2 million rentable square feet, a slight increase in North American occupancy to 90.9%, and reduced expenses of $322.1 million.

Looking ahead to the fiscal year ending December 2026, ARE is projected to post AFFO per share of $6.38, representing a 29.2% decrease from the previous year. The company’s track record for earnings surprises is mixed, having exceeded analyst forecasts in three of the last four quarters but falling short once.

Among 17 analysts covering ARE, the consensus recommendation is “Hold.” This includes four “Strong Buy” ratings, twelve “Hold” ratings, and one “Strong Sell.”

Price Targets and Analyst Actions

On February 10, Morgan Stanley revised its price target for Alexandria Real Estate Equities to $54 and maintained an “Equal Weight” rating.

The average analyst price target stands at $59.86, which is 9.7% above the current share price. The highest target among analysts is $70, suggesting a potential upside of 28.2% from current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Blue Owl Capital Corporation (OBDC) Tops Q4 Earnings and Revenue Estimates

Meta reboots smartwatch plan, aims debut in 2026, the Information reports

Solana futures data shows panicked bulls: Will $80 SOL hold?

Remitly Global, Inc. (RELY) Q4 Earnings and Revenues Surpass Estimates