Clear Secure (YOU) Outpaces Stock Market Gains: What You Should Know

Clear Secure (YOU) closed at $33.34 in the latest trading session, marking a +2.58% move from the prior day. The stock outpaced the S&P 500's daily gain of 0.56%. Elsewhere, the Dow gained 0.26%, while the tech-heavy Nasdaq added 0.78%.

Heading into today, shares of the airport security company had lost 6.15% over the past month, lagging the Computer and Technology sector's loss of 4.09% and the S&P 500's loss of 1.27%.

The investment community will be closely monitoring the performance of Clear Secure in its forthcoming earnings report. The company is scheduled to release its earnings on February 25, 2026. The company is predicted to post an EPS of $0.31, indicating a 65.56% decline compared to the equivalent quarter last year. Alongside, our most recent consensus estimate is anticipating revenue of $235.72 million, indicating a 14.28% upward movement from the same quarter last year.

In terms of the entire fiscal year, the Zacks Consensus Estimates predict earnings of $1.13 per share and a revenue of $895.73 million, indicating changes of -37.22% and +16.25%, respectively, from the former year.

Investors might also notice recent changes to analyst estimates for Clear Secure. Such recent modifications usually signify the changing landscape of near-term business trends. As a result, upbeat changes in estimates indicate analysts' favorable outlook on the business health and profitability.

Research indicates that these estimate revisions are directly correlated with near-term share price momentum. To capitalize on this, we've crafted the Zacks Rank, a unique model that incorporates these estimate changes and offers a practical rating system.

The Zacks Rank system, spanning from #1 (Strong Buy) to #5 (Strong Sell), boasts an impressive track record of outperformance, audited externally, with #1 ranked stocks yielding an average annual return of +25% since 1988. The Zacks Consensus EPS estimate remained stagnant within the past month. As of now, Clear Secure holds a Zacks Rank of #3 (Hold).

In terms of valuation, Clear Secure is presently being traded at a Forward P/E ratio of 22.89. For comparison, its industry has an average Forward P/E of 19.47, which means Clear Secure is trading at a premium to the group.

The Internet - Software industry is part of the Computer and Technology sector. Currently, this industry holds a Zacks Industry Rank of 128, positioning it in the bottom 48% of all 250+ industries.

The Zacks Industry Rank gauges the strength of our industry groups by measuring the average Zacks Rank of the individual stocks within the groups. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Make sure to utilize Zacks.com to follow all of these stock-moving metrics, and more, in the coming trading sessions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

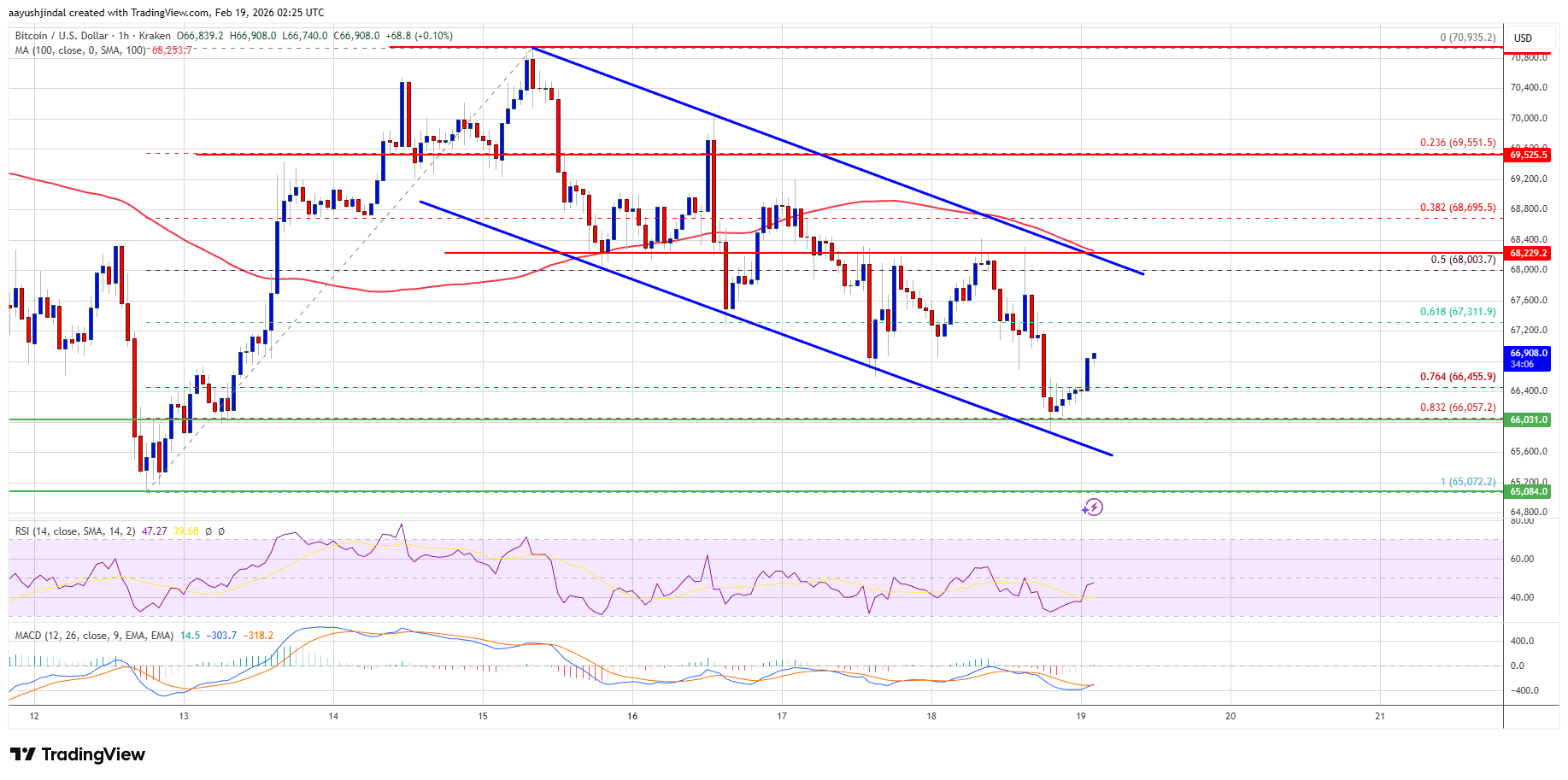

Bitcoin Price Slips In Choppy Trade As Bears Tighten Grip

Vietnamese airlines sign $30-billion deals for 90 Boeing jets