Is Carvana Stock a Buy After Crushing Q4 Expectations?

Carvana CVNA is standing out after reporting record Q4 and full-year results yesterday evening and seeing its stock spike 3% in Wednesday’s trading session.

The e-commerce leader sold 163,522 vehicles during Q4, and nearly 600,000 vehicles total in 2025. Both marks represent new milestones and 43% year over year growth, respectively.

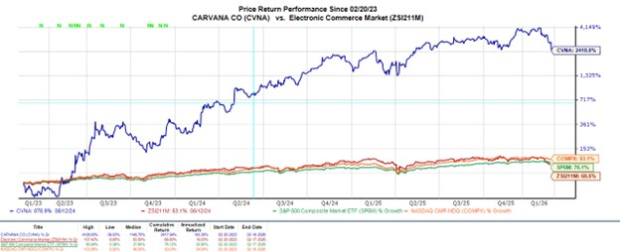

Being one of the market’s top performers, Carvana stock is up a staggering 2,400% in the last three years, but is 25% from an all-time high of $486 a share, which it hit in January.

This certainly makes it a worthy topic of whether it's time to buy Carvana stock after its blowout Q4 results.

Image Source: Zacks Investment Research

Carvana’s Stellar Q4 Results

Carvana reported higher profit and revenue driven by strong demand for used vehicles amid broader economic pressures. Posting record Q4 sales of $5.6 billion, this was a 58% increase from $3.54 billion in the prior year quarter and comfortably topped estimates of $5.22 billion by 7%.

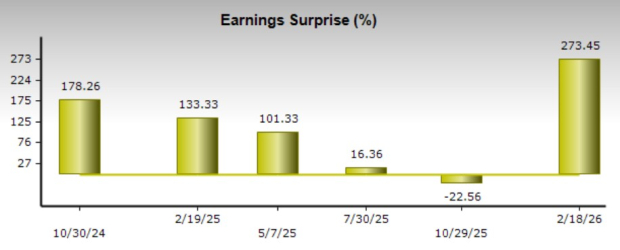

More astonishing, Q4 EPS of $4.22 crushed expectations of $1.13 by 273% and skyrocketed from $0.56 per share a year ago. The massive upside surprise comes as Carvana saw strong growth in every major profitability metric, including net income, operating profit, and gross profit, while seeing stronger cash flow as well.

Notably, Carvana’s cash from operating activities jumped 617% YoY to $430 million, signaling that the earnings strength wasn’t just accounting quirks and that its business is generating real cash.

Image Source: Zacks Investment Research

Full Year Results & Strategic Goals

Rounding out fiscal 2025, Carvana’s total sales spiked 49% to a peak of $20.3 billion from $13.67 billion in 2024. Net income was up more than $1 billion to $1.9 billion. This equated to full-year EPS skyrocketing 405% to a record $8.04, versus $1.59 per share in 2024.

Other full-year highlights included record EBITDA of $2.2 billion, up more than $850 million YoY.

While Carvana didn't provide formal guidance, the company stated its most important goal for 2026 is significant growth in retail units sold and adjusted EBITDA. It’s noteworthy that Carvana did project a sequential increase in retail units sold and adjusted EBITDA in Q1.

Monitoring Carvana’s Valuation

Reassuringly, Carvana stock is trading at a much more reasonable 43X forward earnings multiple. Starting to trade closer to the benchmark S&P 500 and its Zacks Internet-Commerce Industry average, CVNA offers a nice discount to its median of around 68X forward earnings since becoming profitable.

In terms of price to forward-sales, CVNA is trading roughly on par with its industry average at under 3X, a discount to the S&P 500’s 5X.

Image Source: Zacks Investment Research

Bottom Line

Carvana stock currently lands a Zacks Rank #3 (Hold). However, after blowing away earnings expectations, a buy rating could be on the way as EPS revisions are very likely to trend higher for FY26. With CVNA growing into its lofty valuation, the pullback from its all-time high of $486 a share has become more enticing as bubble fears are starting to be quieted.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Samsung and SK Hynix "Adjust Strategy": New Memory Factory Production Schedule Moved Up

Why Wall Street Is Watching Manhattan Associates, Inc. (MANH)' Cloud Expansion Closely

Analysts Bullish On AppLovin Corporation (APP) Outlook Following Impressive Results

Brevan Howard, Which Manages $40 Billion, Announces Major Sale of Bitcoin (BTC) Assets