LiquidChain ($LIQUID) Eyes $1 as Cross-Chain Execution Rolls Out: Best Crypto to Buy in 2026

In 2026, crypto rewards utility over narratives. Capital flows now favor projects that solve structural problems instead of relying on hype-driven cycles. One of the clearest bottlenecks across the market remains execution and liquidity fragmentation between major blockchains.

That backdrop explains the rising interest around LiquidChain ($LIQUID). Built as a Layer-3 execution and liquidity network, LiquidChain focuses on connecting Bitcoin, Ethereum, and Solana through a unified execution layer. As cross-chain activity expands, this design places the project directly in the path of how capital actually moves.

Why LiquidChain Has Huge Utility Behind It

LiquidChain is created to sit above existing chains and coordinate how liquidity flows between them. Bitcoin liquidity, Ethereum liquidity, and Solana liquidity all operate at scale, yet they remain siloed across separate networks.

This fragmentation forces users and institutions to rely on bridges, wrapped assets, and intermediaries. Each added layer increases risk, cost, and execution delays. LiquidChain addresses this problem by treating liquidity as a shared resource instead of a chain-specific one.

Through a unified execution layer, assets can move across ecosystems without breaking liquidity into isolated pools. Execution routes through a single environment, reducing slippage and improving pricing efficiency. This matters most during periods of volatility, when fragmented liquidity amplifies inefficiencies.

Developers benefit from this structure as well. Applications built on LiquidChain can access multi-chain liquidity without managing complex integrations. Execution logic remains consistent, even as assets originate from different blockchains.

This focus on execution utility mirrors the early role Ethereum played for smart contracts. Ethereum expanded what blockchains could do. LiquidChain expands how blockchains interact. That distinction explains why infrastructure-focused investors are closely tracking the project’s progress.

$LIQUID Price Prediction: Why the $1 Target Looks Realistic Post-Launch

Price targets only hold weight when supported by structure. In the case of $LIQUID, the $1 thesis rests on utility expansion, token mechanics, and market positioning after launch.

The $LIQUID token sits at the center of the network. It is used for execution fees, liquidity routing incentives, and participation across the protocol. Demand scales with usage. As cross-chain execution increases, token activity rises alongside it.

Unlike large-cap assets that require massive inflows to move meaningfully, early-stage infrastructure tokens operate on different dynamics. Adoption curves accelerate as utility becomes visible. Network usage drives valuation, not speculation alone.

Post-launch, valuation frameworks tend to shift. Once execution layers go live and liquidity routing becomes active, market participants price in usage potential instead of roadmap expectations. In that environment, the $1 level becomes a function of execution demand and network adoption, not narrative optimism.

This is where $LIQUID separates itself from many altcoins to buy narratives built purely on market cycles. Its upside case ties directly to how capital flows across chains.

Crypto Pricing and the $0.01335 Entry Window

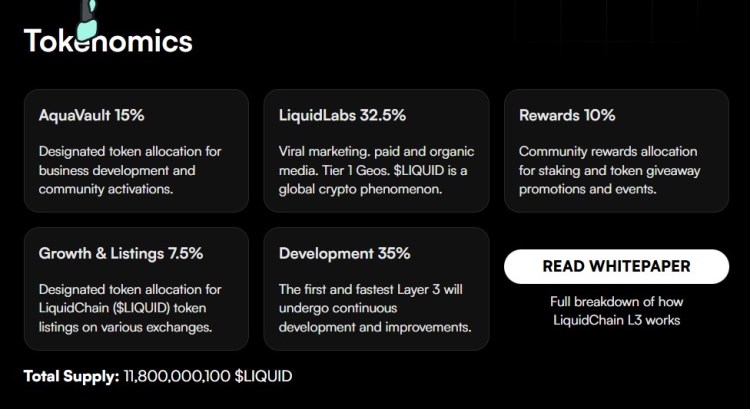

LiquidChain has a fixed total supply of 11,800,000,100 $LIQUID tokens. The largest share goes to development at 35%, ensuring continuous improvements to the Layer-3 network, followed by 32.5% allocated to LiquidLabs for global marketing and ecosystem expansion. The remaining supply is distributed across AquaVault at 15% for business development and community initiatives, 10% for staking and community rewards, and 7.5% reserved for growth and exchange listings.

Raising over $500,000 at this stage shows demand for execution-focused infrastructure. Staking participation reinforces this signal. Locking tokens early reduces immediate sell pressure and aligns incentives around long-term network growth.

Why $LIQUID Is Tipped as the Best Crypto to Buy

Market cycles reward infrastructure when speculation cools. Execution layers, liquidity coordination, and capital efficiency become priorities as ecosystems mature. LiquidChain addresses these needs directly.

The project does not rely on competing with Bitcoin or Ethereum. It enhances them. That positioning reduces narrative risk and anchors value to functionality instead of attention cycles.

Among altcoins to buy for 2026, $LIQUID stands out through utility-driven demand, fixed supply mechanics, and early-stage execution access. These factors combine into a profile that fits long-term capital rotation patterns.

As cross-chain execution becomes standard rather than experimental, networks enabling that transition tend to capture disproportionate value. LiquidChain’s role places it at the center of that shift.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Goldman Sachs CEO Says US Must Codify How Crypto ‘Will Operate’

Biggest Liquidity Driver Ever Approaches, Crypto Market Expected to Bottom Soon

Asure Software (ASUR) Moves 5.9% Higher: Will This Strength Last?

Zacks Industry Outlook Highlights Casella Waste, Republic Services and Clean Harbors