Tokenization, buoyed by momentum over the past year and supported by global financial giants, is rapidly reshaping the world of finance. With further growth projected, much of this transformation is unfolding through the efforts of established industry players like Chainlink. Today, major banks, asset managers, and even governments are exploring this shift. In this article, we take a closer look at how tokenization is advancing in the United Kingdom and examine Chainlink’s pivotal role in this evolution.

Tokenization’s Traction in the United Kingdom

The UK stands out as home to one of the world’s deepest capital markets, lending significant weight to its moves in the tokenization arena. Britain’s regulatory bodies—namely, the Financial Conduct Authority (FCA), HM Treasury, and the Bank of England—are pushing legislation that not only encourages innovation but also maintains high standards of market conduct and operational resilience. Recently, the country has entered a new phase: pilot programs have matured into live applications meeting real operational demands, attracting collaboration among index providers, asset managers, fintechs, and infrastructure companies.

Chainlink’s Expanding Influence

Chainlink has taken a central role in enabling this transformation. One notable development is FTSE Russell—a subsidiary of the London Stock Exchange Group—now publishing its global indices on-chain using Chainlink’s DataLink solution. This initiative helps bridge traditional and digital finance by distributing global benchmark data directly on blockchain networks.

“This pioneering move offers reliable benchmark data, used to track and manage trillions of pounds in assets, directly on blockchain networks. It enables tokenized products and traditional funds to rely on the same trusted inputs. FTSE Russell and Chainlink are bringing global financial indices on-chain via Chainlink DataLink,” Chainlink highlighted.

Innovative Services Power Compliance and Integration

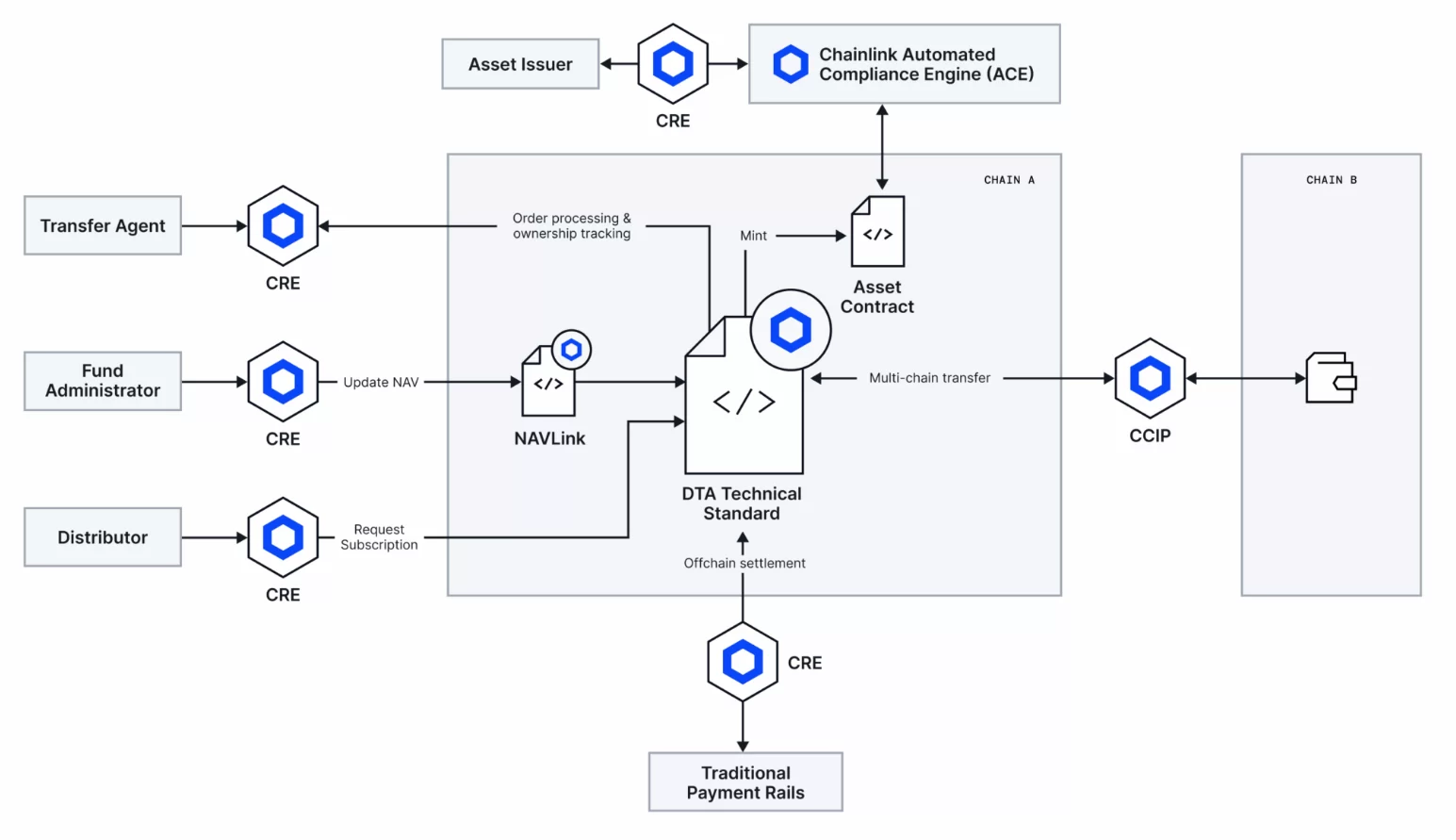

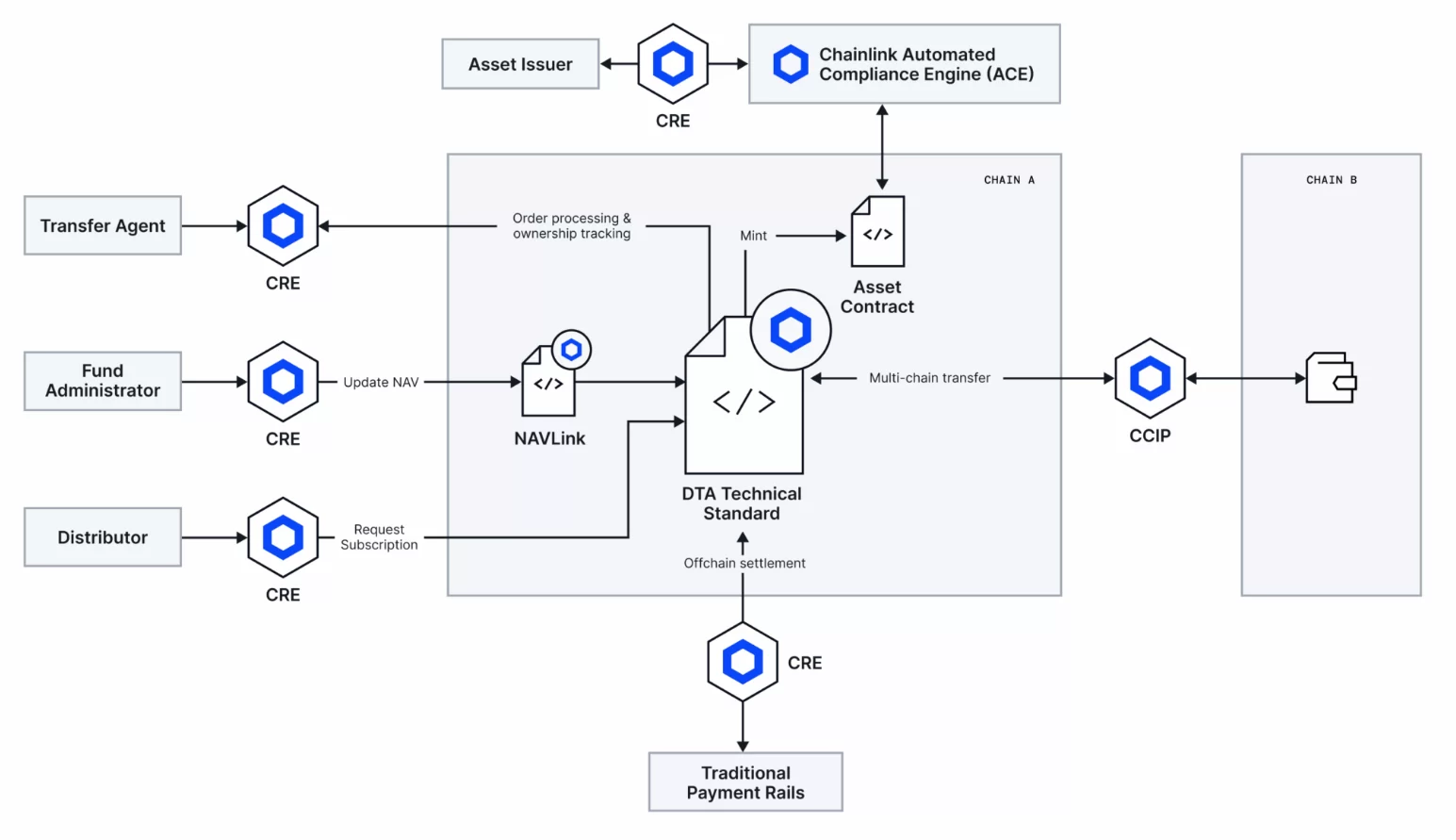

Beyond data provision for exchanges, Chainlink has launched its Automated Compliance Engine (ACE) to address the regulatory complexities of tokenization. ACE enables compliance protocols, suitability screenings, and policy controls to be embedded directly into on-chain workflows. This seamless integration eases the path for enterprises to meet diverse compliance requirements while managing tokenized assets across networks.

Additionally, Chainlink provides powerful interoperability and synchronisation tools, such as the Cross-Chain Interoperability Protocol (CCIP) and the Chainlink Runtime Environment (CRE). These platforms safely move assets, data, and workflows between multiple environments. By covering everything from regulatory needs to asset tracking and blockchain transfers, Chainlink has developed a comprehensive suite of tools to support the process end-to-end.

For banks, asset managers, infrastructure providers, and policymakers in the UK, tokenization has progressed well beyond experimentation into full-scale implementation. Within this landscape, Chainlink’s expanding toolkit is making the transition smoother while establishing its own stake in the ecosystem. Looking ahead, Chainlink’s continued growth in the field underscores its long-term potential as tokenization becomes increasingly mainstream.