Velo3D Stock Edges Higher Thursday: What's Going On?

Velo3D Inc (NASDAQ:VELO) shares are trading higher Thursday afternoon as investors reacted to fresh insider activity and this week's new defense contract. Here’s what investors need to know.

- Velo3D stock is charging ahead with explosive momentum. Why is VELO stock up today?

Velo3D Stock Rebounds After Sharp Tuesday Sell-Off

On Tuesday, Velo3D shares fell sharply even after the company announced an $11.5 million multi-year full-rate production contract with a major U.S. defense contractor for high-performance 3D-printed components.

The deal uses the company's Rapid Production Solution and industrial-scale laser powder bed fusion platforms to deliver critical parts faster and at lower cost than traditional manufacturing.

Insider Confidence In VELO?

Bullish sentiment appeared to improve Thursday after Wednesday's after-hours release of new SEC Form 4 filings, although the stock did not immediately react when the disclosures were posted.

Director Jason Michael Lloyd disclosed open-market purchases totaling 7,000 Velo3D shares at an average price of about $3.91 in the fourth quarter, increasing his beneficial ownership to 13,376 shares.

A separate Form 4 reflected a routine compensation event, with CEO and director Arun Jeldi receiving 12,583 common shares through the vesting and settlement of previously granted restricted stock units, bringing his directly held stake to 37,746 shares.

Because Jeldi’s Form 4 is a scheduled equity compensation tied to a multi-year service-based vesting program rather than a new open-market purchase, it is not seen as a meaningful catalyst for Thursday's move in the stock.

Shares Below Key Moving Averages

Currently, Velo3D is trading 30.3% below its 20-day simple moving average (SMA) and 33.2% below its 50-day SMA, indicating a bearish short-term trend.

However, the stock is just 1.3% below its 100-day SMA, suggesting some longer-term stability, especially as shares have increased 178.27% over the past 12 months. The stock is positioned closer to its 52-week lows than its highs, reflecting ongoing volatility.

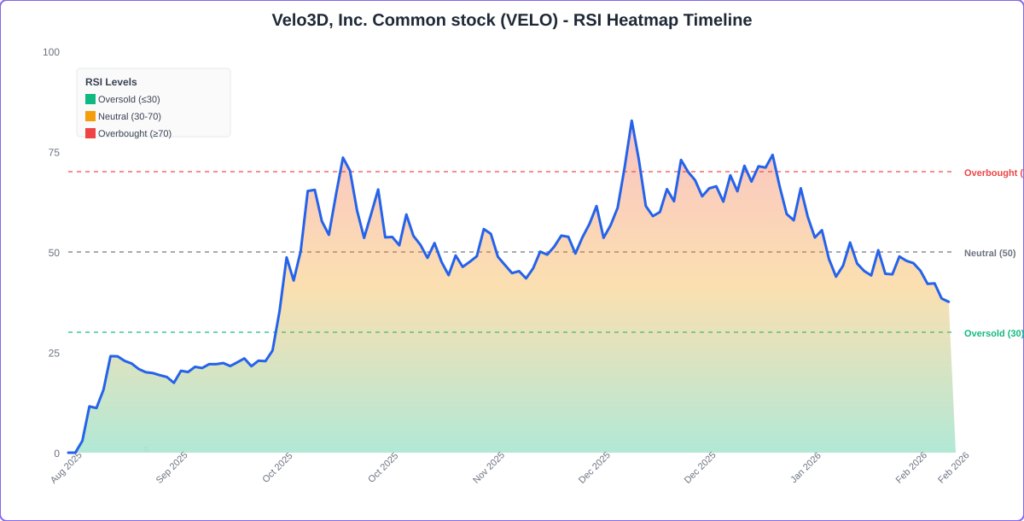

The RSI is at 38.03, which is considered neutral territory, while the MACD shows a value of -1.2657, below its signal line at -0.6283, indicating bearish pressure on the stock.

This combination suggests that while the stock is not in oversold territory, it is facing challenges in gaining upward momentum.

Earnings Ahead In March

The countdown is on: Velo3D is set to report earnings on March 2.

- EPS Estimate: Loss of 56 cents

- Revenue Estimate: $8.68 million

Velo3D Shares Edge Higher Thursday

VELO Price Action: Velo3D shares were up 3.77% at $9.36 at the time of publication on Thursday.

Image: Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tightening Bitcoin Bollinger Bands forecast explosive price move, but which way?

Cenovus Energy Reports Soaring Q4 Profits Driven by Unprecedented Production Levels

JPMorgan Europe Fined €12.2 Million by ECB for Misreporting Capital Requirements

Klarna Hits $1 Billion Revenue - But IPO Story Now Faces Legal Test