Client Relationship Retention and Steady Sales Momentum Make Jack Henry & Associates (JKHY) a Resilient Business

Conestoga Capital Advisors, an asset management company, released its fourth-quarter 2025 investor letter. As many believe, US equities experienced solid returns in 2025, with double-digit gains across all major indices, yet underlying conditions revealed extreme volatility and market leadership. In Q4 2025, Conestoga Capital Advisors SMid Cap Strategy trailed the Russell 2500 Growth Index, returning -2.71% vs. 0.33% for the Index. Relative performance fluctuated throughout the quarter. Negative stock selection in Industrials and Real Estate drove underperformance in the quarter, while underweight in the volatile biotechnology industry also impacted relative returns. Nevertheless, positive stock selection in Financials and Basic Materials countered these losses. From a factor standpoint, a "tug-of-war" between high- and low-quality elements lasted throughout the quarter. For the full year, the composite delivered a total return of -4.71% net of fees, compared to the benchmark’s 10.31% return. Please review the Strategy’s top five holdings to gain insights into their key selections for 2025.

In its fourth-quarter 2025 investor letter, Conestoga Capital Advisors highlighted Jack Henry & Associates, Inc. (NASDAQ:JKHY). Jack Henry & Associates, Inc. (NASDAQ:JKHY) is a financial technology company that offers solutions and payment processing services for community banks and credit unions. On February 19, 2026, Jack Henry & Associates, Inc. (NASDAQ:JKHY) stock closed at $161.14 per share. One-month return of Jack Henry & Associates, Inc. (NASDAQ:JKHY) was -12.95%, and its shares declined 5.84% over the past twelve months. Jack Henry & Associates, Inc. (NASDAQ:JKHY) has a market capitalization of $11.663 billion.

Conestoga Capital Advisors stated the following regarding Jack Henry & Associates, Inc. (NASDAQ:JKHY) in its fourth quarter 2025 investor letter:

"Jack Henry & Associates, Inc. (NASDAQ:JKHY) constitutes a leading provider of technology solutions and payment processing services primarily for community banks and credit unions. The stock performed well after the company reported solid fiscal first-quarter results, characterized by steady top-line growth and successful contract wins for its modernization solutions. Despite industry consolidation headwinds, JKHY’s consistent sales momentum and ability to secure long-term client relationships highlight the resilience of its business model and its critical role in the financial services infrastructure."

Jack Henry & Associates, Inc. (NASDAQ:JKHY) is not on our list of 30 Most Popular Stocks Among Hedge Funds. According to our database, 37 hedge fund portfolios held Jack Henry & Associates, Inc. (NASDAQ:JKHY) at the end of the third quarter, up from 26 in the previous quarter. While we acknowledge the potential of Jack Henry & Associates, Inc. (NASDAQ:JKHY) as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you're looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

In another article, we covered Jack Henry & Associates, Inc. (NASDAQ:JKHY) and shared Fenimore Asset Management's views on the company. In addition, please check out our hedge fund investor letters Q4 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HBAR Knocks on $0.10 Again as Buyers Return—but Resistance Still Holds

Safe Pro Awarded Contract to Provide U.S. Government with AI Powered Edge Processing Systems

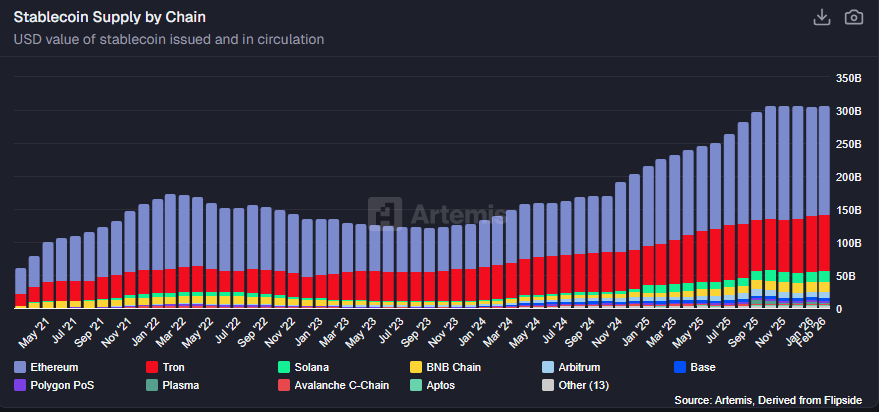

USDT sees fastest market cap decline since 2022 as stablecoin supply falls in February

LyondellBasell Slashes Dividend Amid 'One Of The Longest Downturns In Chemical Industry'