February 20 marks a pivotal day for the first quarter with two major events poised to shape economic sentiment. The release of the PCE report will serve as a litmus test for the Federal Reserve’s battle against inflation, while the Supreme Court’s tariff ruling could determine whether the chaos over customs duties resurfaces in 2025.

PCE Report

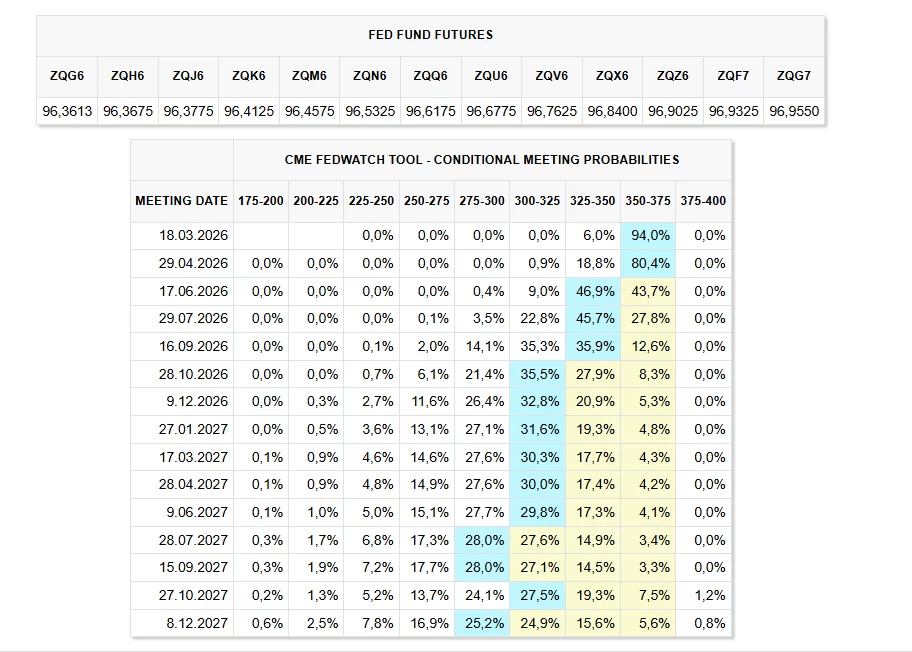

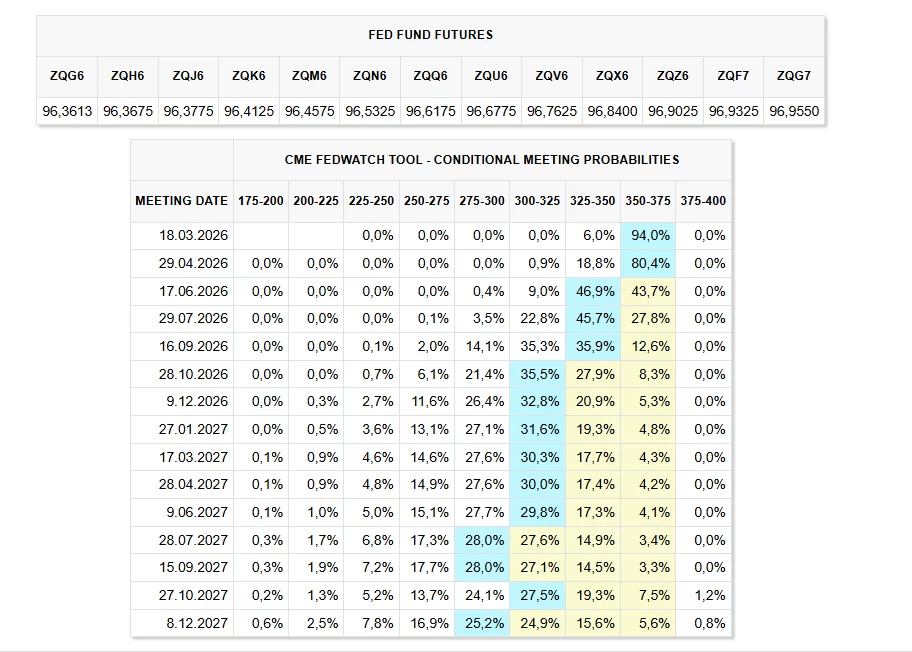

At 4:30 p.m., the Personal Consumption Expenditures (PCE) report—regarded as the Fed’s preferred inflation gauge—will be published. Both the consensus forecast and previous month’s data sit at 2.8 percent. Core PCE came in at 2.9 percent last month, and expectations for January point to a decline to 2.8 percent. Before the release, markets generally anticipate that the Federal Reserve will leave rates unchanged during both its March and April meetings.

Fed Chair Jerome Powell is slated to remain in his role until May, making him responsible for steering the institution through at least the June meeting. With robust employment figures and inflation yet to approach the 2 percent target, policymakers currently project a maximum of only two rate cuts this year.

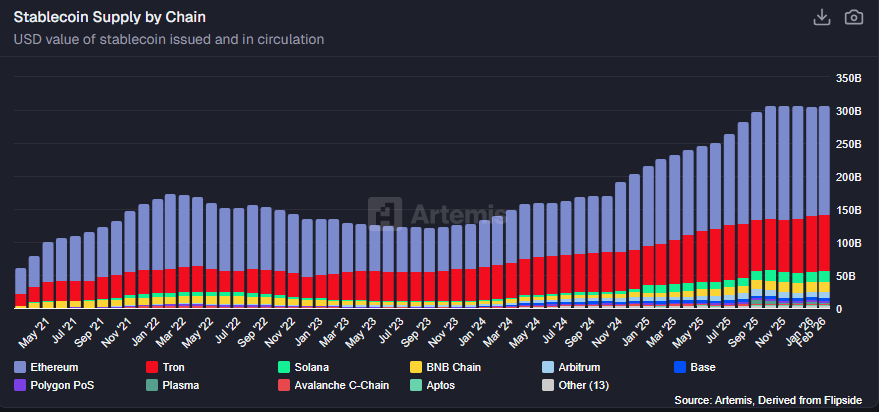

Should today’s PCE numbers come in below expectations, confidence in the likelihood of two rate cuts for 2026 could strengthen. Such a scenario might restore appetite for risk in financial markets and boost sentiment across equities and cryptocurrencies alike.

Supreme Court Tariff Ruling

The Trump administration previously suggested the Supreme Court would deliver its tariff decision in January, but that announcement never materialized. With a deadline stretching into March, the Court is expected to issue updates today. A month ago, January’s final date came and went as the Court began its recess. Industry observers anticipate a decision after the Court’s break, possibly at 6:00 p.m. this evening; however, a delay into the following week remains possible, keeping the exact timing uncertain.

A tariff verdict that goes against Trump could trigger a rapid decline in cryptocurrency values. The turbulence surrounding customs duties negotiations in 2025 was a bruising experience for crypto markets, which suffered steep losses. Should tariffs now be scrapped, the U.S. risks losing trillions in trade deals and would be compelled to return hundreds of billions in tax revenues to trading partners.

Trump argued that canceling the tariffs would spell disaster for the economy. Since the November hearing, the most significant headwind for cryptocurrencies has been the Supreme Court’s pending tariff decision. If a ruling comes today, a major uncertainty will finally be resolved. In contrast, keeping tariffs in place would eliminate ambiguity, lending support to the crypto sector’s outlook.