- SUI: Parallel execution boosts scalability, attracting DeFi and gaming developers.

- WLFI: Political narrative drives volatility and high-risk trading opportunities.

- DOT: Parachains enable interoperability and strengthen long-term multichain adoption.

Crypto traders always hunt for the next breakout setup. Strong fundamentals often spark those explosive moves. Right now, three promising altcoins — SUI, WLFI, and DOT show serious upside potential. Each project targets a different narrative. One focuses on scalable infrastructure. Another leans into political momentum. The third builds a multichain future. If momentum returns to altcoins, these names could lead the charge.

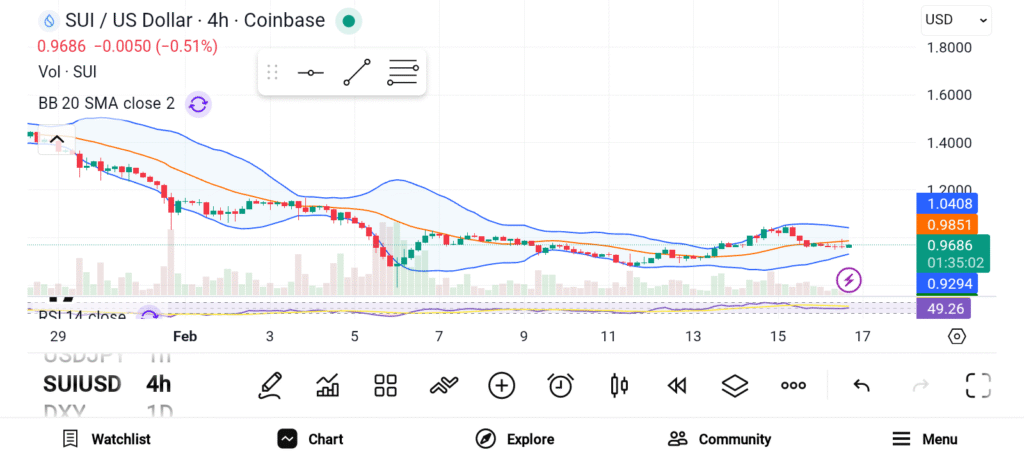

Sui Network (SUI)

Source: Trading View

Source: Trading View

Sui Network stands out as a high-performance Layer 1 blockchain. The design focuses on scalability and developer freedom. An object-based architecture allows parallel transaction execution. That structure boosts speed while preserving decentralization. Developers building DeFi and gaming apps value low latency. Sui delivers that performance without sacrificing network security. More projects continue launching across the ecosystem. Ecosystem growth often drives long-term value. Analysts point to stronger market sentiment around SUI. Ongoing upgrades support confidence among investors. Capital often rotates toward infrastructure plays during recovery phases. Scalable networks usually benefit first. Sui combines strong engineering with rising adoption. That mix creates a solid case for long-term growth. For investors seeking technical strength, SUI deserves attention.

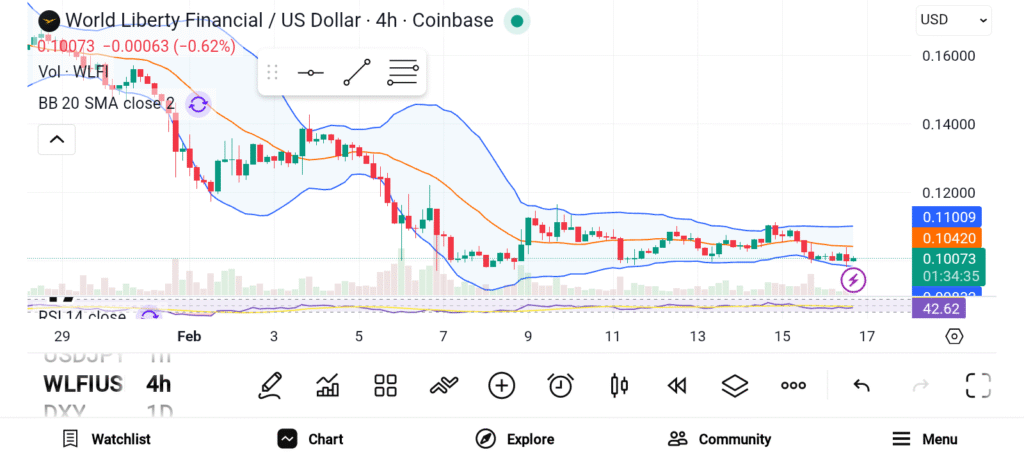

World Liberty Financial (WLFI)

Source: Trading View

Source: Trading View

World Liberty Financial takes a different path. The project connects finance with political identity. Strong ideological branding shapes the ecosystem narrative. Narrative-driven tokens often surge during election cycles. Political headlines move markets fast. Assets tied to real-world events can spike sharply. Traders who track sentiment shifts may find opportunity here. Timing matters more than fundamentals in this segment. WLFI carries higher risk than infrastructure coins. Volatility can swing both ways. However, high risk often attracts aggressive traders. For those who understand political cycles, WLFI offers a speculative play tied to global developments.

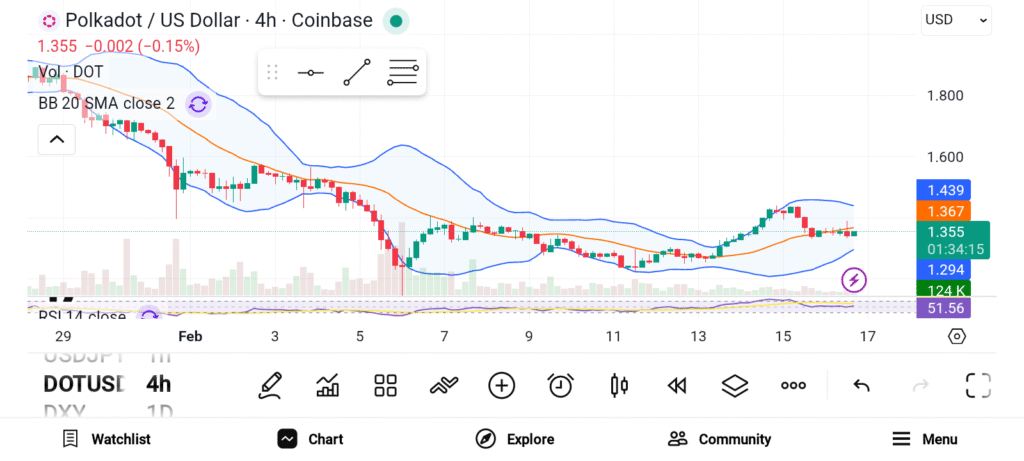

Polkadot (DOT)

Source: Trading View

Source: Trading View

Polkadot continues building toward a connected blockchain future. The network uses parachains and shared security. A relay chain allows different blockchains to communicate smoothly. That structure tackles fragmentation across crypto ecosystems. Interoperability remains a major long-term theme. Many blockchains still operate in isolation. Polkadot aims to link those networks under one secure framework. Developers gain flexibility without sacrificing shared protection. Ongoing upgrades and grant programs support steady development. Infrastructure-focused investors value that consistency. DOT already holds an established position in the market. That durability strengthens long-term confidence. Polkadot offers a clear solution to cross-chain challenges. As adoption grows, demand for seamless communication may rise.

Sui Network offers scalable infrastructure with strong technical design. World Liberty Financial targets political momentum and narrative-driven volatility. Polkadot advances interoperability through parachains and shared security. Each altcoin serves a unique narrative, giving investors diversified breakout potential.