Enbridge Shares Up 22.9% in a Year: Should You Buy the Stock or Wait?

Enbridge Inc. ENB shares are rapidly climbing toward its 52-week high of $54.20, closing at $51.59 on Feb. 19. The stock has outperformed its sub-industry peers, including Kinder Morgan Inc. KMI and Enterprise Products Partners LP EPD, gaining 22.9% over the past year compared with gains of 22.4% for KMI and 7.7% for EPD.

Enbridge is a prominent name in North America’s midstream energy sector, operating an extensive crude oil and liquids transportation network and gas transportation pipelines, while maintaining a presence in renewables and utility businesses. ENB recently reported its fourth-quarter earnings, with its adjusted earnings per share of 63 cents beating the Zacks Consensus Estimate of 60 cents.

The company’s strong fundamentals and stable business model make Enbridge a preferred choice in the energy sector for risk-averse investors. Before offering any investment advice, it would be wise to closely look at ENB’s fundamentals.

Stable Business Model Supported by Take-or-Pay Contracts

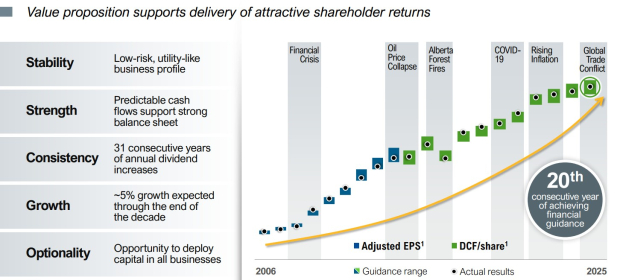

ENB’s midstream business is highly stable, owing to its contractual nature. In fact, 98% of its EBITDA is supported by long-term “take-or-pay” contracts, which shield it from commodity price volatility. This implies that shippers are expected to pay even when they do not use capacity. Additionally, the company has highlighted that more than 95% of its customer base comprises investment-grade companies.

Furthermore, Enbridge’s acquisition of U.S. gas utilities is contributing positively to its EBITDA. The utility business adds another layer of stability to its operations, resulting in predictable earnings supported by regulated rates and long-term agreements. Thus, the company’s earnings are anticipated to remain stable with minimal exposure to fluctuations in commodity prices.

Enbridge’s 31-Year Dividend Streak

Enbridge continues to reward shareholders with dividend hikes. The company has increased its quarterly dividend to C$0.97 per share in 2026 (C$3.88 on an annualized basis), marking the 31st consecutive year of dividend-per-share growth. ENB continues to generate long-term shareholder value through its relatively low-risk business model and by allocating capital in a disciplined manner. The company generates predictable cash flows backed by long-term agreements, which enable it to return capital to shareholders sustainably.

Enbridge’s recent project additions have increased its current backlog to C$39 billion, which extends till 2033. The multi-year backlog visibility is expected to enhance its earnings and distributable cash flows (DCF), thereby supporting a steadily growing dividend.

Time to Invest in the Stock or Wait?

Enbridge’s stable business model, supported by long-term take-or-pay contracts, and its strong project backlog are expected to generate stable, predictable cash flows. This will enable the company to support a steadily growing dividend and increase its annual investment capacity, enhancing its ability to fund growth projects across its core business units.

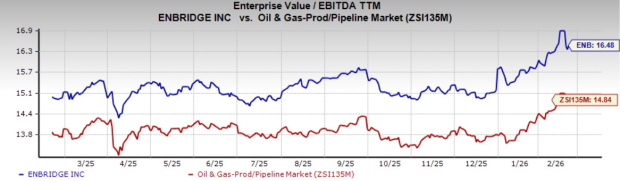

ENB’s current valuation indicates that the stock may be overvalued, at a trailing 12-month enterprise value to EBITDA (EV/EBITDA) of 16.48X, above the broader industry average of 14.84X. Kinder Morgan and Enterprise Products currently trade at a trailing 12-month EV/EBITDA of 15.10X and 11.37X, respectively.

Image Source: Zacks Investment Research

Enbridge’s recent earnings release mentions that its adjusted EBITDA increased 7% year over year to C$20 billion in 2025. The company reaffirmed near-term growth of 7-9% for adjusted EBITDA within 2023-2026. Given that the stock is currently overvalued, investors should wait for a more opportune moment to buy ENB stock, while those who have already invested can retain the stock, which currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICP, Filecoin And Livepeer Lead AI And Big Data Developer Activity Rankings

Expert Reveals How Low Bitcoin Could Crash If $65K Breaks

XRP Ledger News Today: AI Agents Can Now Pay With XRP and RLUSD via x402

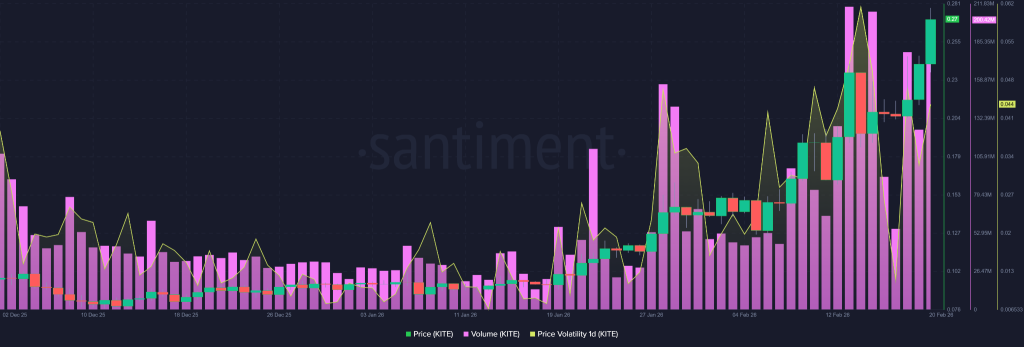

KITE Crypto On-Chain Data Signals Aggressive Expansion as Whale Activity and Volume Surge