OP dropped nearly 25% in 24 hours after Base revealed it is moving away from the OP Stack to its own unified technical stack. The sell-off pushed OP toward $0.12, as investors quickly reassessed the long-term impact on Optimism and its Superchain ecosystem.

Base launched in 2023 and rapidly became one of the most widely used Ethereum layer-2 networks. Today, it has about $3.85 billion locked in the protocol. When Base first went live, both teams shared that Base could earn up to 118 million OP tokens over six years, tying its growth closely to Optimism’s economics.

Because Base generated significant activity and revenue within the Superchain model, any structural change immediately affects how investors value OP.

Base clarified that this move does not mean it is cutting ties with Optimism entirely. The company said it will continue working with Optimism for support and remain compatible with OP Stack standards during the transition.

For everyday users and developers, nothing changes immediately.

The shift is mainly technical. By controlling its own stack, Base says it can ship upgrades faster and simplify how the network operates behind the scenes. The goal is to double its pace of major upgrades to around six per year, compared to three today.

In its blog post, the team wrote:

“This unification does not mean Base will be built in isolation. The protocol remains public and specified in the open, and alternative implementations are welcome and encouraged.”

The market reaction is largely economic, not functional. Investors worry that if Base operates independently, Optimism could lose a major revenue and activity driver.

In simple terms, Base was one of the strongest engines powering the Superchain. If that engine changes structure, valuation assumptions change too.

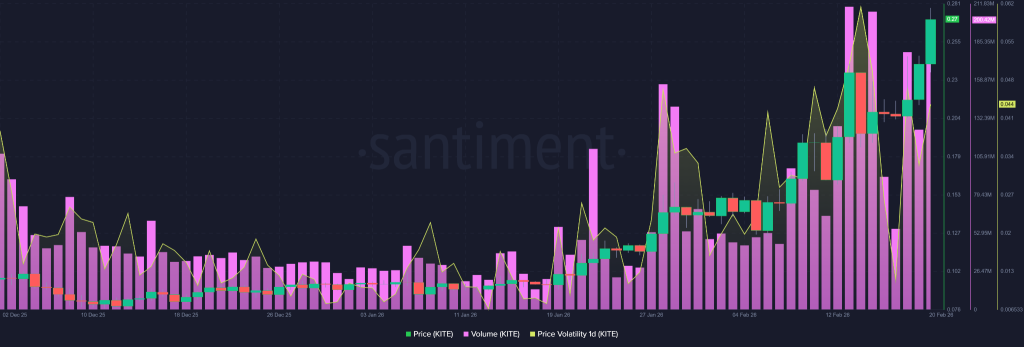

OP’s chart is clearly trending down. The token recently hit a low near $0.1283 and is struggling to hold that level.

Source:

TradingView

Source:

TradingView

If strong buying does not step in soon, the price could fall even further because current support looks weak. Next level to watch is the breaking above the $0.1450 resistance level, before considering any bullish move.

(adsbygoogle = window.adsbygoogle || []).push({});For now, Base continues operating normally. Node operators will need to migrate to the new Base client in the coming months, but no urgent action is required.

The bigger question is whether Optimism can maintain growth without relying so heavily on Base. The next few months will reveal whether OP’s price drop is a short-term overreaction or a sign of deeper changes in Ethereum’s layer-2 landscape.