Why DNOW (DNOW) Shares Are Getting Obliterated Today

What Happened?

Shares of energy and industrial distributor DNOW (NYSE:DNOW) fell 19.1% in the morning session after the company reported disappointing fourth-quarter 2025 financial results, which included a significant loss and missed Wall Street's expectations.

For the quarter, DNOW posted revenue of $959 million, which fell short of analysts' estimates. The results were particularly weak on the bottom line, with the company reporting a GAAP loss of $0.95 per share, a significant miss compared to the profit of $0.15 per share that analysts had anticipated. The quarter's performance, which came after the company's recent all-stock acquisition of MRC Global, was also marked by a sharp decline in profitability. Adding to investor concerns, DNOW's operating margin fell to negative 17.7%, a steep drop from the positive 5.1% margin recorded in the same period of the previous year.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks. Is now the time to buy DNOW?

What Is The Market Telling Us

DNOW’s shares are quite volatile and have had 16 moves greater than 5% over the last year. But moves this big are rare even for DNOW and indicate this news significantly impacted the market’s perception of the business.

The biggest move we wrote about over the last year was 8 months ago when the stock gained 9.8% on the news that the company announced it will merge with MRC Global in an all-stock transaction.

The deal will create a leading energy and industrial solutions provider with a combined enterprise value of approximately $3.0 billion. Under the terms of the agreement, MRC Global shareholders will receive 0.9489 shares of DNOW common stock for each share of MRC Global they own. Upon closing, DNOW shareholders will own approximately 56.5% of the combined company, with MRC Global shareholders owning the remaining 43.5%. The merger is expected to generate significant value for shareholders, with an estimated $70 million in annual cost savings within three years. The combination is also projected to be accretive to adjusted earnings per share in the double-digits within the first year after the deal is finalized. This strategic move combines the complementary footprints of both companies across key energy and industrial centers in the United States.

DNOW is flat since the beginning of the year, and at $13.29 per share, it is trading 24.1% below its 52-week high of $17.50 from February 2025. Investors who bought $1,000 worth of DNOW’s shares 5 years ago would now be looking at an investment worth $1,266.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICP, Filecoin And Livepeer Lead AI And Big Data Developer Activity Rankings

Expert Reveals How Low Bitcoin Could Crash If $65K Breaks

XRP Ledger News Today: AI Agents Can Now Pay With XRP and RLUSD via x402

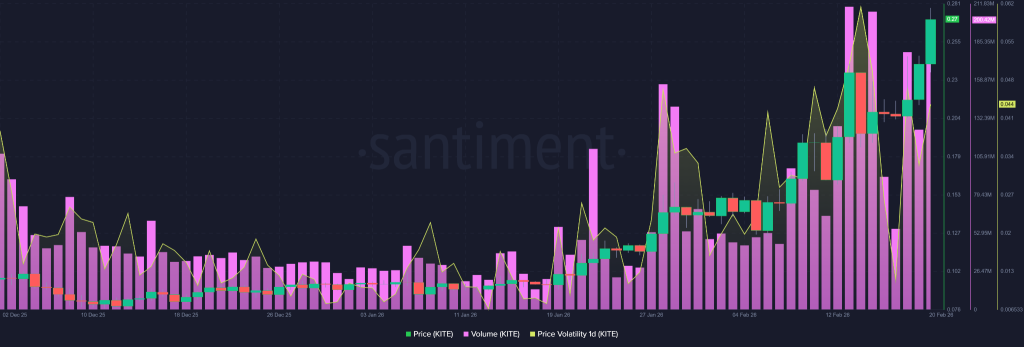

KITE Crypto On-Chain Data Signals Aggressive Expansion as Whale Activity and Volume Surge