Should You Buy Cenovus Stock at a Premium or Step Away Now?

Cenovus Energy Inc. CVE is approaching its 52-week high of $23.24, closing the latest session at $23.13.

The rally has been supported by a consistent operational performance, expanding production volumes and a measured approach to capital allocation. At the same time, richer valuation levels and growing sensitivity to softer oil prices are beginning to shape the investment debate.

Following the stock’s strong run, investors are now weighing whether fundamentals can continue to justify additional gains or if the recent strength warrants a more cautious stance.

Strong Relative Performance on Fundamentals

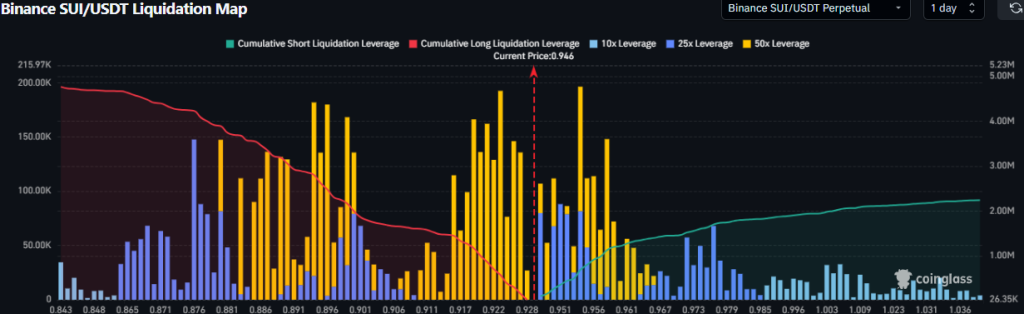

The broader Canadian energy sector has benefited from a constructive commodity backdrop over the past year. Cenovus has clearly outperformed. Over the past 12 months, CVE shares have gained 58.5%, surpassing the industry’s 42.9% increase. The stock has also outpaced Canadian Natural Resources Limited’s CNQ 41.8% rise and Suncor Energy’s SU 43.8% growth in the same period.

Image Source: Zacks Investment Research

Importantly, this outperformance has not been purely sentiment-driven. Cenovus has delivered consistent earnings results, leveraged its scalable oil sands resource base and improved cash flow visibility. Operational reliability and portfolio integration, including upstream production and downstream refining capacity, have enhanced its ability to generate stable returns in supportive pricing environments.

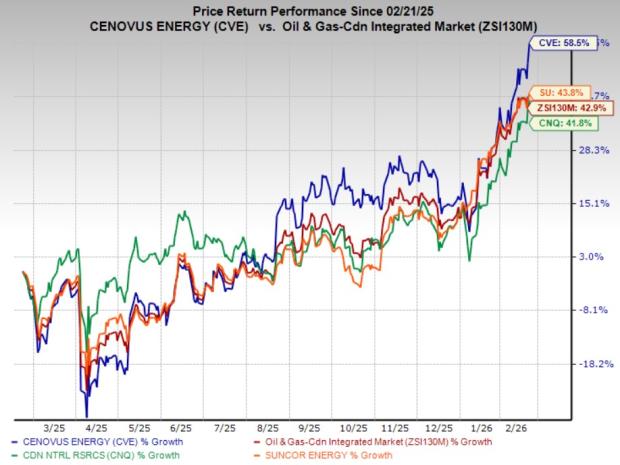

Valuation & Expectations Leave Limited Cushion

As shares press against a 52-week high, expectations appear elevated and valuation now reflects much of the recent optimism. At the current levels, the stock appears stretched relative to its cyclical earnings profile, suggesting that much of the good news is already priced in. In other words, CVE increasingly looks overpriced, given the commodity-sensitive nature of its cash flows.

Image Source: Zacks Investment Research

Oil Price Sensitivity Creates Meaningful Risks

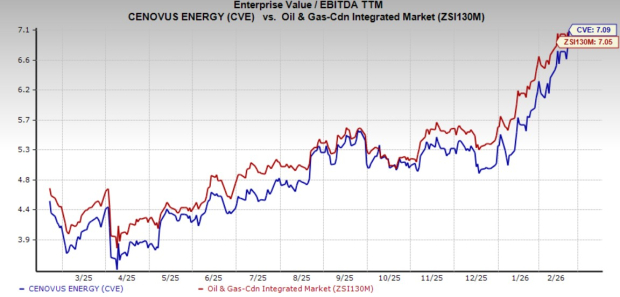

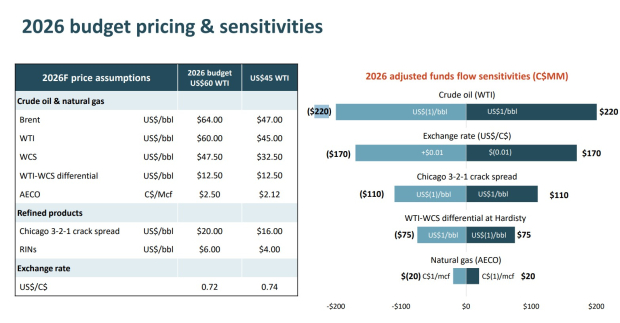

Cenovus’ 2026 financial plan assumes a mid-cycle oil price environment. The company has indicated that at US$50 WTI, CVE can fund total capital expenditure and maintain its base dividend. However, at US$45 WTI, the cash flow would only cover sustaining capital and the base dividend.

This framework highlights a key vulnerability. If oil prices fall below $50 per barrel for a sustained period, excess free cash flow would narrow significantly. That would limit funds available for share repurchases and dividend growth — two pillars of the shareholder return strategy.

The sensitivity is substantial. For 2026, every US$1 change in WTI will impact adjusted funds flow by approximately C$220 million. Such leverage to price swings creates notable downside exposure in a weakening crude environment.

Image Source: Cenovus Energy

Cenovus’ production mix includes a significant share of heavy oil. As a result, realized pricing depends not only on WTI but also on the WTI-Western Canadian Select (WCS) differential. For 2026, every US$1 change in the WTI-WCS differential will affect adjusted funds flow by roughly C$75 million.

While the company benefits from pipeline access and refining capacity, which help mitigate differential risks, it is not fully insulated. If heavy oil discounts widen due to transportation constraints or weaker demand, upstream margins could come under additional pressure.

Image Source: Cenovus Energy

Softer Oil Price Outlook Could Pressure Upstream Margins

West Texas Intermediate crude has recently traded in the mid-$60s per barrel range. However, forward projections suggest a softer pricing backdrop. Per the U.S. Energy Information Administration, WTI averaged $65.40 per barrel in 2025, and is expected to decline to $53.42 in 2026 and $49.34 in 2027. The agency also expects global oil supply to exceed demand in 2026, leading to rising inventories and downward pressure on prices.

For Cenovus, this outlook carries material implications. The company produces heavy and bitumen-blend crude from Canada’s oil sands, with realized prices closely tied to WCS benchmarks. Because WCS typically trades at a discount to WTI due to quality differences and transportation costs, sustained weakness in WTI would likely translate into lower realized prices.

If WTI trends toward the sub-$55 environment projected for 2026 and 2027, particularly if differentials widen, Cenovus’ upstream netbacks could compress meaningfully. Even stable production volumes would not fully offset the earnings and cash flow impacts of weaker pricing.

Bottom Line

Cenovus’ integrated model and scalable resource base provide resilience in favorable commodity conditions. However, with the stock trading just below its 52-week high, expectations appear elevated at a time when oil price sensitivity remains pronounced.

The company’s financial framework functions well in a supportive pricing environment, but downside risks are significant if WTI weakens or heavy oil differentials expand. Given these exposures and limited margin for error near technical highs, the current risk/reward balance appears skewed to the downside.

CVE currently carries a Zacks Rank #5 (Strong Sell). With commodity uncertainty still a meaningful overhang and shares hovering near peak levels, investors may be better served by avoiding the stock rather than chasing recent momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Maintains Macro Bullish Structure Despite Deeper Correction

Analysis-US Supreme Court ruling offers little respite for global economy

Will Quantum Computers Spell the End of Bitcoin? We’ve Gathered Everything We Know

Is SUI Price Entering a New Macro Wave? ETF Flows Add Fuel