Russell 2000 Drop, EM Stocks Hit Records After Court's Tariff Ruling: What's Moving Markets Friday?

Wall Street delivered a split verdict Friday after the Supreme Court struck down President Donald Trump's global tariffs, pressuring U.S. small caps while lifting internationally exposed equities and emerging markets to fresh highs.

The Russell 2000 fell 0.4%, lagging the broader market, while the tech-heavy, globally oriented Nasdaq 100 gained 0.5%.

In a historic decision, the Court ruled that the International Emergency Economic Powers Act (IEEPA) does not authorize the president to impose tariffs, grounding its reasoning in separation-of-powers principles.

"The Framers gave ‘Congress alone' the power to impose tariffs during peacetime," the Court wrote. "The whole power of taxation rests with Congress."

The justices did not address whether the administration must refund more than $130 billion in tariffs already collected under the emergency declarations.

Investors interpreted the ruling as a relative negative for domestically focused small- and mid-cap companies. Many small-cap firms had benefited from elevated import duties that shielded them from foreign competition.

With tariffs now legally constrained and potentially rolled back, competitive pressure from overseas producers could intensify.

By contrast, emerging markets rallied sharply. The iShares MSCI Emerging Markets ETF (NYSE:EEM) jumped more than 1% to a record high, putting the asset class on track for a ninth consecutive weekly gain — the longest winning streak since 2005.

Friday's market moves unfolded against a challenging macro backdrop. U.S. GDP expanded at just a 1.4% annualized pace in the fourth quarter of 2025, a steep slowdown from the prior quarter's 4.4% growth and well below expectations for 3%.

Meanwhile, December's Personal Consumption Expenditures index rose 0.4% month over month, lifting the annual rate to 2.9%. Core PCE — the Federal Reserve's preferred inflation gauge — also increased 0.4% on the month, pushing the year-over-year rate to 3% and topping estimates of 2.9%.

President Trump blasted the ruling shortly after its release, calling the decision "a disgrace" and saying he has "a backup plan for tariffs."

Adding another layer of geopolitical uncertainty, Trump also said the U.S. may consider a limited military strike against Iran.

Friday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day % |

| Nasdaq 100 | 24,955.53 | 0.6% |

| S&P 500 | 6,893.30 | 0.5% |

| Dow Jones | 49,446.39 | 0.1% |

| Russell 2000 | 2,657.06 | -0.4% |

Russell 1000’s Top 5 Gainers On Friday

| RingCentral, Inc. (NYSE:RNG) | +34.80% |

| Celsius Holdings, Inc. (NASDAQ:CELH) | +8.49% |

| Corning Incorporated (NYSE:GLW) | +6.73% |

| Ciena Corporation (NYSE:CIEN) | +6.60% |

| Coherent Corp. (NYSE:COHR) | +6.51% |

Russell 1000’s Top 5 Losers On Friday

| Akamai Technologies, Inc. (NASDAQ:AKAM) | -10.95% |

| Figure Technology Solutions, Inc. (NYSE:FIGR) | -9.65% |

| Universal Display Corporation (NASDAQ:OLED) | -9.48% |

| Caris Life Sciences, Inc. (NASDAQ:CAI) | -9.31% |

| Karman Holdings Inc. (NYSE:KRMN) | -9.05% |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICP, Filecoin And Livepeer Lead AI And Big Data Developer Activity Rankings

Expert Reveals How Low Bitcoin Could Crash If $65K Breaks

XRP Ledger News Today: AI Agents Can Now Pay With XRP and RLUSD via x402

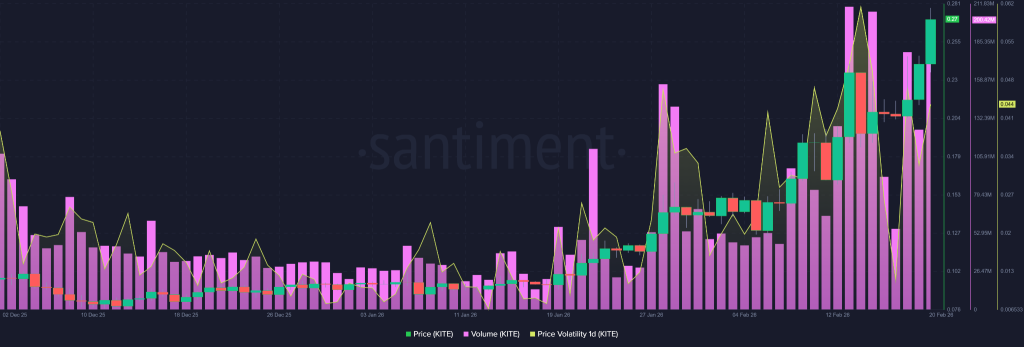

KITE Crypto On-Chain Data Signals Aggressive Expansion as Whale Activity and Volume Surge