GE HealthCare Wins FDA Clearances for Next-Gen SIGNA MRI Portfolio

GE HealthCare Technologies Inc. GEHC recently announced FDA 510(k) clearance for three new magnetic resonance (MR) innovations — SIGNA Sprint with Freelium, a 1.5T sealed magnet MRI system; SIGNA Bolt, an advanced 3T MRI scanner; and SIGNA One, an AI-enabled workflow ecosystem designed to streamline MRI exams from planning to post-scan processes. These launches address key pressures in the radiology market, including rising imaging volumes driven by an aging population, increasing disease prevalence, workforce constraints and growing sustainability requirements.

Per management, the FDA clearance of the latest SIGNA MRI platform reinforces the company’s focus on broadening access to high-quality imaging and advancing clinical standards. The systems are designed to boost efficiency while preserving diagnostic accuracy, positioning GEHC to meet rising MRI demand with smarter, faster and more sustainable solutions.

Likely Trend of GEHC Stock Following the News

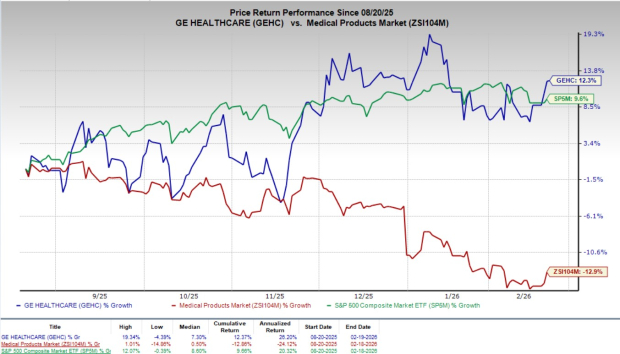

Following the announcement, shares of GEHC gained 0.1% at yesterday’s closing. Over the past six months, shares of the company have climbed 12.3% against the industry’s 12.9% decline. However, the S&P 500 has risen 9.6% during the same time frame.

The FDA clearances signal significant progress in GEHC’s multi-year innovation roadmap, reinforcing its leadership in precision imaging while aligning with broader healthcare trends centered on sustainability, automation and operational efficiency. By embedding AI-enabled workflow tools directly into hardware platforms, the expanded portfolio positions GE HealthCare to capture incremental MRI demand and support longer-term revenue potential.

GEHC currently has a market capitalization of $37.80 billion.

Image Source: Zacks Investment Research

More on the Next-Generation SIGNA Portfolio

GEHC’s SIGNA Sprint with Freelium is a sealed-magnet 1.5T MRI platform designed to deliver helium-free operation. By reducing helium reliance to less than 1%, the system maintains power efficiency and image. It delivers strong imaging performance through high homogeneity, elevated signal-to-noise ratio and deep-learning tools such as AIR Recon DL and Sonic DL.The system delivers consistent image quality and resilience, featuring over five-hour ride-through, conventional-level homogeneity and compatibility with existing power infrastructure. Its ventless design enables flexible siting, while SIGNA One-driven scanning and autonomous magnet management support uptime and reduce service reliance.

The company’s SIGNA Bolt is a next-generation 3T MRI system, designed to deliver high-precision diagnostics with improved efficiency and sustainability. Built on a deep-learning architecture, it streamlines workflows while controlling energy use and operating costs. The advanced 80/200 gradient delivers research-grade performance with 30% lower power consumption versus prior models. A new AIR Coil suite enhances patient comfort and exam flexibility. The platform supports key pathways such as neurology and oncology, and features a sustainability profile including up to 65% lower peak power demand and 34% less equipment room space.

SIGNA One acts as the digital backbone of the new MRI ecosystem. SIGNA Sprint with Freelium and SIGNA Bolt are unified by SIGNA One, an AI-driven workflow ecosystem to improve MRI efficiency and user experience. The platform targets throughput gains and variability reduction through an intuitive interface that minimizes training needs. Key features include the SIGNA One Table for smoother patient handling, an AI-enabled in-room camera for automated positioning, contactless physiological gating and high-resolution in-room consoles for streamlined control. Together, these capabilities are designed to accelerate setup, enhance clinical confidence and improve technologist and patient experience.

Industry Prospects Favoring the Market

Going by the data provided by Precedence Research, the magnetic resonance imaging market is valued at $8.8 billion in 2026 and is expected to witness a CAGR of 3.9% through 2035.

Factors like the rising demand for advanced diagnostic imaging across neurology, oncology and cardiology; the growing adoption of high-field and specialty MRI systems; the expansion of healthcare infrastructure globally and increased funding from OEMs, private equity and healthcare infrastructure investors are boosting the market’s growth.

Other News

GE HealthCare recently announced a $35 million expansion of its contract with the Biomedical Advanced Research and Development Authority (BARDA). Funded mainly by BARDA, the agreement aims to accelerate the development of AI-enabled ultrasound and next-generation imaging solutions for trauma care and mass-casualty preparedness.

GE HealthCare introduced ReadyFix in the United States, a remote fleet management platform designed to enhance medical device uptime and improve operational efficiency across healthcare networks. The solution is integrated with the company’s MAC VU360 resting ECG workstations, enabling reliable ECG measurements along with real-time system connectivity that supports remote diagnostics, repairs and proactive maintenance.

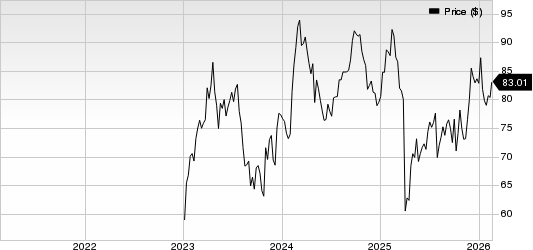

GE HealthCare Technologies Inc. Price

GE HealthCare Technologies Inc. price | GE HealthCare Technologies Inc. Quote

GEHC’s Zacks Rank & Other Key Picks

Currently, GEHC has a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the broader medical space are Intuitive Surgical ISRG, Veracyte VCYT and Cardinal Health CAH.

Intuitive Surgical, sporting a Zacks Rank #1 (Strong Buy) at present, reported fourth-quarter 2025 adjusted earnings per share (EPS) of $2.53, beating the Zacks Consensus Estimate by 12.4%. Revenues of $2.87 billion surpassed the Zacks Consensus Estimate by 4.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 13% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 13.2%.

Veracyte, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 51 cents, which surpassed the Zacks Consensus Estimate by 59.4%. Revenues of $131.8 million beat the Zacks Consensus Estimate by 5.5%.

VCYT has an estimated earnings recession rate of 3% for 2026 compared with the industry’s 17.5% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.1%.

Cardinal Health, currently carrying a Zacks Rank #2, reported a second-quarter fiscal 2026 adjusted EPS of $2.63, which surpassed the Zacks Consensus Estimate by 10%. Revenues of $65.6 billion beat the Zacks Consensus Estimate by 0.9%.

CAH has an estimated long-term earnings growth rate of 15% compared with the industry’s 9.1% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 9.3%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICP, Filecoin And Livepeer Lead AI And Big Data Developer Activity Rankings

Expert Reveals How Low Bitcoin Could Crash If $65K Breaks

XRP Ledger News Today: AI Agents Can Now Pay With XRP and RLUSD via x402

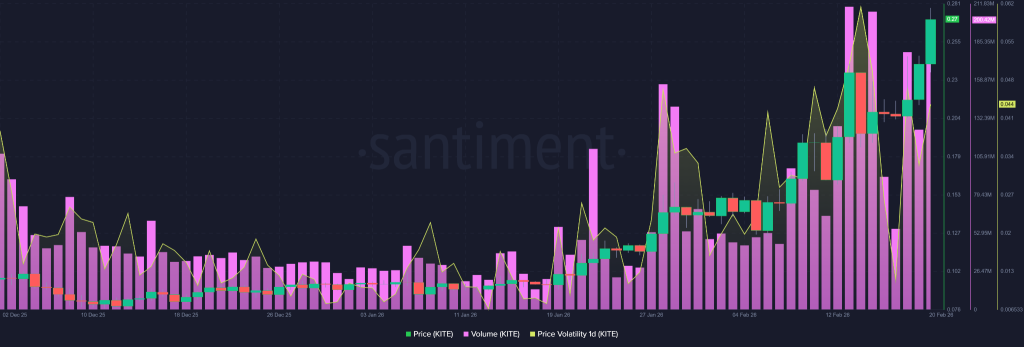

KITE Crypto On-Chain Data Signals Aggressive Expansion as Whale Activity and Volume Surge