The most recent GDP figures aren't as concerning as they may appear. Here's what you should understand.

Economic Growth Stalls at End of 2025

After maintaining strong momentum for most of 2025, the U.S. economy encountered significant challenges in the final quarter. A six-week government shutdown, combined with a slowdown in consumer spending, led to a marked deceleration in growth as the year concluded.

GDP Growth Falls Short of Expectations

The Commerce Department reported on Friday that the nation's gross domestic product—the total value of goods and services produced—expanded at an annualized rate of just 1.4% in the fourth quarter. This figure fell short of economists’ predictions, which hovered around 2%, and represented a sharp decline from the previous quarter’s robust 4.3% growth rate.

Analysts Remain Optimistic

Despite the weaker-than-anticipated GDP numbers, many experts believe the underlying fundamentals of the economy remain solid and anticipate a pickup in growth in the near future. As eToro U.S. investment analyst Bret Kenwell explained to CBS News, “While today’s headline figure is disappointing, a closer look reveals the situation isn’t as dire as it might seem.”

Delayed Data and Inflation Trends

The release of the latest GDP figures was postponed due to the recent government shutdown, marking the first official estimate of fourth-quarter growth. The Commerce Department is scheduled to provide two additional updates for the quarter in the coming months.

Additionally, the government published the Personal Consumption Expenditures (PCE) report on Friday, which is closely watched by the Federal Reserve as a measure of inflation. In December, headline PCE rose at an annual rate of 2.9%, indicating that inflationary pressures remain persistent.

Key Insights from the Latest GDP Report

Impact of the Government Shutdown

Economists point to the 43-day government shutdown as the primary factor behind the economic slowdown in late 2025. During this period, hundreds of thousands of federal employees were furloughed and funding for numerous federal programs was suspended.

Gregory Daco, chief economist at EY-Parthenon, described the shutdown as a “self-inflicted black eye” in an email statement, noting that the disappointing end to the year was largely the result of this unprecedented lapse in government operations.

The shutdown, which spanned nearly half of the fourth quarter from October to early November, is estimated to have reduced GDP growth by about one percentage point, primarily due to decreased federal government services. This event also led to a significant reduction in government spending during the period.

Consumer Spending Slows

Consumer activity, a major driver of the U.S. economy, also lost some steam. Spending increased by 2.4% in the fourth quarter, down from a 2.9% rise in the previous quarter. Although the decline was not dramatic, it contributed to the overall slowdown.

As Kenwell observed, “Spending didn’t collapse, but it did lose momentum compared to earlier in the year.” Since consumer expenditures make up about two-thirds of total economic activity, even modest changes can have a significant impact.

Looking Ahead: Signs of Recovery

Despite the recent slowdown, other areas of the economy are showing resilience. Job creation exceeded expectations last month, with employers adding 130,000 new positions. At the same time, inflation is beginning to ease.

With the government shutdown now over, analysts are forecasting a rebound in economic growth for 2026. Capital Economics, an investment advisory firm, projects that GDP will expand at a 3% annual rate in the first quarter of the new year.

Michael Pearce, chief U.S. economist at Oxford Economics, also anticipates stronger growth, citing reduced tariff pressures and ongoing tax cuts as factors that will encourage increased spending. “We expect a sharp rebound in the coming months, driven by a larger tax refund season,” Pearce noted in a recent report.

Related News

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Maintains Macro Bullish Structure Despite Deeper Correction

Analysis-US Supreme Court ruling offers little respite for global economy

Will Quantum Computers Spell the End of Bitcoin? We’ve Gathered Everything We Know

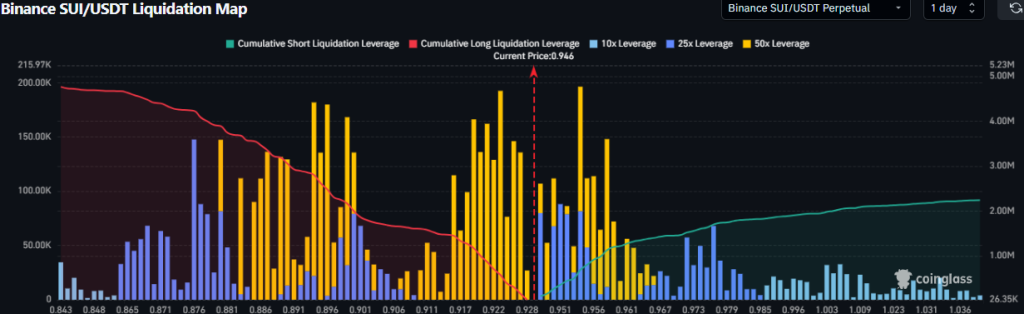

Is SUI Price Entering a New Macro Wave? ETF Flows Add Fuel