News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

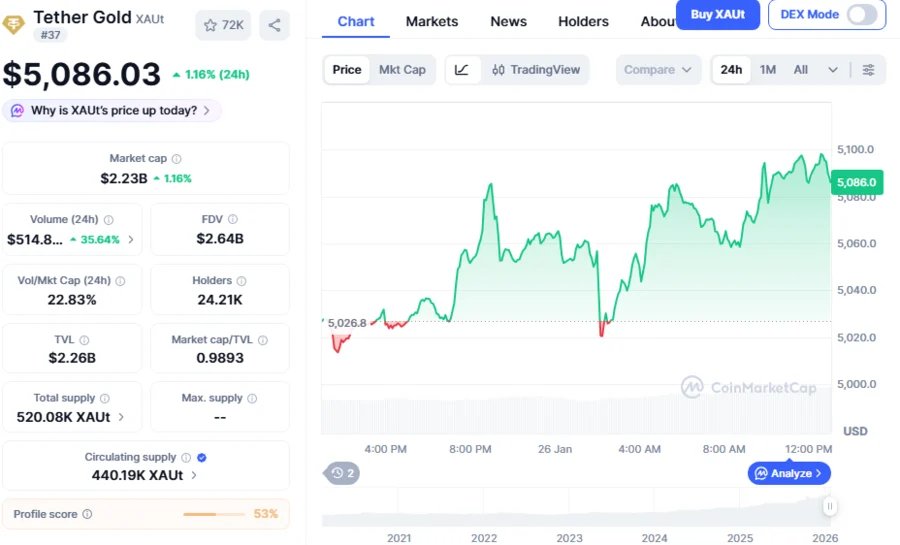

1Bitget Daily Digest (Jan.26)|SIGN, and JUP are set for large token unlocks this week; crypto market long liquidations reached $612 million; a Spark lending whale sold 11,190 ETH2Bitget UEX Daily | EU Suspends Tariffs on US; Gold Hits Record High Breaking $5000, Silver Breaks $100; Rieder Top Fed Contender (January 26, 2026)3a16z-backed Entropy shuts down, promises investors refunds

‘Dollar takes a hit’ as Trump challenges alliances

101 finance·2026/01/26 13:48

Strategy Boosts Bitcoin Holdings with Significant New Acquisition

Cointurk·2026/01/26 13:30

XRPL Commons approve permissioned domains, DEX amendments after Devnet tests

Cointelegraph·2026/01/26 13:27

Nvidia is now TSMC’s biggest customer as Apple slips to second place

Cointelegraph·2026/01/26 13:24

Morning Brief: Ethereum Gears Up for the Quantum Age

101 finance·2026/01/26 13:21

IonQ buys SkyWater for $1.8 billion to secure domestic chip manufacturing for quantum computers

Cointelegraph·2026/01/26 13:15

Whale Dumps ETH, Buys 7,546 XAUT Tokens Worth $36.04 Million Amid Craze for Digital Gold for Safe Haven

BlockchainReporter·2026/01/26 13:12

Crypto liquidations surge to $750 million as markets tumble over the weekend

101 finance·2026/01/26 13:12

Bitcoin Kicks Off the Week on Unstable Footing Amid Ongoing Uncertainty

101 finance·2026/01/26 12:54

Crypto Assets Hit Undervalued Levels: Here Are Top Coins to Consider

CoinEdition·2026/01/26 12:51

Flash

13:51

Goldman Sachs Head of Precious Metals Trading Binet-Laisne Reportedly to LeaveGlonghui, January 26|According to informed sources, Benjamin Binet-Laisne, the head of precious metals trading at Goldman Sachs, will be leaving the firm. As hedge funds and trading companies compete for talent, Binet-Laisne's departure highlights the challenges banks face in retaining traders in the precious metals market.

13:50

Pi Network Advances Mainnet Preparation With Testnet USDT IntegrationPi Network testnet wallet now supports simulated USDT, letting users send and receive tokens for practice.

Testnet users can try swaps and liquidity pools while developers test DeFi tools before mainnet.

Pi Network is encouraging users to test USDT activity through its testnet wallet as it continues preparing its ecosystem for future mainnet utilities. Pi Network s promoted early participation, urging pioneers to try stablecoin-style transactions in a simulated environment before onchain features are introduced.

A simulated USDT balance has been added to the testnet wallet and users can now send and receive the testnet stablecoin. The system is designed as a training transfer mechanism that does not require any funds and exposes users to a virtual ecosystem that is similar to actual payments in stablecoins.

🔥 #PiNetwork Testnet USDT is set 🚀 Have you explored the Pi Testnet wallet yet? 👀

This is the best time to: 🔹 Test #PiNetwork transactions 🔹 Explore utilities in $Pi 🔹 Get familiar before mainnet actions

Active testing today = smoother adoption tomorrow ✌️

Real pioneers… pic.twitter.com/sPPuVKPknq

— Pi Network s (@PiNetworks) January 26, 2026

Developers are using the same test environment to evaluate tools and workflows that could support decentralized utilities. This structure also provides a space to detect technical issues related to transactions and user experience.

Pi Network has been improving and updating its ecosystem with new tools aimed at expanding app creation and Pi-based payments. Earlier this month, we reported that a creator event was launched in which the first 1,000 qualified survey respondents will receive 5 Pi credits, usable only inside App Studio.

Pi Network’s Stablecoin-style Transfers and DeFi Tools

Screenshots shared around the update referenced an estimated 59,000 test USDT in circulation on the testnet. The data showed wallet balances and transaction options available to users inside the simulated environment.

The testnet wallet interface is a training route for users who may later interact with mainnet applications. By practicing with simulated USDT, users can learn how to send assets, review balances, and follow transaction prompts. The same environment is also intended to help users understand how common DeFi actions are executed.

Pi Network’s testnet participation is a step that can reduce onboarding friction later by making users familiar with basic actions. The process also allows repeated testing without exposure to market volatility or fees tied to real assets.

Moreover, Pi Network recently released a developer library that allows Pi ecosystem apps to integrate in-app Pi payments in under 10 minutes. CNF reported that the network cited 17.5 million KYC users and 15.8 million Mainnet migrations as it continues 2026 development efforts.

At the time of reporting, PI traded at

$0.1735

, a

3.2%

drop to settle at a market cap of $1.45 billion. It has shed over

8%

in the past week.

13:45

BlackRock Submits Bitcoin Futures ETF S-1 Filing to SECBlockBeats News, January 26th, Bloomberg ETF analyst Eric Balchunas mentioned on social media that BlackRock has just filed the formal S-1 registration statement for its upcoming iShares Bitcoin Premium Income ETF (filed with the SEC on January 23rd). The fee and ticker have not been announced yet.

The product's strategy is: "Tracking the performance of the Bitcoin price, while providing additional income through an active management strategy, mainly by selling covered call options based on IBIT shares and occasionally trading based on ETP indexes."

BlockBeats Note: This S-1 filing is the first step for the product to formally register with the SEC. The next steps may involve 19b-4 rule changes, Nasdaq listing application, and other processes before approval for official issuance and trading.

News