News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin’s post-quantum plan BIP-360 gains traction, but will it reverse market sell-off?2Bitcoin holders are being tested as inflation fades: Pompliano3 Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

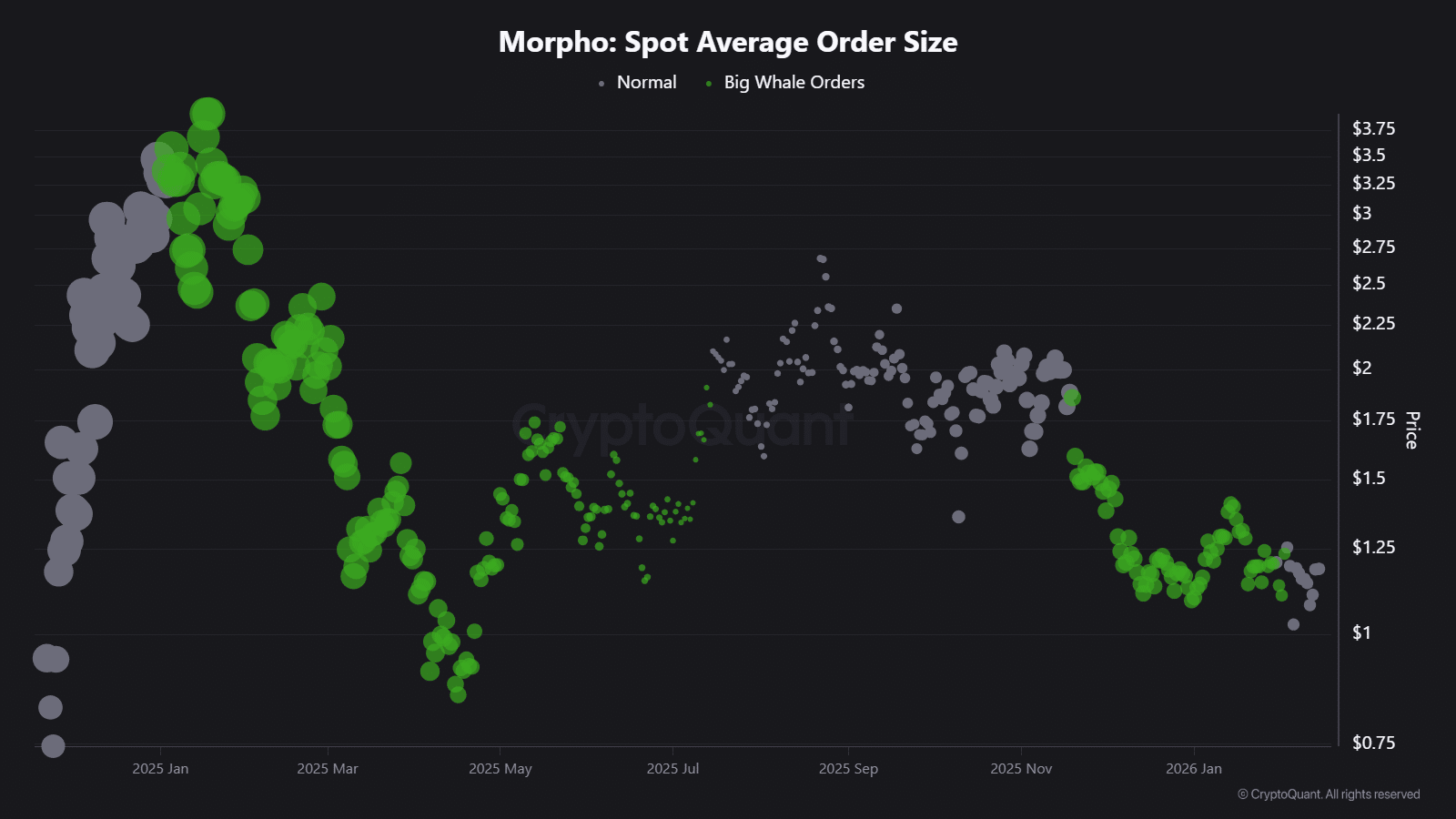

Apollo’s $90 mln plan – Enough to erase MORPHO’s 40% Q4 slide?

AMBCrypto·2026/02/15 08:03

![Bittensor [TAO] targets $241 as the ‘AI narrative’ attempts a comeback](https://img.bgstatic.com/spider-data/d176f86423bb36641aa0013d339dd0541771139020101.png)

Bittensor [TAO] targets $241 as the ‘AI narrative’ attempts a comeback

AMBCrypto·2026/02/15 07:03

Institutions may get 'fed up' and fire Bitcoin devs over quantum: VC

Cointelegraph·2026/02/15 06:18

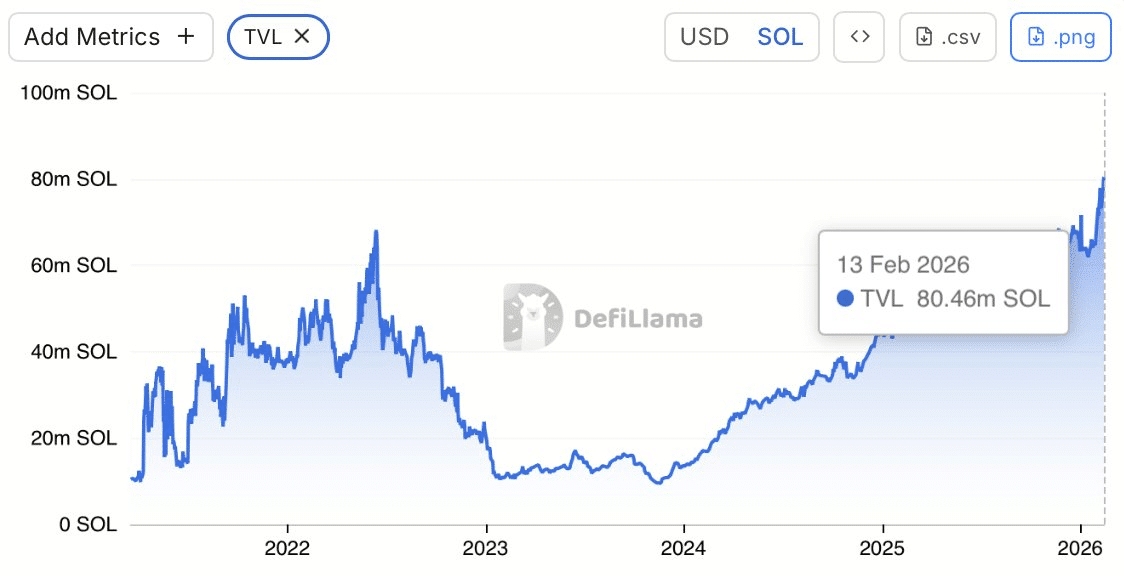

Solana’s divergence explained – Is SOL undervalued or not?

AMBCrypto·2026/02/15 05:03

SolidProof Introduces Ozone Chain in its Quantum-Resistant Blockchain Security Ecosystem

BlockchainReporter·2026/02/15 05:00

Bitcoin Holds Firm Above $70,000 as Meme Coins Rally into the Weekend

Cointurk·2026/02/15 04:12

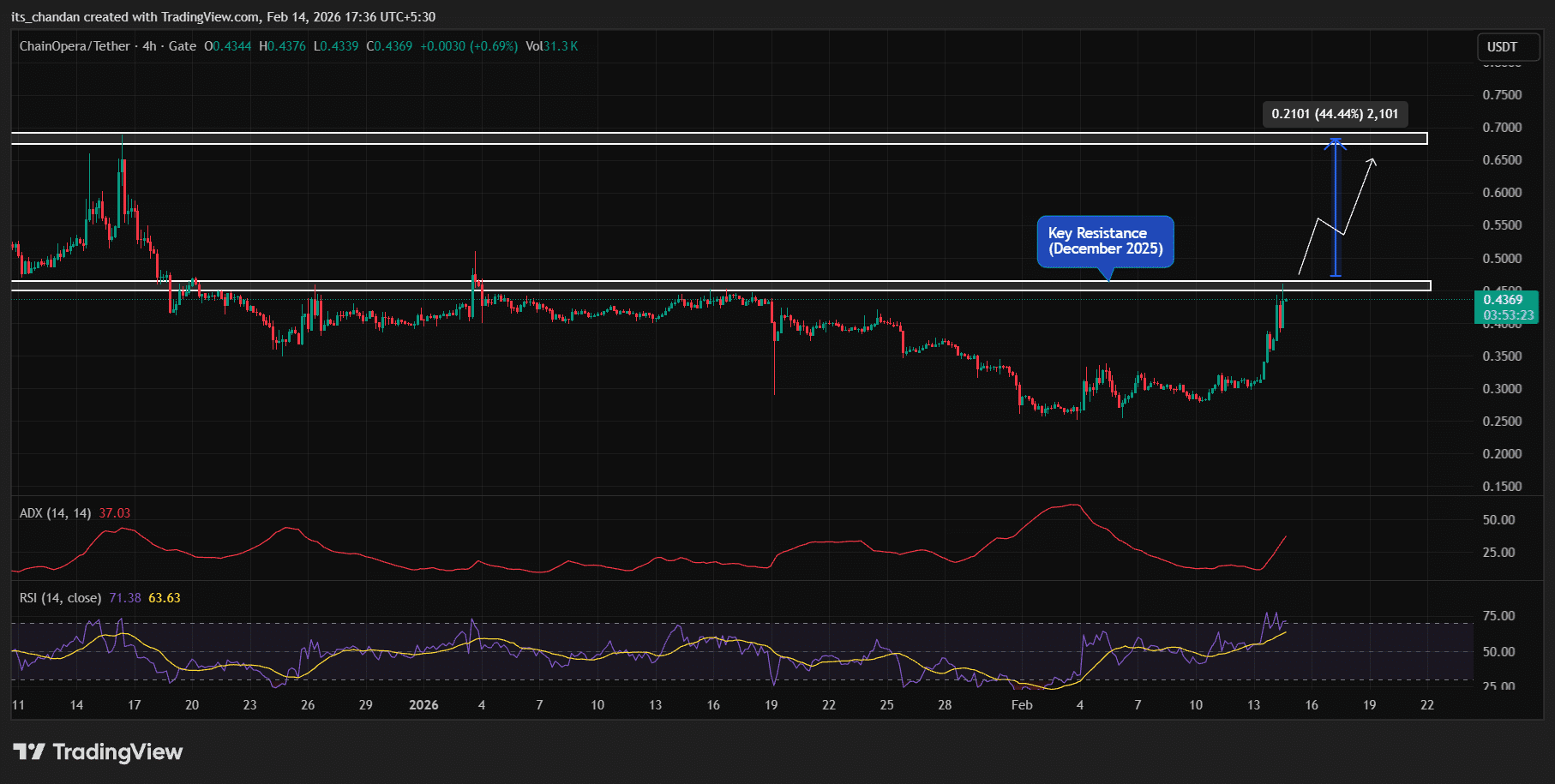

How COAI’s price can rally by 45% after hitting THIS key resistance

AMBCrypto·2026/02/15 04:03

Flash

08:22

Ancient NFT EtherRock 71 sold for $132,000According to ChainCatcher, EtherRock posted on X that half an hour ago, EtherRock 71 was sold for $132,000 (63.3 ETH).

08:05

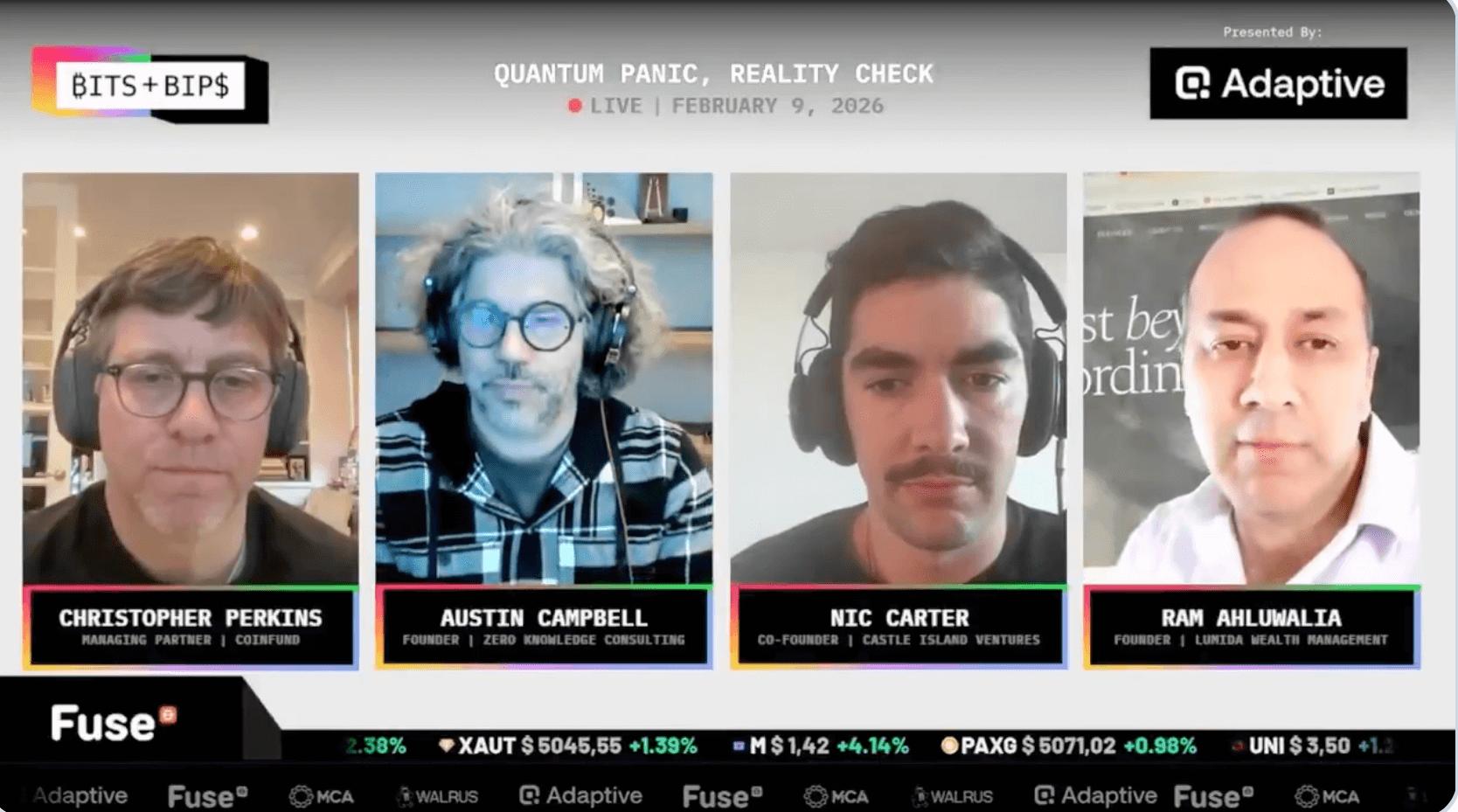

Venture capitalist: Bitcoin developers must urgently address the quantum computing threat to avoid institutional takeoverChainCatcher news, according to Cointelegraph, venture capitalist Nic Carter stated on a podcast that the long-term inaction of bitcoin developers regarding the potential threat of quantum computing to bitcoin could lead large institutions holding substantial amounts of bitcoin (such as BlackRock) to become dissatisfied, ultimately triggering an "institutional takeover." Nic Carter warned that institutions will not tolerate the core security issues of bitcoin being ignored for a long time. "If developers continue to do nothing, institutions will lose patience, dismiss the current developers, and replace them with new ones."

08:05

Current mainstream CEX and DEX funding rate displays a bearish market sentiment, but bearish sentiment towards ETH has significantly easedBlockBeats News, February 15th, according to Coinglass data, as Bitcoin surged past $70,000, Ethereum briefly rose above $2,100. Currently, mainstream CEX and DEX funding rates indicate that although the market remains bearish, the bearish sentiment towards Ethereum has been significantly alleviated, with almost all platforms now showing neutral ETH rates. Specific funding rates are shown in the attached image.

BlockBeats Note: Funding rates are fees set by cryptocurrency trading platforms to maintain the balance between contract prices and underlying asset prices, usually applicable to perpetual contracts. It is a fund exchange mechanism between long and short traders, and the trading platform does not charge this fee. It is used to adjust the cost or profit of traders holding contracts to keep the contract price close to the underlying asset price.

When the funding rate is 0.01%, it represents the baseline rate. When the funding rate is above 0.01%, it indicates a generally bullish market. When the funding rate is below 0.005%, it indicates a generally bearish market.

News