News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Gold and Silver Rebound; SpaceX Acquires xAI; Palantir Revenue Surges (February 3, 2026)2BitMine adds 41,000 ETH to its balance sheet, while its unrealized losses amount to $6B3XRP price prediction: What the loss of the $1.77 swing low means for you

Jensen Huang Cuts Ties with OpenAI?

美投investing·2026/02/03 02:09

TDK Stock Surges as Strong Forecast Eases Concerns Over Memory Prices

101 finance·2026/02/03 01:36

Will GameStop Dump Its Bitcoin? CEO Says ‘Way More Compelling’ Move Ahead

Decrypt·2026/02/03 01:34

Elon Musk finalizes $1.25 trillion agreement to merge SpaceX with Grok

101 finance·2026/02/03 00:21

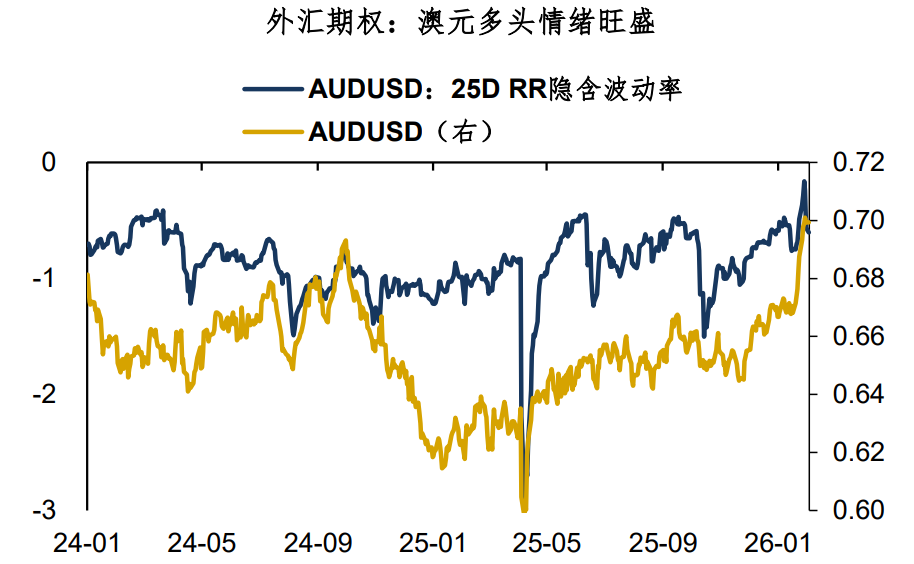

AUD: Either Believe Early or Don't Believe at All

BFC汇谈·2026/02/03 00:01

Crypto Assets Enter Accumulation Zone as Market Pullback Deepens As of 2nd February

BlockchainReporter·2026/02/03 00:00

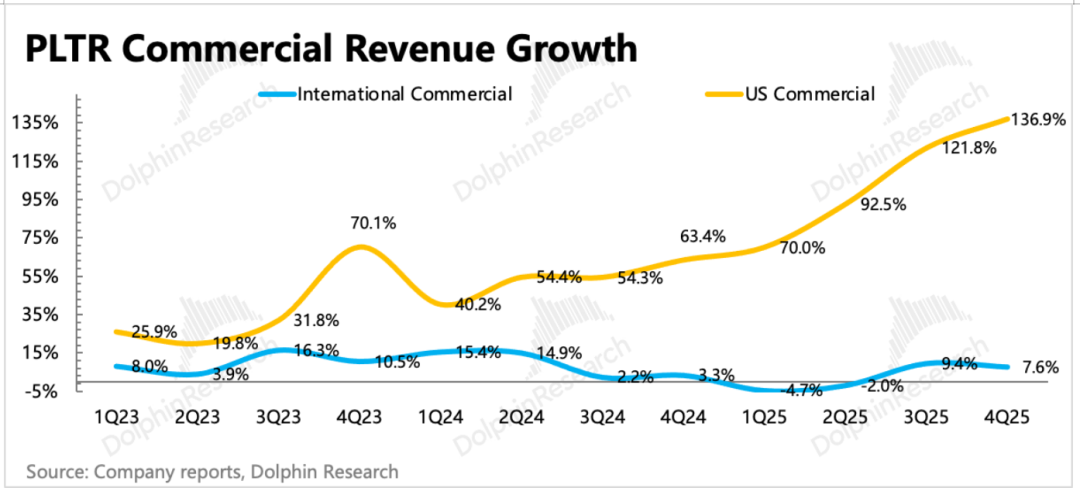

Palantir's chief executive is optimistic following the software firm's 'outstanding' quarterly results

101 finance·2026/02/02 23:12

Flash

02:43

「On-chain Shareholder」 Liquidates Nasdaq Short Position and Margin Buys Gold, Additionally Dips $59 Million to Buy the Crypto MarketBlockBeats News, February 3rd, according to Coinbob Popular Address Monitor, on-chain gold's largest short whale "On-chain Stockholder" (0xfc66...) has concentrated $80 million to short various commodities, with current weekly profit reaching $9.4 million. The address has been continuously closing positions to take profits in the past few days, mainly focusing on on-chain US stock shorts linked to the XYZ100 (Nasdaq 100 Index), with related positions decreasing from about $19.6 million to less than $300,000. Subsequently, the released funds were added to the precious metals shorts, and the total short position has reached $47 million. Among them, the largest short is in PAXG (on-chain gold), with a size of $24.9 million.

Meanwhile, the overall position structure of the account has undergone significant changes. The total position size has increased to $115 million. In addition to retaining about $57 million in commodity shorts, part of the focus has shifted back to the crypto market. A new long position of nearly $59 million has been opened to buy the dip in XRP, SOL, ETH, and other currencies. Holdings related to on-chain stocks have been significantly reduced. The current main commodity holdings compared with last Friday are as follows:

5x PAXG (on-chain gold): The position size has increased from $12 million to $24.9 million, with an average price decreasing from $5,250 to $4,991, with an unrealized profit of about $980,000;

5x xyz:GOLD (gold mapping contract): The position size has increased to $12.8 million, with an average price decreasing from $5,320 to $4,814, with an unrealized loss of about $83,000;

2x xyz:SILVER (silver mapping contract): The position size has increased to $9.49 million, with an average price decreasing from $108 to $81, with an unrealized loss of about $170,000.

It is reported that this address has always focused on on-chain contract operations of crypto assets, and since January 8th, has been continuously reducing leveraged ETH, BTC, and SOL short positions; gradually increasing on-chain stock positions instead, with its on-chain stock position gradually increasing by nearly $80 million within January, and recently returning to the crypto market.

02:41

Truist lowers UnitedHealth's target price to $370Glonghui, February 3rd|Truist has lowered UnitedHealth's target price from $410 to $370, while maintaining a "Buy" rating.

02:40

Denso in Japan lowers its full-year operating profit forecast by nearly one fifthGlonghui, February 3rd|Denso, a major auto parts supplier for Toyota Motor, has lowered its full-year operating profit forecast by nearly one-fifth, mainly due to the impact of U.S. import tariffs and rising raw material costs. Denso has revised its operating profit forecast for the fiscal year ending March 2026 down by 17.8%, from the previous estimate of 651 billion yen to 535 billion yen (approximately $3.44 billion).

News