News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin’s post-quantum plan BIP-360 gains traction, but will it reverse market sell-off?2Bitcoin holders are being tested as inflation fades: Pompliano3 Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

Bitcoin Soars: BTC’s Triumphant Rally Surges Past $69,000 Milestone

Bitcoinworld·2026/02/17 04:21

CZ FUD Opportunity: Timeless Wisdom Reveals How Savvy Crypto Investors Thrive Amid Market Chaos

Bitcoinworld·2026/02/17 04:21

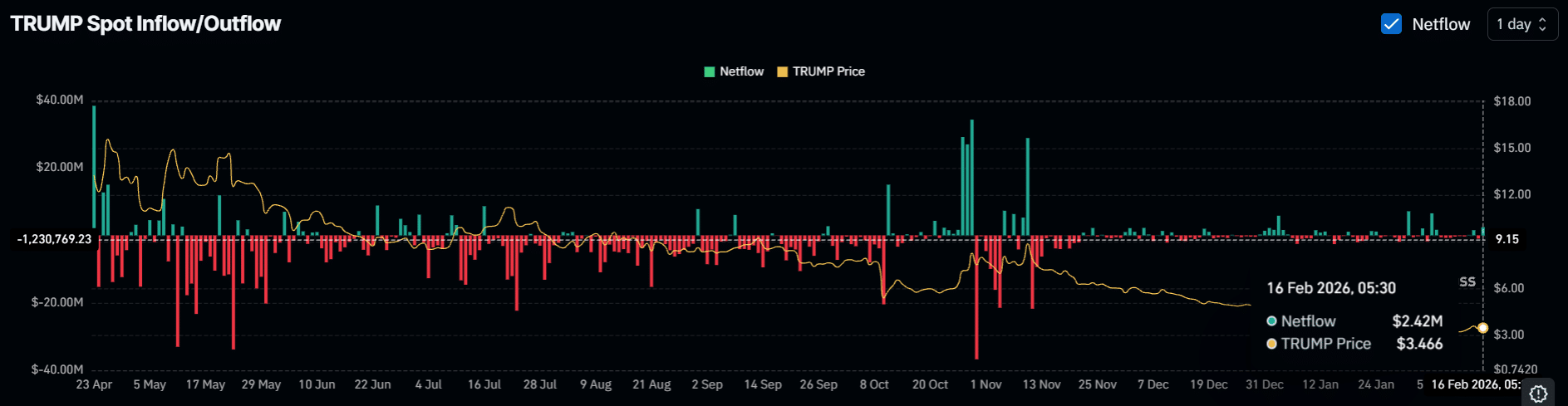

6.33 mln TRUMP tokens set to unlock: Will this lead to a 12% drop?

AMBCrypto·2026/02/17 04:03

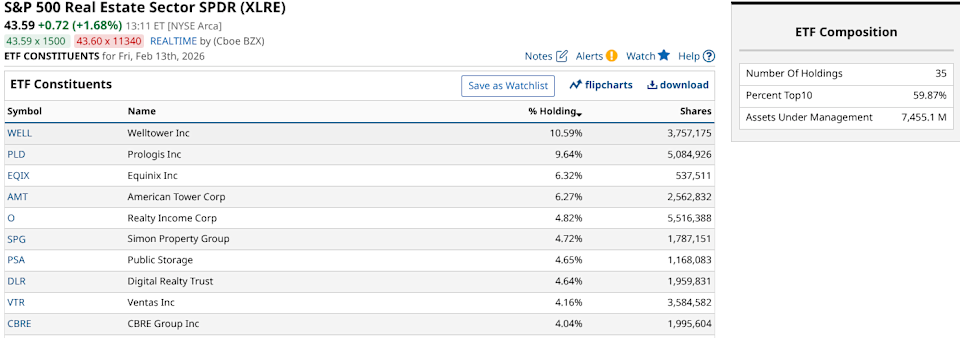

How to Approach These Two Historically High-Yield Sector ETFs During the Ongoing Rally

101 finance·2026/02/17 03:36

Trump’s emerging global strategy is encouraging Sweden to reconsider adopting the euro

101 finance·2026/02/17 03:30

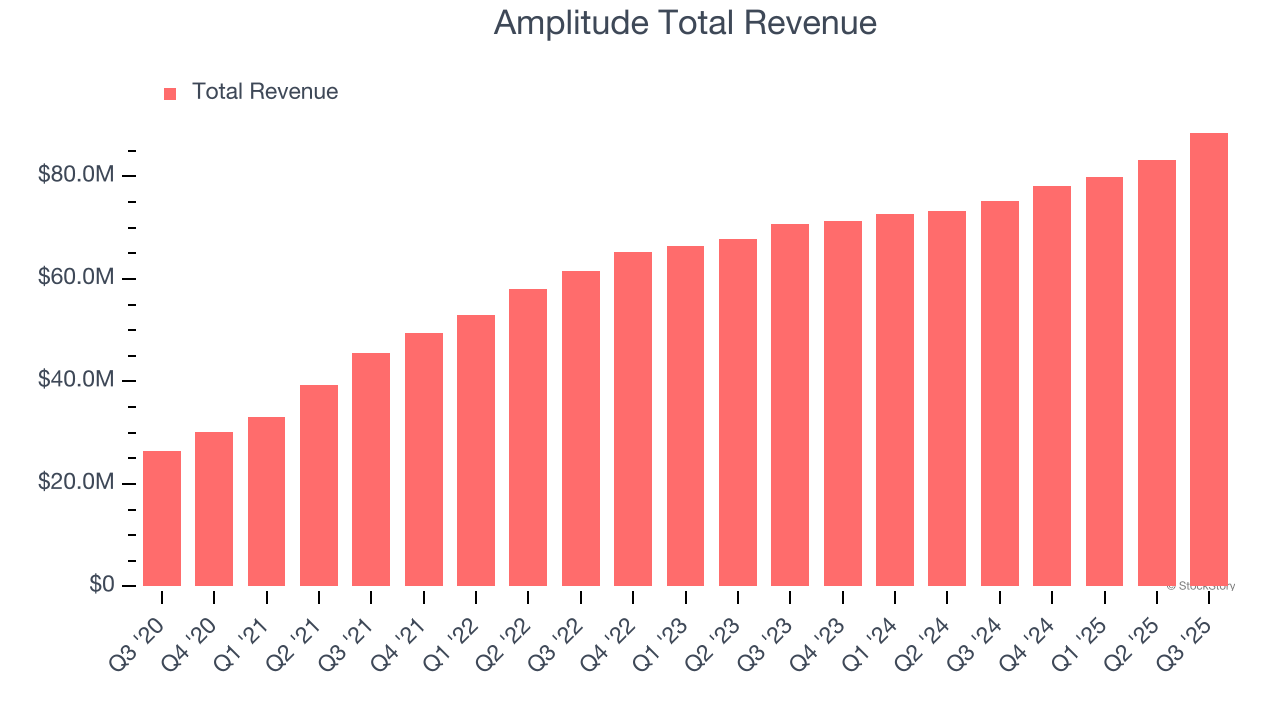

Amplitude Earnings: What To Look For From AMPL

Finviz·2026/02/17 03:09

Earnings To Watch: Insulet (PODD) Reports Q4 Results Tomorrow

Finviz·2026/02/17 03:09

Transocean (RIG) - Among the Energy Stocks that Gained This Week

Finviz·2026/02/17 02:45

The Williams Companies (WMB) Surged This Week. Here is Why

Finviz·2026/02/17 02:45

Flash

04:32

Data: The current Crypto Fear and Greed Index is 11, indicating a state of extreme fear.ChainCatcher News, according to Coinglass data, the current Crypto Fear & Greed Index is 11, up 0 points from yesterday. The 7-day average is 9, and the 30-day average is 17.

04:31

Data: Detected 30 million USDT transferred out from a certain exchangeAccording to ChainCatcher, Coinglass data shows that at 12:27 on February 17, 30 million USDT was transferred from a certain exchange to an unknown wallet.

04:12

Goldman Sachs raises allocation of Japanese stocks to overweightGlonghui, February 17th|According to a research report, Goldman Sachs has upgraded its allocation of Japanese stocks from "neutral" to "overweight." This move reflects the view of Goldman Sachs' Japan portfolio strategy team, which raised the 12-month target for the TOPIX index from 3,900 points to 4,300 points. The reason is that they believe Japanese Prime Minister Sanae Takaichi's recent election victory should drive more net inflows of foreign capital and valuation expansion at the index level. Goldman Sachs strategists are optimistic in the first half of the year about Japanese stocks related to defense, critical resources, shipbuilding, electric power resources, the theme of U.S. reindustrialization, and corporate governance reform.

News