News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

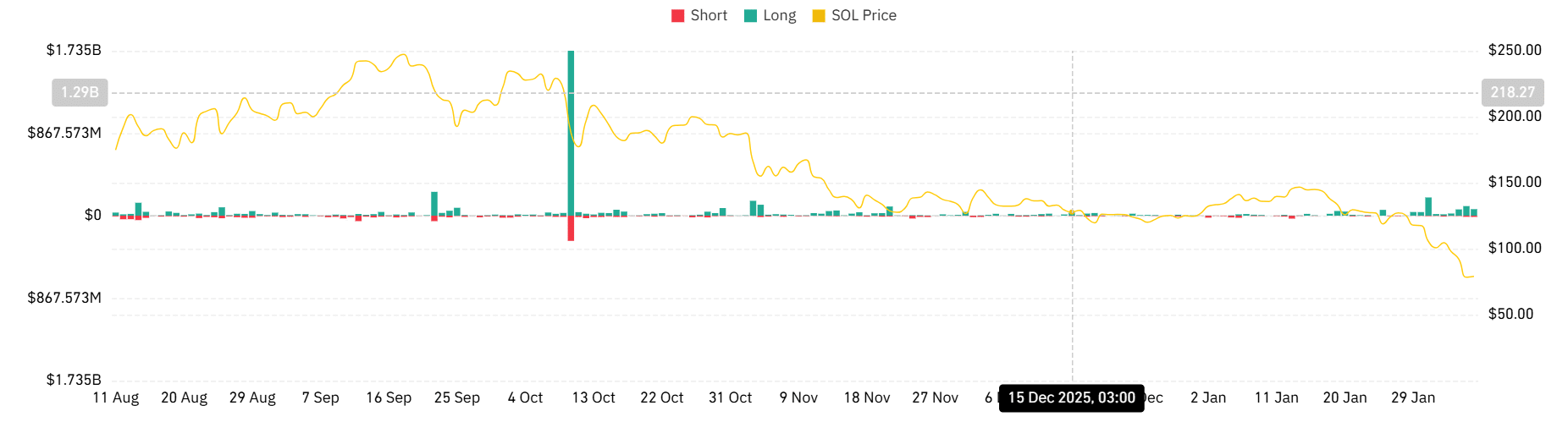

Solana drops 15%, hits 2-year low: Can SOL bulls hold $70?

AMBCrypto·2026/02/06 10:03

After Wall Street's Big Gamble on Crypto, Retail Investors Pay a "High Price"

新浪财经·2026/02/06 09:46

Wistron Executive, Nvidia Supplier: Artificial Intelligence Is Not a Bubble

新浪财经·2026/02/06 09:45

Vauxhall parent company Stellantis faces £19bn loss due to mismanaged transition to electric vehicles

101 finance·2026/02/06 09:34

U.S. House passes three cryptocurrency bills improving market structure and stablecoin regulation.

TokenTopNews·2026/02/06 09:30

Vitalik Buterin highlights creator coins' failures due to high content volume and low quality filtering.

TokenTopNews·2026/02/06 09:30

Flash

10:06

Bitcoin's return rate for February this year is currently -17.36%, while the historical average return rate is 10.94%.BlockBeats News, February 6, according to Coinglass data, bitcoin's return rate for February this year is currently reported at -17.36%, while the historical average return rate is +10.94%. Since 2013, bitcoin's average return rate in February has been +10.94%, with a median return rate of +11.68%. In the past 13 years, February saw 10 increases and 3 decreases. The decline in February this year is currently second only to -31.03% in February 2014 and -17.39% in February 2025.

10:06

Decred price surges 30%, outperforming the market—Will DCR reach $30?Reported by Bijie Network: Decred (DCR) price surged over 30%, breaking through $24.65 and rising against the trend, ignoring the overall market downturn that wiped out $38 billions in market capitalization. This increase was mainly driven by breaking through the $22.17-$23.40 resistance zone, with trading volume also increasing, indicating signs of accumulation. If the daily closing price remains above this area, there is potential to move further towards $30, but maintaining the upward momentum remains key.

10:03

Strategy's counterparty lost $31.13 million in a single day and transferred $8.29 million to replenish fundsOn February 6, Coinbob's popular address monitoring showed that the Strategy counterparty stopped out approximately $175 million worth of long positions this morning, recording a loss of $31.13 million. The account funds dropped from tens of millions of dollars to less than $6 million. Subsequently, this address transferred $8.29 million to Hyperliquid to supplement margin, and the account's total funds have now recovered to about $12.9 million. The specific losses include: $17.83 million loss on ETH long positions, $6.3 million loss on BTC long positions, $3.57 million loss on SOL long positions, and $3.43 million loss on XRP long positions. This address started building positions in December last year and, due to taking the opposite direction to MicroStrategy, is regarded as an on-chain counterparty.

News