News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin’s post-quantum plan BIP-360 gains traction, but will it reverse market sell-off?2Bitcoin holders are being tested as inflation fades: Pompliano3 Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

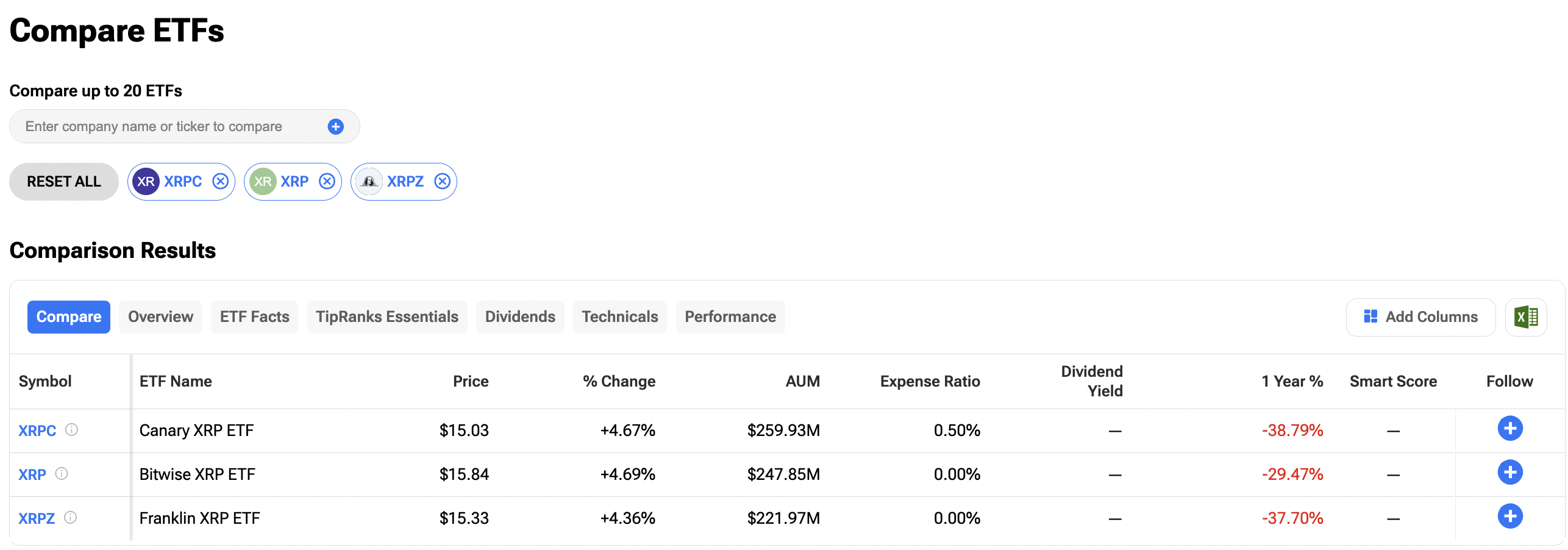

XRP ETFs’ Sudden Demand Slump Could Cost Ripple Its Top-Four Crown as XRP Price Teeters

Tipranks·2026/02/16 12:54

AI concerns threaten £575m acquisition of FTSE-listed software firm

101 finance·2026/02/16 12:51

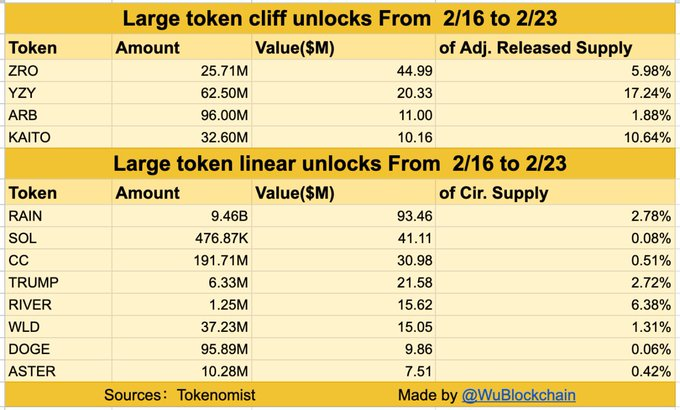

Market Watch: $321M Token Supply Release Could Shake Altcoins

CoinEdition·2026/02/16 12:51

The DAO Governance Crisis: Why You Cannot Code Away Human Nature

BlockchainReporter·2026/02/16 12:45

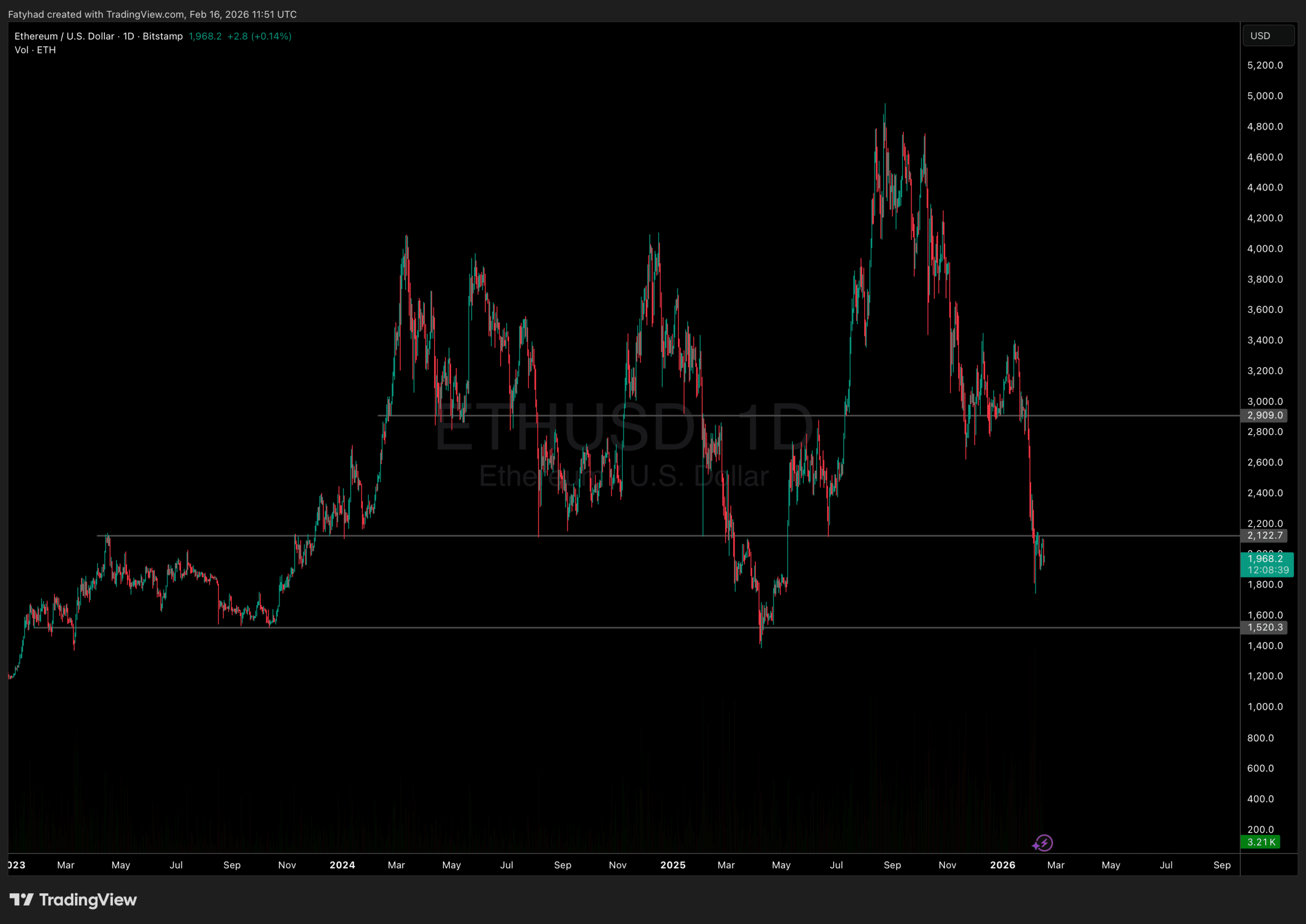

Ethereum Whale Offloads $543M in ETH: Red Alert For The Market?

Coinspeaker·2026/02/16 12:42

BNB Chain Implements ERC-8004 to Bring Verifiable On-Chain Identity for Autonomous Agents

Cointurk·2026/02/16 12:30

Motorola Solutions Stock: Does Wall Street Have a Positive or Negative Outlook?

101 finance·2026/02/16 12:27

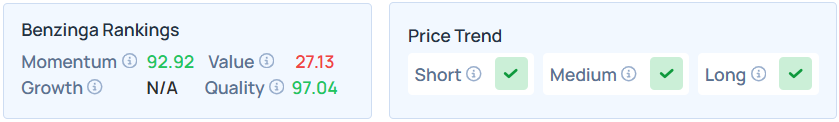

Nvidia Supplier TSMC Sees Momentum Surge As Global AI Demand Hits Fever Pitch

Finviz·2026/02/16 12:24

West Fraser Timber Co. Ltd. (WFG) Earns Outperform Rating Amid Supply Constraints

Finviz·2026/02/16 12:18

Flash

13:01

South Korean police confirm the outflow of 22 seized BTC, with internal transfer routes and possible staff involvement under investigationAccording to Odaily, 22 bitcoins held by the Gangnam Police Station in South Korea during an investigation have been confirmed to be missing, with a current value of approximately 2.1 billion KRW. These bitcoins were voluntarily submitted assets received by the police during a 2021 case investigation. The investigation revealed that the physical cold wallet was not stolen, but the assets inside were transferred. Law enforcement agencies have launched an investigation into the internal flow and possible internal involvement. It is reported that this incident was discovered during a nationwide inspection following the disclosure of the theft of 320 bitcoins at the Gwangju District Prosecutors' Office. (Donga)

12:55

Morgan Stanley adjusts leadership of its European investment banking businessThis American bank has appointed William Bertagna as Deputy Head of Investment Banking for the Europe, Middle East, and Africa (EMEA) region. Bertagna will succeed Martin Grebner, who, together with Markus Fimpel, has been selected to lead the bank’s EMEA industrial group. Karsten Hofacker, who previously led the region’s industrial group, will transition to become Head of EMEA Financial Sponsors M&A. (Bloomberg)

12:41

Chainlink Expands Adoption With Integrations on Ethereum, Solana, and BNB Chain12 Chainlink standard integrations landed across 7 services on Ethereum, Solana, BNB Chain, Polygon and Robinhood Chain.

Bank of England chose the network for the 2026 Synchronisation Lab and CME launched LINK futures expanding regulated access.

Chainlink posted a weekly adoption update showing 12 integrations of the Chainlink standard across seven services and five chains: BNB Chain, Ethereum, Polygon, Robinhood Chain, and Solana. New integrations named in the update included Asseto Finance, Ondo Finance, PokemonBNB, Polymarket, Robinhood, and Tessera.

⬡ Chainlink Adoption Update ⬡

This week, there were 12 integrations of the Chainlink standard across 7 services and 5 different chains: BNB Chain, Ethereum, Polygon, Robinhood Chain, and Solana.

New integrations include @AssetoFinance, @OndoFinance, @pokemonbnb36904,… pic.twitter.com/p4PZTYf85M

— Chainlink (@chainlink) February 15, 2026

Several of the additions were tied to onchain markets that require external data, verification, or automated execution. In tokenized real-world assets, Ondo Finance integrated Chainlink as the official data oracle for its tokenized stocks and ETFs, with feeds going live on Ethereum for listed products.

As we reported, SPDR S&P 500 ETF Trust, Invesco QQQ Trust, and Tesla are the first options feeds (SPYon, QQQon, and TSLAon), allowing these tokenized stocks to be used as collateral on Ethereum DeFi for stablecoin loans and liquidation checks.

Asseto Finance also linked its RWA products to Chainlink infrastructure. According to its announcement, Asseto uses the network’s services to support cross-chain movement of its tokenized fund exposure between Ethereum and BNB Chain, alongside onchain data needed for the product’s operation.

Chainlink Adds Oracle Data, Verification, and Market Automation

On Solana, Tessera adopted Chainlink as its oracle provider and integrated Chainlink Proof of Reserve in production to verify the offchain holdings backing its tokenized private equity assets.

For trading and market resolution, Polymarket launched new 5-minute crypto markets that use Chainlink Data Streams as the resolution source for prices, including BTC/USD. CNF outlined that the rollout adds a shorter-duration format to Polymarket’s existing fast markets and offers incentives for liquidity providers.

Elsewhere, Robinhood launched a public testnet for Robinhood Chain and partnered with Chainlink as the oracle platform. Previously we reported that the testnet targets developers building tokenized digital and real-world asset apps ahead of a planned mainnet launch later in 2026.

The update also listed PokemonBNB among new integrations on BNB Chain.

Beyond integrations, the network cited three new ecosystem developments. Bank of England selected Chainlink for its Synchronisation Lab, where the network said it will test synchronized settlement workflows for payment-versus-payment FX and delivery-versus-payment securities transactions. Separately, the CFTC named Sergey Nazarov to its Innovation Advisory Committee, and CME Group announced the first trades for new Chainlink futures.

Earlier on, we covered that cofounder Sergey Nazarov said this crypto cycle has avoided system-wide failures seen in prior downturns. He linked the change to stronger risk controls and continued market functioning during volatility. Nazarov also said real-world asset issuance and onchain commodity-linked perpetual markets are still growing despite price swings.

LINK trades at $8.79, dropping 3.1% in the past day, with market cap now standing at $6.23 billion.

News