News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Gold and Silver Rebound; SpaceX Acquires xAI; Palantir Revenue Surges (February 3, 2026)2BitMine adds 41,000 ETH to its balance sheet, while its unrealized losses amount to $6B3XRP price prediction: What the loss of the $1.77 swing low means for you

Jensen Huang Cuts Ties with OpenAI?

美投investing·2026/02/03 02:09

TDK Stock Surges as Strong Forecast Eases Concerns Over Memory Prices

101 finance·2026/02/03 01:36

Will GameStop Dump Its Bitcoin? CEO Says ‘Way More Compelling’ Move Ahead

Decrypt·2026/02/03 01:34

Elon Musk finalizes $1.25 trillion agreement to merge SpaceX with Grok

101 finance·2026/02/03 00:21

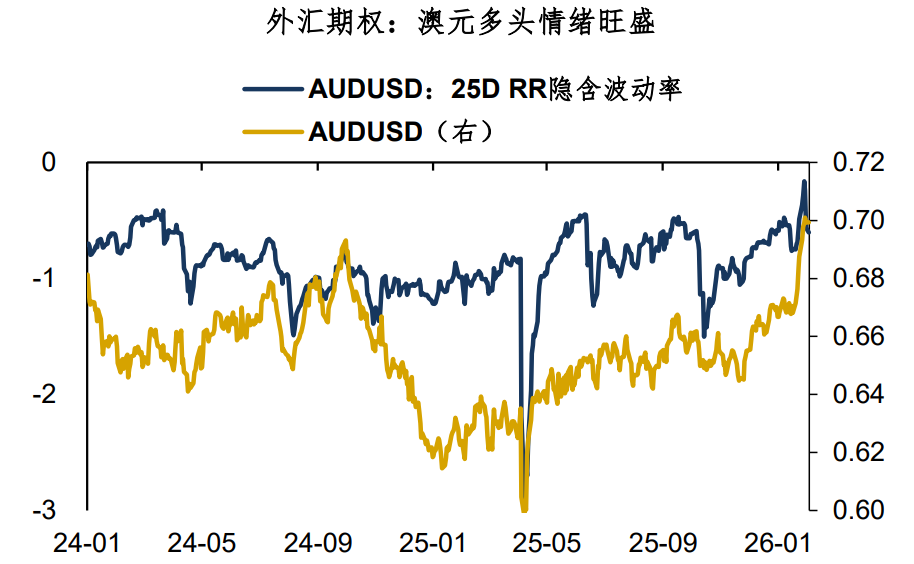

AUD: Either Believe Early or Don't Believe at All

BFC汇谈·2026/02/03 00:01

Crypto Assets Enter Accumulation Zone as Market Pullback Deepens As of 2nd February

BlockchainReporter·2026/02/03 00:00

Flash

03:03

Opinion: The 21-day moving average may provide short-term support for goldPANews, February 3rd – Matrixport released a chart today showing that after a rapid upward movement, gold has pulled back to near its 21-day moving average, which may provide support in the short term. This round of correction was mainly influenced by market news that Kevin Warsh might be nominated as the Chairman of the Federal Reserve, with his hawkish stance interpreted as a signal of tightening. Nevertheless, Matrixport believes that against the backdrop of continued expansion of US debt, there is still demand to allocate gold. This correction is mainly to digest gains and release profit-taking, which may provide a new window for positioning in gold and silver, and does not change the long-term bullish outlook on gold. Since 2023, when the gold price was below $2,000 per ounce, Matrixport has remained bullish on gold and sees this pullback as an opportunity to position.

03:01

"HYPE Trend Rider" has an unrealized profit of $17.21 million from long positions, topping the HYPE profit leaderboard on the Hyperliquid platform.According to AiCoin's real-time on-chain monitoring, the "HYPE Trend Rider" (0x8def…2dae) currently holds a HYPE long position with an unrealized profit of $17.21 million, making it the single largest profitable HYPE position on the entire Hyperliquid platform. The average entry price for this long position was $24.36, with the current position valued at $50.25 million and a return rate of 239%. Tracking shows that this address closed short positions in BTC, ETH, and SOL yesterday, with the three trades generating a combined profit of approximately $6.42 million in just three days. Specifically: the ETH short yielded $4.86 million, the BTC short $1.01 million, and the SOL short $548,000. Currently, the total assets in this address amount to about $33.75 million, with cumulative total profit and loss reaching $25.56 million. For more details on this address's positions and trading records, please visit: https://www.aicoin.com/zh-Hans/hyper-detail/0x8def9f50456c6c4e37fa5d3d57f108ed23992dae

02:47

Glassnode: Bitcoin's short-term stabilization may depend on the easing of selling pressure and a rebound in demandPANews reported on February 3 that, according to Glassnode analysis, bitcoin has dropped to $74,000, with the 14-day RSI falling into the oversold zone and momentum significantly weakening. Spot trading volume has rebounded somewhat, but the response is sluggish, indicating that the downtrend is still ongoing rather than a buy-the-dip scenario. The spot market is dominated by sellers, ETFs remain under pressure, there is clear deleveraging in the derivatives market, on-chain activity is sluggish, and the overall market has entered a risk-averse mode.Short-term stabilization may depend onthe easing of selling pressure and a recovery in demand

Trending news

MoreNews